The key points from the document are:

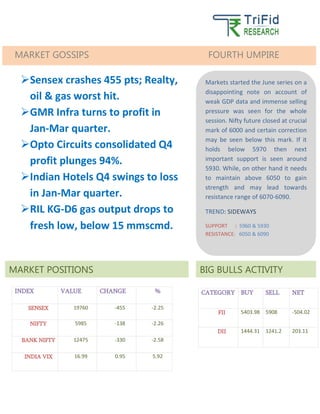

1) Indian markets opened lower in June due to weak GDP data, with the Sensex falling 455 points and Nifty down 138 points.

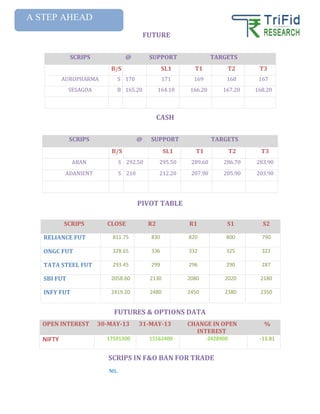

2) Nifty futures closed just below the 6000 level and further declines could see support around 5970 or 5930. Upside is limited until resistance at 6050 or 6090 is breached.

3) Several companies reported losses or declining profits in the latest quarter, with real estate, oil and gas sectors hit hardest in the market.