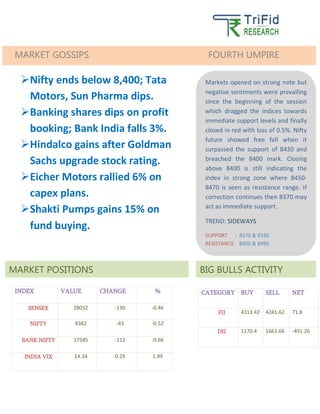

On November 20, 2014, Indian stock indices closed lower with Nifty ending below 8,400, driven by negative sentiments and profit booking in banking stocks. Key support and resistance levels were noted, with 8370 acting as immediate support and resistance seen at 8450-8490. Notable stock movements included gains in Hindalco due to a Goldman Sachs rating upgrade and a significant rise in Shakti Pumps on fund buying.