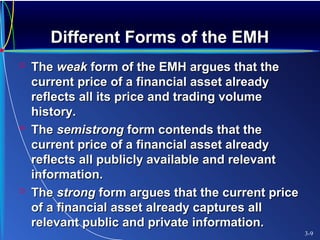

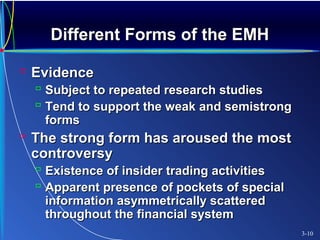

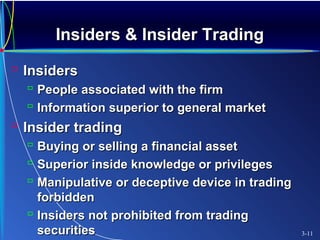

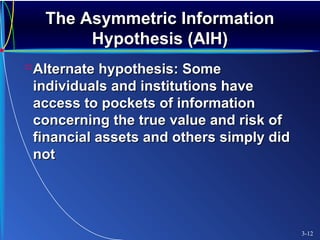

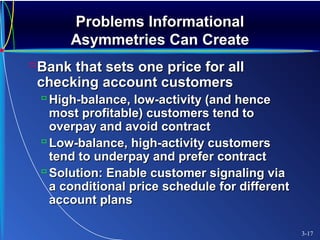

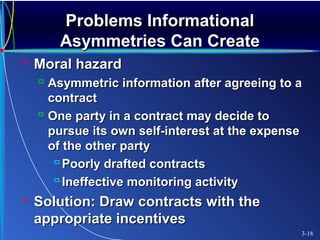

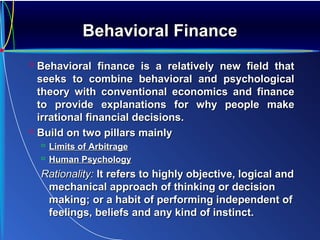

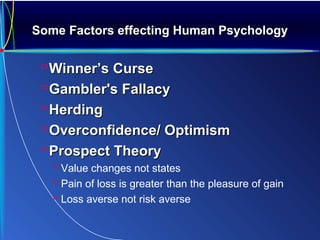

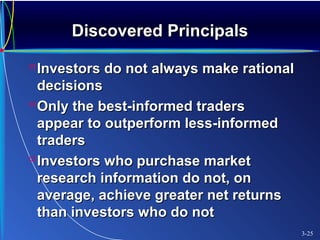

This document discusses financial information markets and the efficient market hypothesis. It introduces the efficient market hypothesis, which states that financial markets are informationally efficient and prices instantly reflect all available information. The document then discusses the debate between the efficient market view and the asymmetric information view. The asymmetric information perspective is that some market players have better information than others, which can lead to pockets of market inefficiency. Problems that can arise from informational asymmetries, like adverse selection and moral hazard, are also summarized.