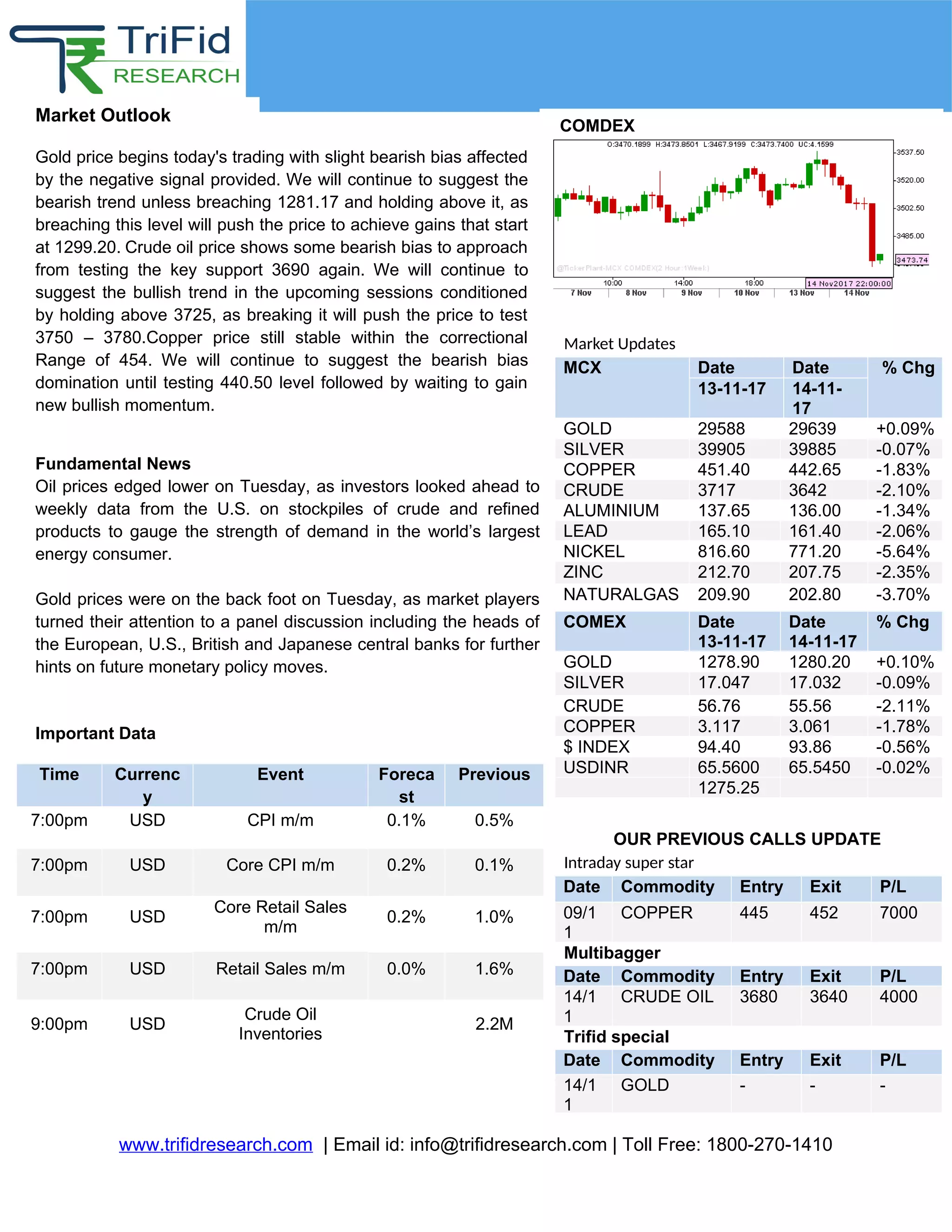

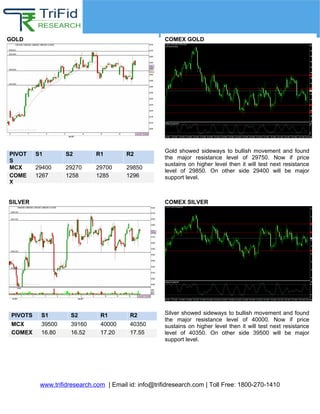

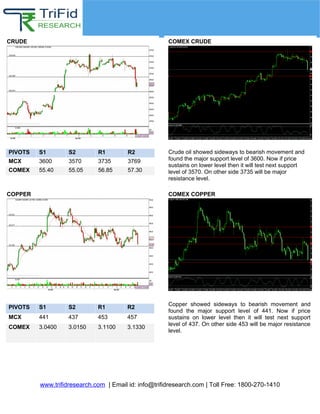

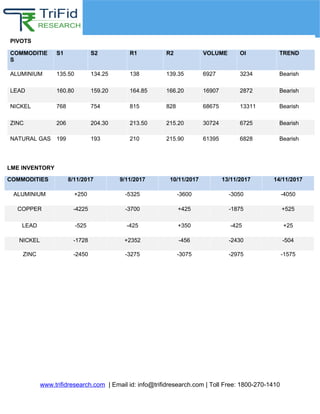

The market outlook for November 15, 2017, shows slight fluctuations in commodity prices, with gold and silver experiencing minor changes while crude oil and copper trends are bearish. Key support and resistance levels are identified for major commodities, indicating potential price movements for gold, crude oil, and copper. Upcoming U.S. economic data on inflation and retail sales is anticipated to impact market sentiment.