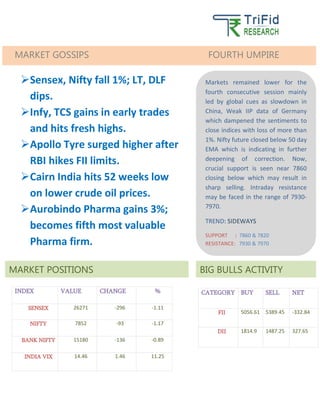

The markets remained lower for the fourth consecutive session due to global cues like slowdown in China and weak German economic data. Key indices closed over 1% lower. Important support for the Nifty is seen at 7860 and a close below that level could result in sharp selling. The trend is seen as sideways with resistance at 7930-7970 and support at 7860-7820. FII were net sellers while DII were net buyers in the market.