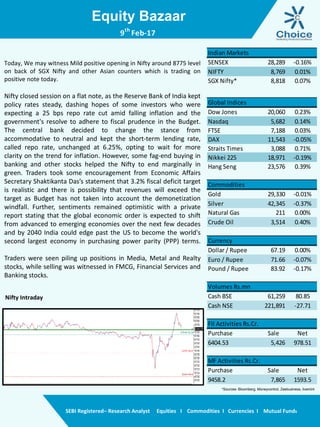

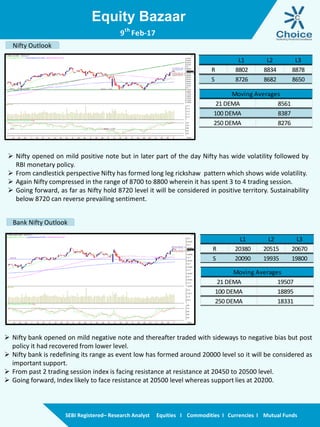

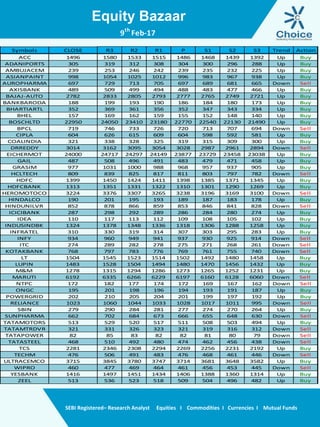

The document provides a daily market summary and outlook. It notes that the Nifty may open mildly positive due to positive Asian markets. The RBI kept policy rates steady, going against expectations of a rate cut. Some buying in banking and other stocks helped the Nifty end marginally higher. Traders were encouraged by statements on fiscal deficit targets being realistic. The outlook provides technical analysis on the Nifty and Bank Nifty, noting resistance and support levels. It provides recommendations on whether to buy or sell various stocks.