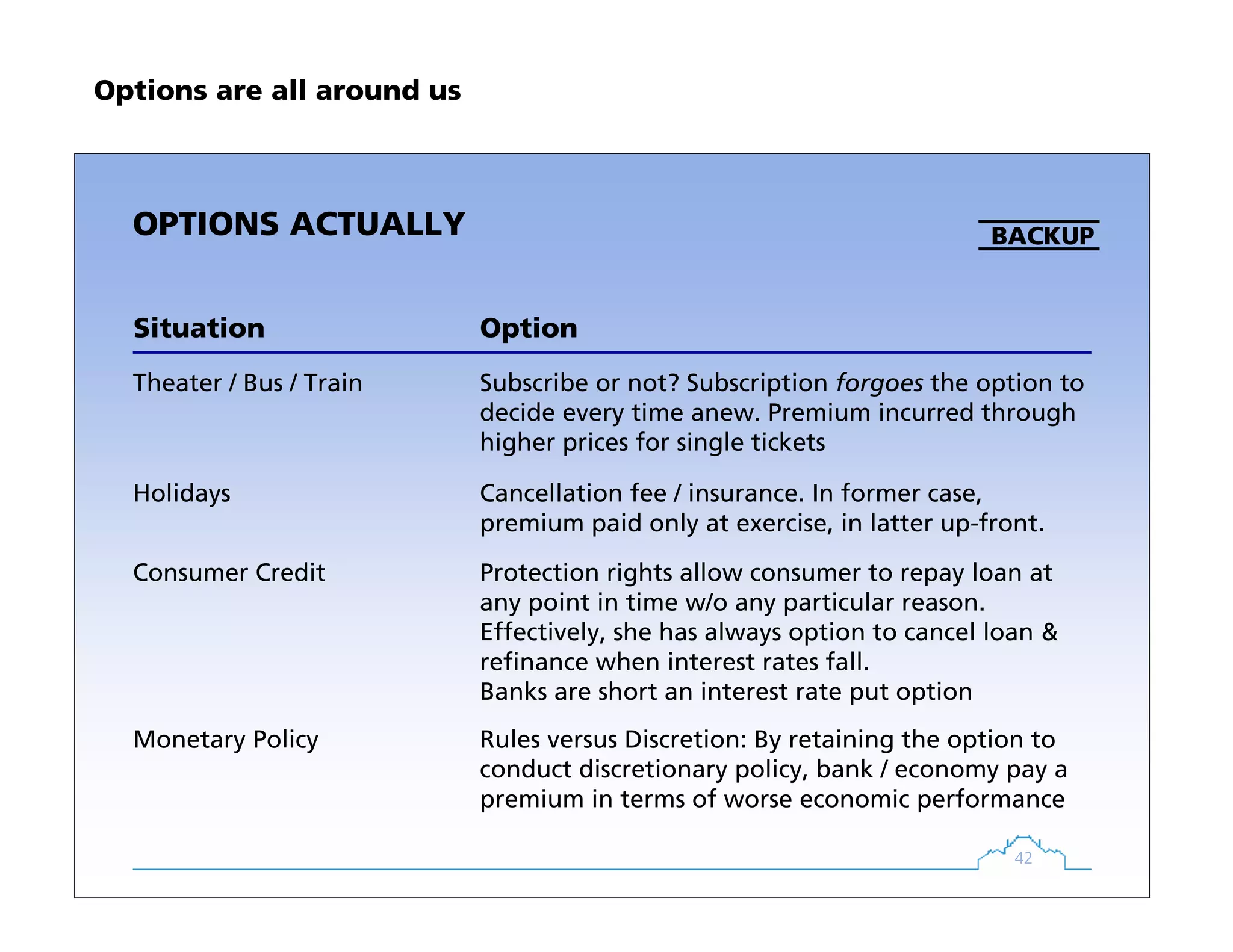

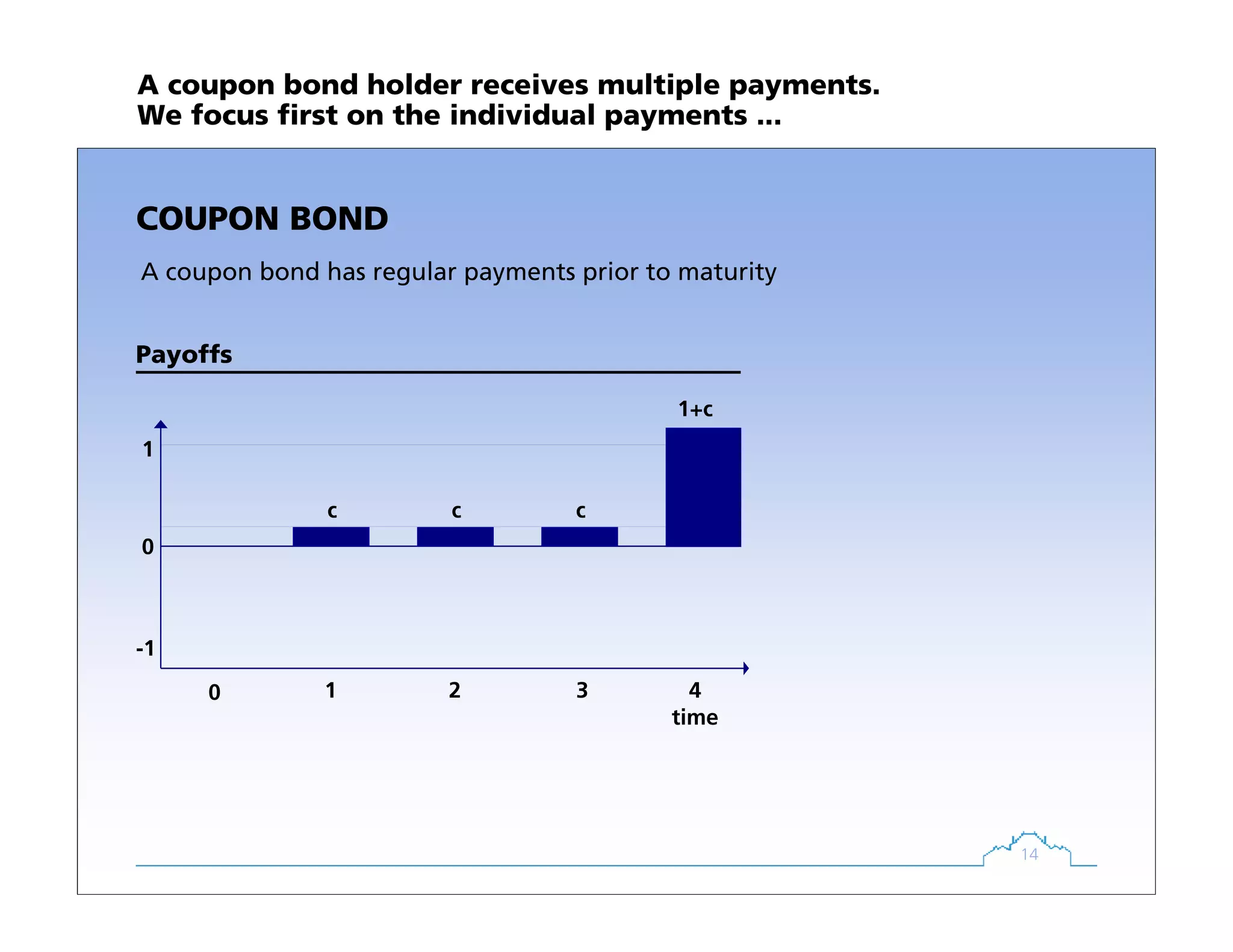

The document discusses fixed income products and derivatives. It begins with an agenda covering key concepts like no-arbitrage pricing. It then examines various fixed income products, including zero coupon bonds, coupon bonds, forward rates, floating rate bonds, and interest rate swaps. It also discusses yield-to-maturity as the internal rate of return for a bond, assuming reinvestment at the same rate. Throughout, it emphasizes the principle of no-arbitrage pricing and how derivatives can be replicated and priced using a portfolio of basic assets.

![15

ZERO BOND

A bond without coupons

Single payment at maturity: principal (here equal unity)

PricingPayoffs

TERMSHEET

1

(0, )

[1 (0, )]T

B T

i T

=

+

Example

Notes

Yield a.k.a. „spot rate“,

„zero rate“

-1

0

1

1 2 3 40

time

1

2

(0,1) 1.045 0.96

(0,2) 1.0475 0.91

(0,3) 0.87

(0,4) 0.82

B

B

B

B

−

−

= =

= =

=

=

Zero bonds are the basic building blocks of fixed income pricing](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-15-2048.jpg)

![16

PricingPayoffs

TERMSHEET

Examples

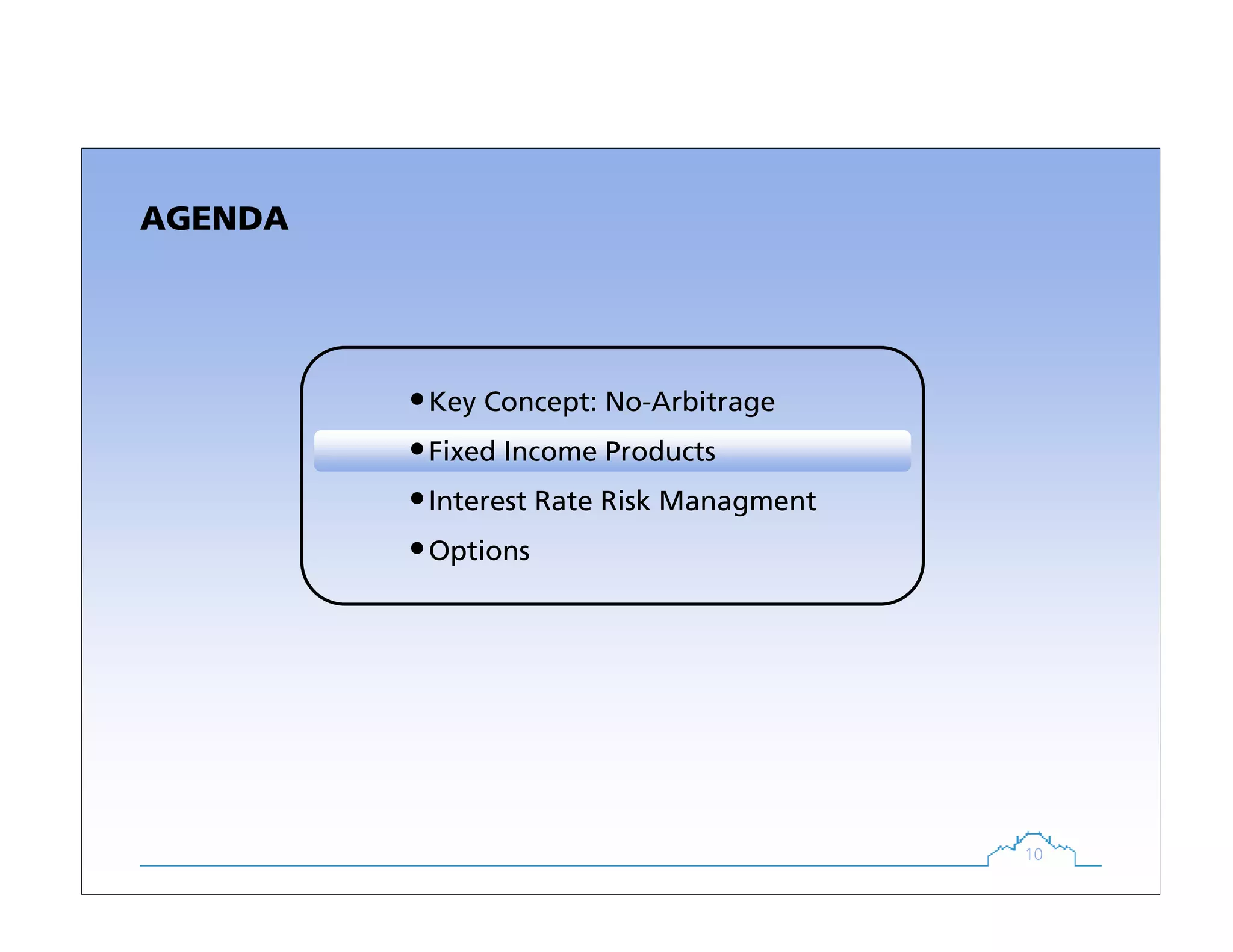

COUPON BOND

A coupon bond has regular payments prior to maturity

1(0, , )

[1 (0, )]

T

t t

c

B T c

i t

== ∑

+

1

[1 (0, )]T

i T

+

+

time

-1

0

1

c

1+c

1 2 3 40

cc

(0,4,10%) 2.3B =

(0,4,0.5%) 1.02B =

A coupon bond is just a collection of zero bond payments](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-16-2048.jpg)

![17

COUPON BOND AT PAR

1

1 [1 (0, )]

[1 (0, )]

T

tT

t

i T

c i

i t

−

−

=

− +

= =

+∑

For which coupon, would the

bond trade at par?

Par Value

(=1)

(1 ) [1 (0, )] T

c i T −

+ +

( 1)

[1 (0, 1)] T

c i T − −

+ −

M

1

[1 (0,1)]c i −

+

= Bond price

+

+

+

Par bonds have a coupon equal to their yield-to-maturity](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-17-2048.jpg)

![18

PricingPayoffs

TERMSHEET

(0, )B t =

Examples

FORWARD RATES

An agreement today, to borrow money between t and T at rate f(0,t,T)

[1 (0, )]

(0, , ) 1

[1 (0, )]

T

T t

t

T t

i T

f t T

i t

−

−

+

= −

+

1

4 2

2

1.051

(0,2,4)

1.0475

f

⎛ ⎞

= ⎜ ⎟

⎝ ⎠

8.06%=

[1+f(0,2,4)]2

-1

0

1

1 t=2 3 T=40

time

B(0,2)

B(0,2)

(0, ) [1 (0, , )]T t

B T f t T −

+

Replicate with

long/short position

in zeros

Forward Rates lock in future conditions for borrowing and lending](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-18-2048.jpg)

![19

NotesPayoffs

CARRY TRADE

Example of a simple, zero-investment portfolio.

Borrow short-term and lend long-term with different maturities

• No initial capital,

zero price

• Effectively a forward

contract

• Risk of reinvestment/

repricing at T1

• Profitable if

• Or, if future spot rate

below today’s forward

2

2 1 2(1, )[1 (0, )]T

B T T i T− +

1

1[1 (0, )]T

i T> +

2 1 1 2(1, ) (0, , )i T T f T T− <

-1

0

1

1 T1=2 3 T2=40

time

[1+i(0,2)]2

[1+i(0,4)]4

BACKUP

The carry trade bets on differences between future spot rates

and today’s forward rates](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-19-2048.jpg)

![20

ZEROS AND FORWARDS BACKUP

1

11 (0, ) [1 (0, 1, )]T T

ti T f t t=+ = + −∏

1 (0, , )f t t n+ + =

No-Arbitrage implies that zero

rates are geometric averages

of forward rates

Likewise, forward rates are

geometric averages of forward

rates

1

1

0[1 (0, , 1)]n n

j f t j t j−

= + + + +∏

The math is simple: (0, )B T =

(0,2) (0,3) (0, )

(0,1)

(0,1) (0,2) (0, 1)

B B B T

B

B B B T −

K

What do forward rates tell

us about market

expectations of future

spot rates?

Do they say more than

current spot rates?

Multi-period zeros are like a sequence of forward contracts](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-20-2048.jpg)

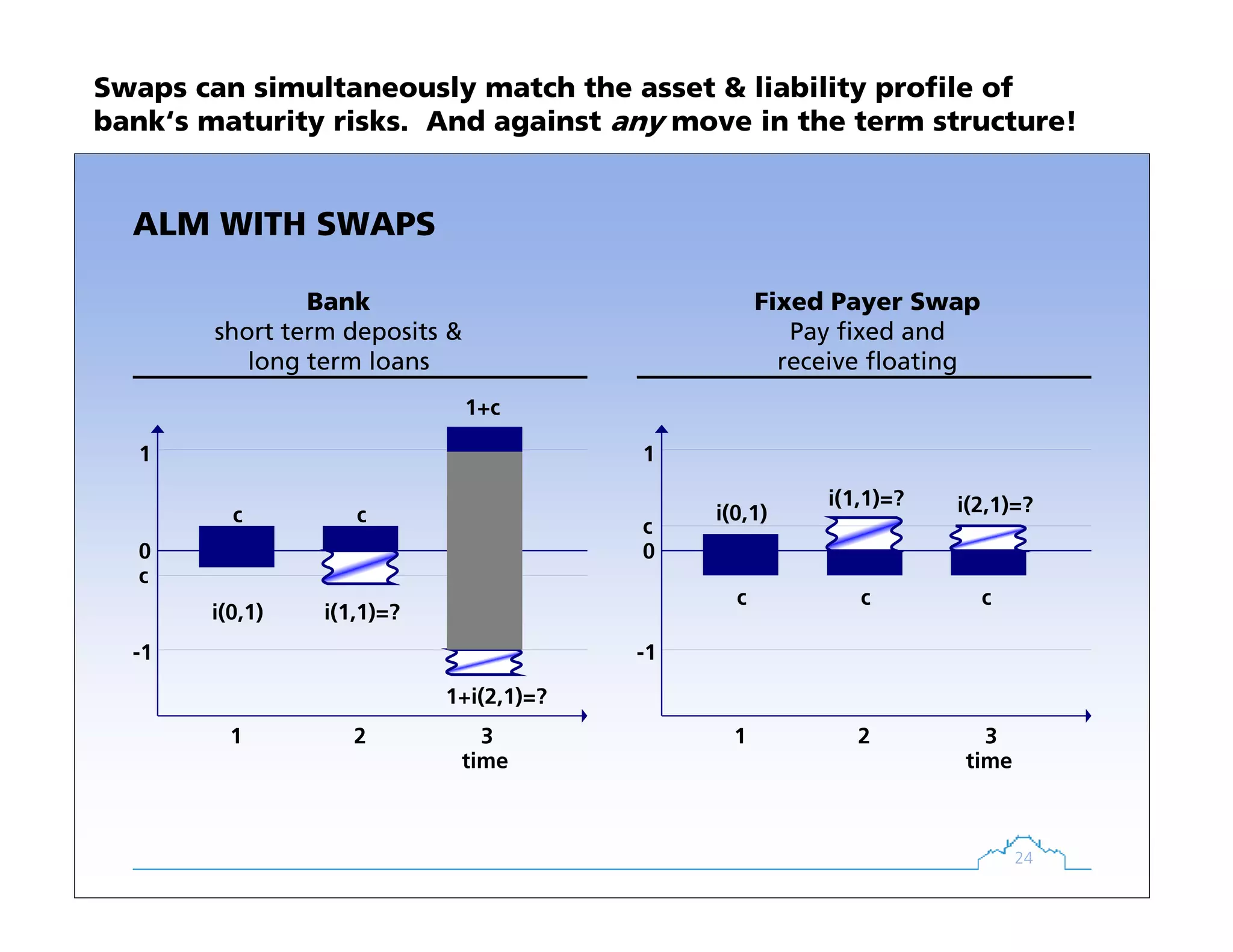

![23

PricingPayoffs

TERMSHEETINTEREST RATE SWAP

Exchange of interest rate payments: fixed v floating. No exchange of principal

Interest rates calculated for „notional“ principal

• A portfolio of coupon

bond (long) and floater

(short) with same

principal

• Here: “fixed receiver“,

opposite picture for

fixed payer

• Coupon such that initial

value is zero: Fixed-leg

is par bond!

1

1 [1 (0, )]

[1 (0, )]

T

tT

t

i T

c

i t

−

−

=

− +

=

+∑

Example

4y year swap-rate: 5.08%

time

-1

0

1

1 2 3 40

i(1,1)=? i(2,1)=?i(0,1) i(3,1)=?

ccc c

Swaps match a floater with a fixed coupon bond](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-23-2048.jpg)

![29

DURATION

Present

Values

time

What is the

average time

until all claims

are paid?

(... and let us

average with

present-value

weights)

1

(1 ) (1 )

(0, , )

(0, , ) (0, , )

t T

T

t

c i i

D T c t T

B T c B T c

− −

=

+ +

= +∑

1

[1 (0, )] [1 (0, )]

(0, , )

(0, , ) (0, , )

t T

T

teff

c i t i T

D T c t T

B T c B T c

− −

=

+ +

= +∑

To understand price sensitivity, duration is important.

It measures the center of gravity of the payoffs‘ present values](https://image.slidesharecdn.com/1725c8aa-d530-4a82-aa49-94434f60f969-160117130420/75/emNAFI2007-29-2048.jpg)