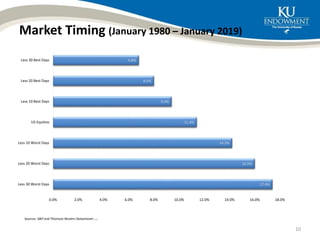

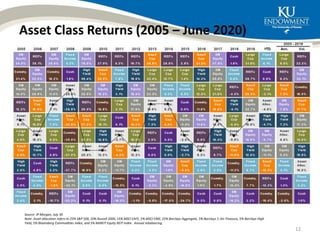

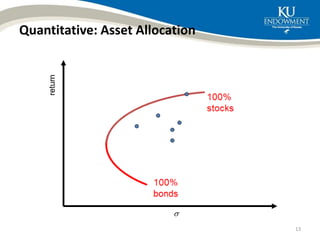

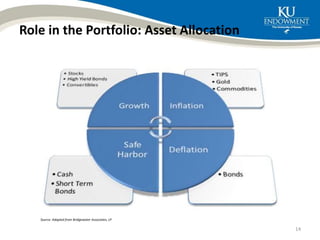

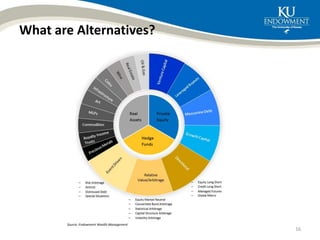

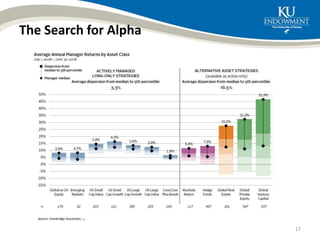

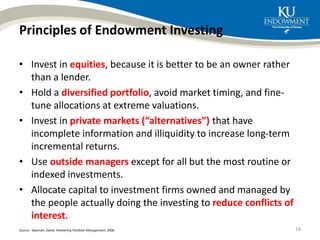

This document discusses managing the KU Endowment. It provides background on the KU Endowment, including that it is over $1.6 billion and supports over 6,500 scholarships annually. It explains that endowments have a perpetual, long-term focus to generate returns to support universities. The primary investment objective for the KU Endowment is to generate annual real total returns that exceed 5.5% spending over 10-year periods. It discusses the three sources of investment returns: security selection, market timing, and asset allocation, noting asset allocation accounts for over 100% of returns. The document reviews the KU Endowment's asset allocation compared to peers and outlines their investments in public equities, bonds, private