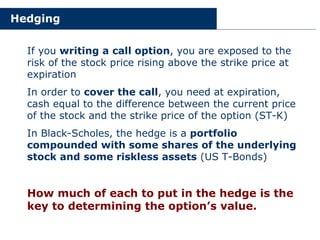

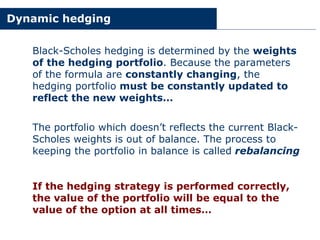

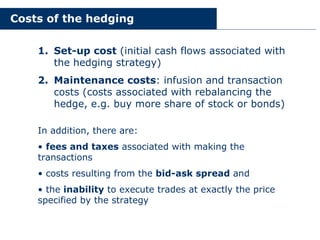

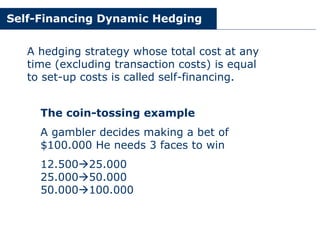

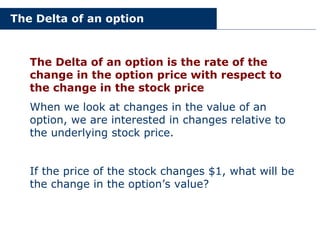

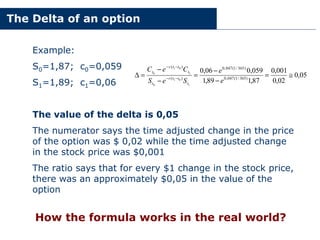

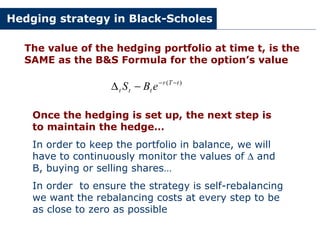

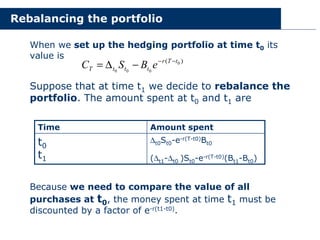

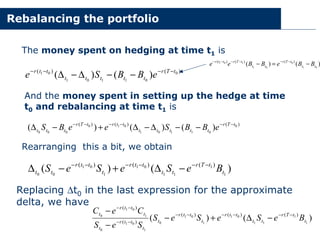

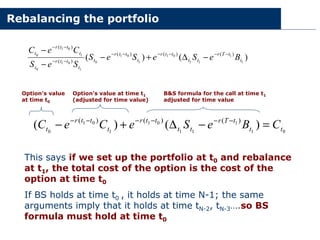

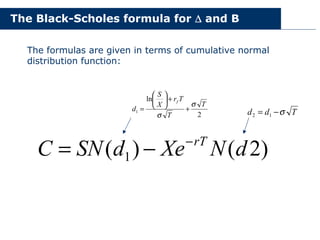

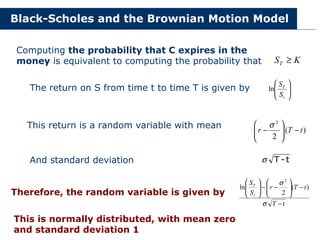

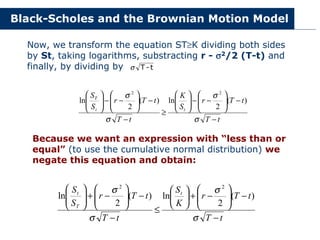

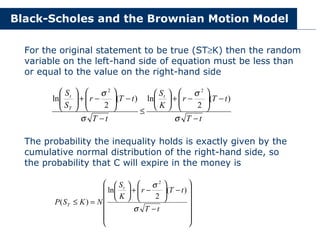

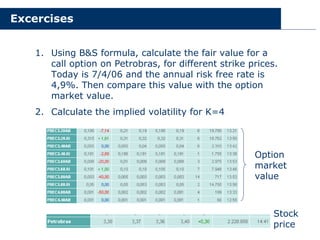

This document discusses the Black-Scholes formula and hedging strategies for options. It explains that dynamic hedging under the Black-Scholes model replicates the payoff of an option using a portfolio of the underlying stock and riskless bonds. The weights of this hedging portfolio determine the option's value. Rebalancing is required to maintain a perfect hedge as the Black-Scholes parameters change over time. Transaction costs are not considered in the basic Black-Scholes framework.