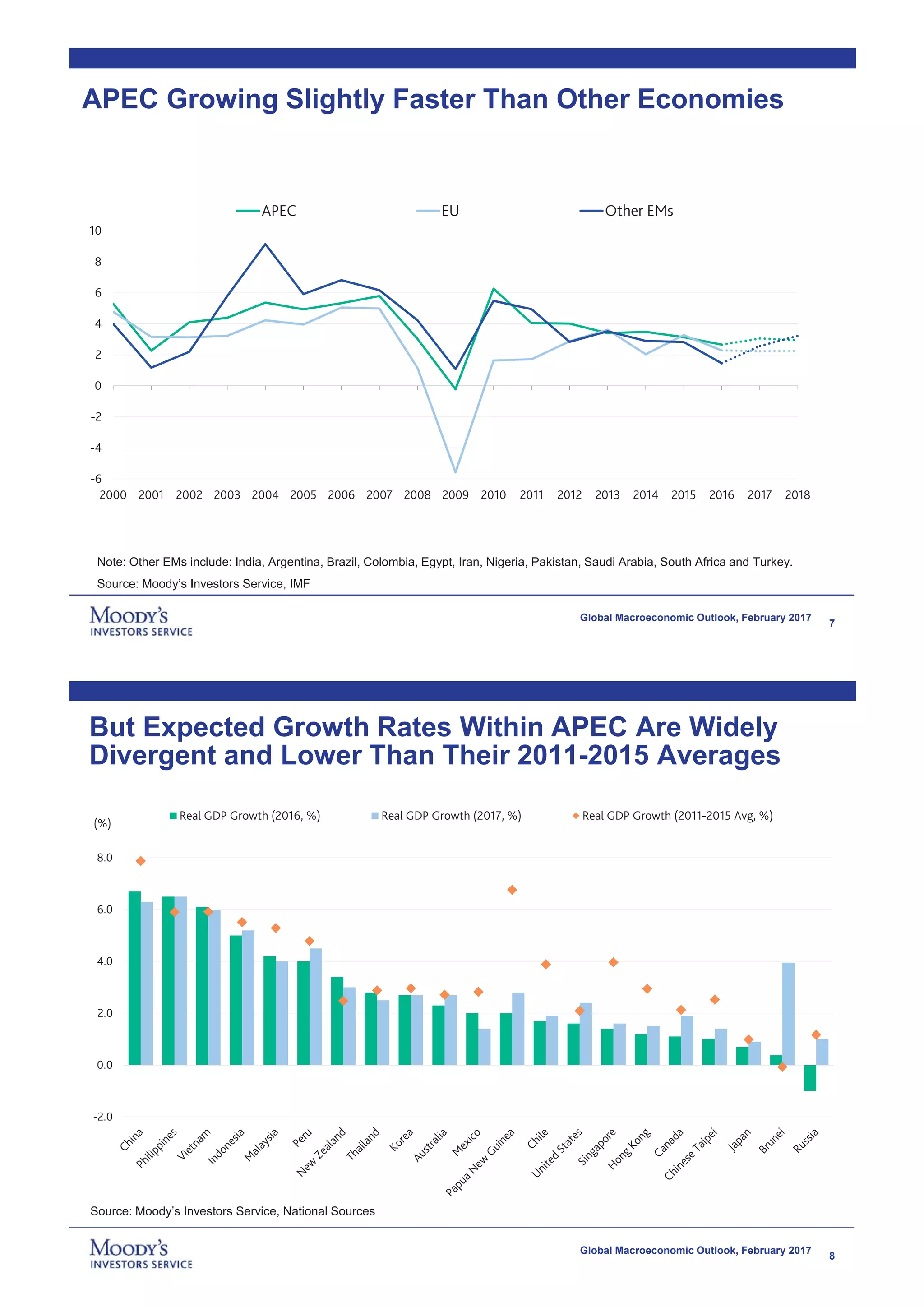

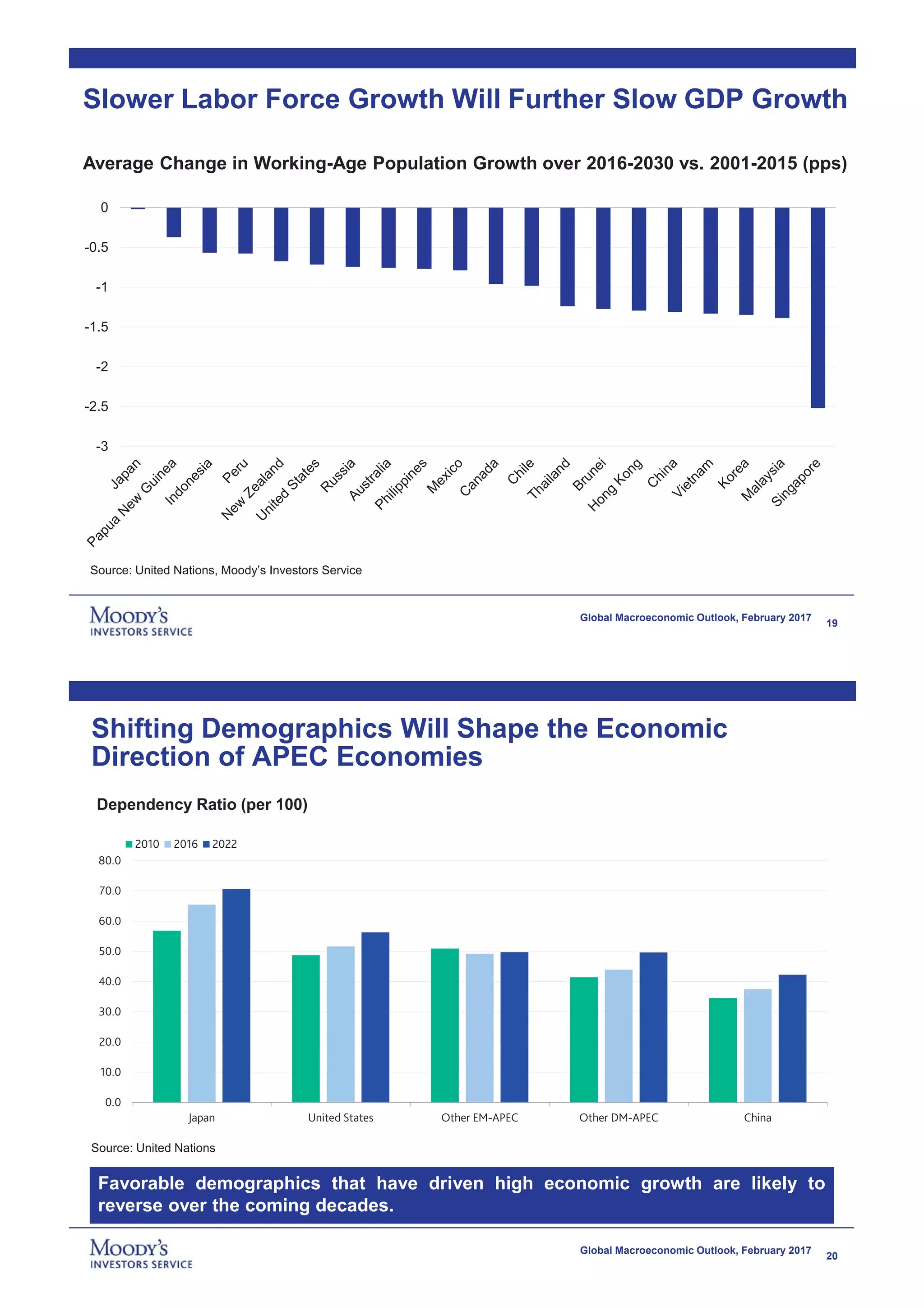

The document outlines the global economic outlook for 2017, indicating that growth is expected to improve slightly but remain below historical averages, with anticipated G20 real GDP growth of around 3%. It highlights risks such as sluggish trade growth, declining productivity, and geopolitical tensions, particularly regarding US trade policies. The document notes that while some factors, like fiscal policies and stable commodity prices, may support a modest recovery, significant downside risks persist.