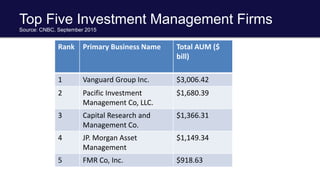

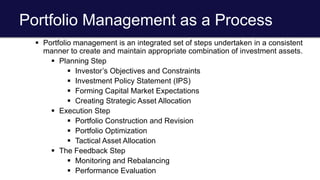

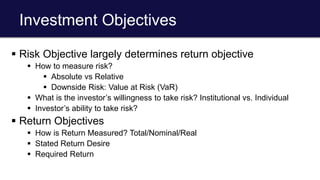

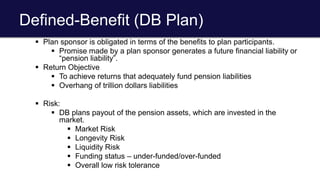

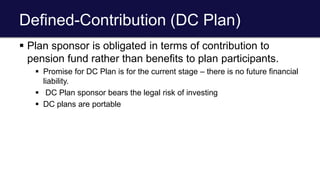

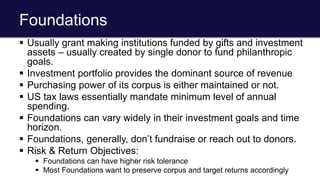

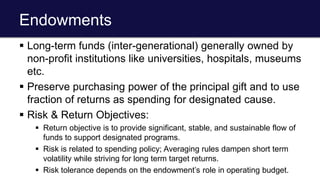

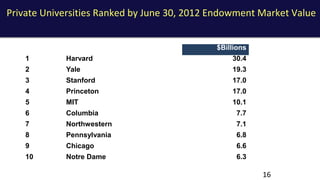

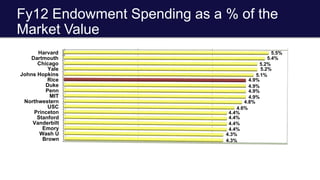

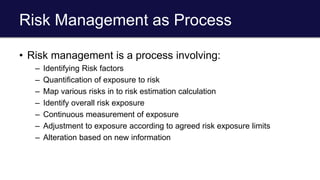

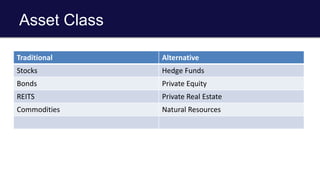

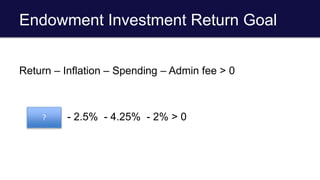

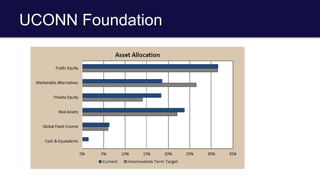

This document provides an overview of investment management and the asset management industry in the United States. It discusses that the largest segment is made up of registered investment companies which managed $18.2 trillion in assets at the end of 2014. It also lists the top five investment management firms by total assets under management. The rest of the document discusses various types of institutional and individual investors, the portfolio management process, investment objectives and constraints for different investor types like pension plans and endowments, and risk management practices.