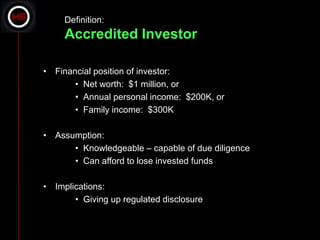

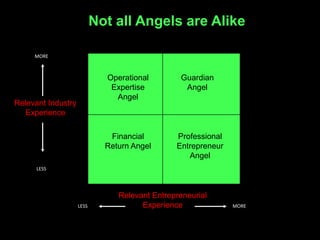

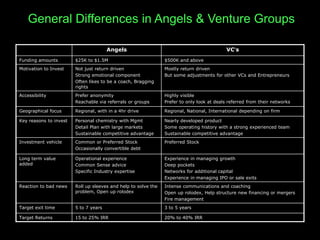

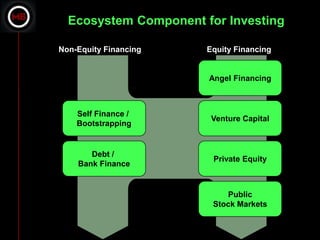

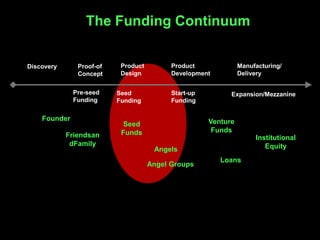

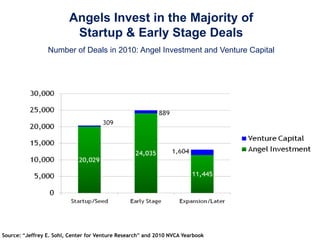

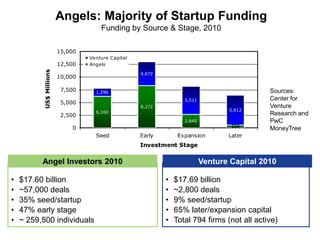

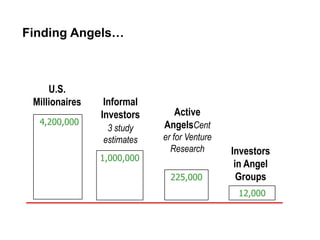

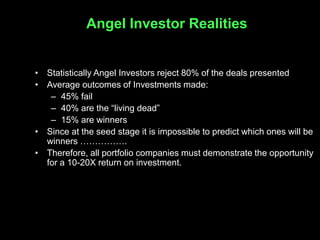

Angel investors provide the majority of early stage funding for startups. They are high net worth individuals who invest their own money in companies, often locally, and typically invest between $25,000-$500,000. Angels fill an important role by providing the earliest professional funding for startups between friends/family and venture capital. They invest at the seed and startup stages where 90% of outside equity comes from angels.