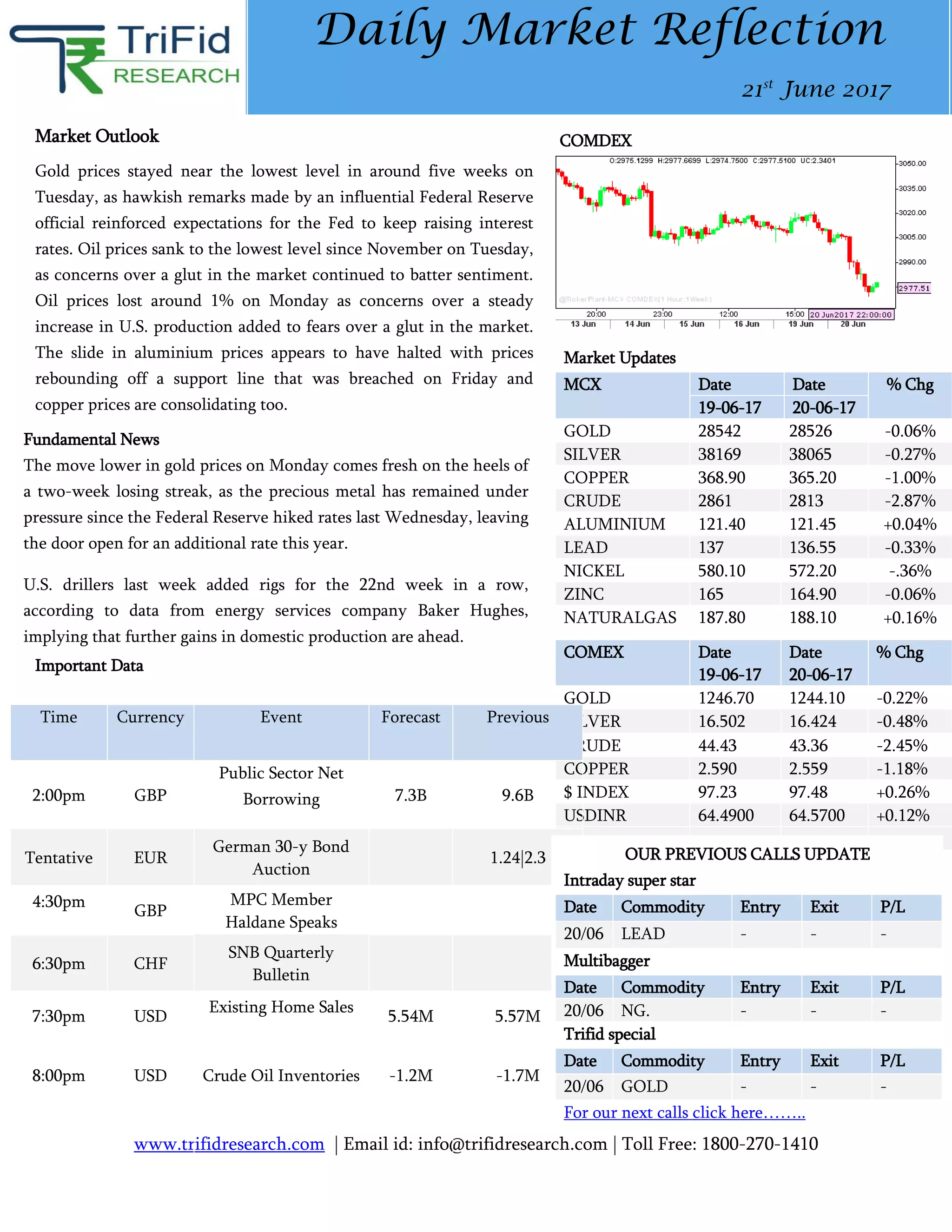

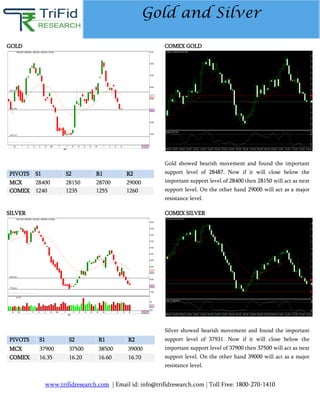

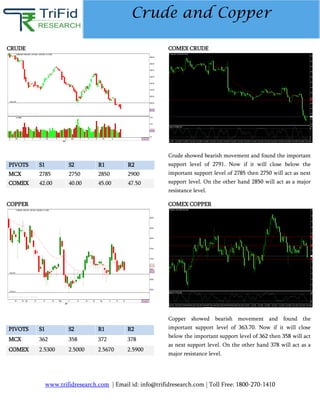

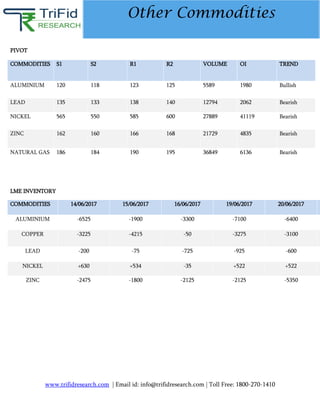

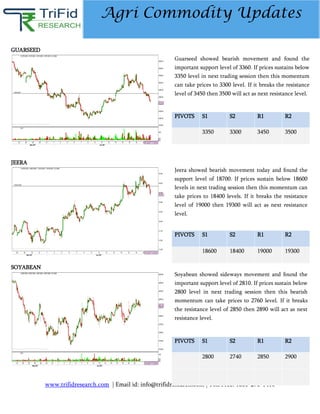

The market reflection report from Trifid Research highlights recent trends in commodity prices, noting declines in gold, oil, copper, and silver due to hawkish Federal Reserve remarks and concerns over production gluts. Key support and resistance levels are outlined for gold, silver, crude oil, and copper, indicating potential future price movements. The document also emphasizes Trifid Research's commitment to client privacy and responsibility regarding trade executions.