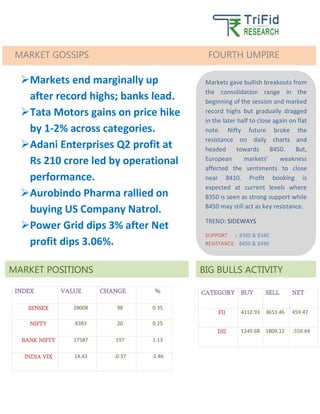

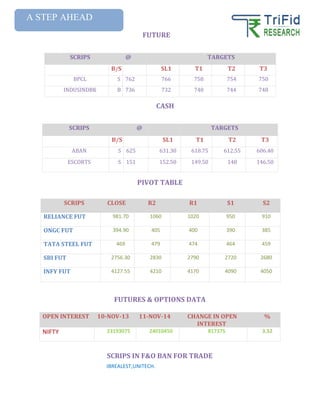

The document summarizes the performance of the Indian stock market on November 13th. It reports that indexes like the Sensex and Nifty saw gains of around 0.3-0.35% and reached new record highs, though losses in European markets later caused indexes to close near the day's opening levels. Banking stocks led the gains overall, while specific companies like Tata Motors, Adani Enterprises, and Aurobindo Pharma saw share price movements. The document provides analysis on expected trading ranges and resistance/support levels for indexes going forward, as well as buy/sell recommendations and targets for specific stocks.