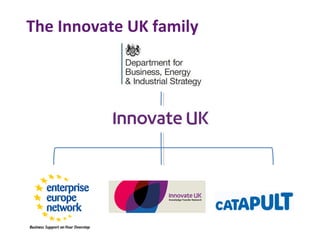

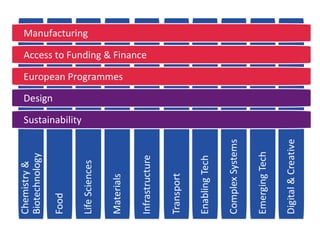

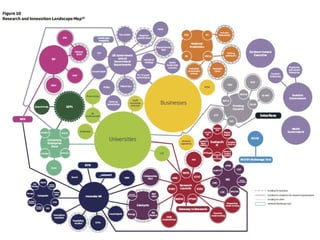

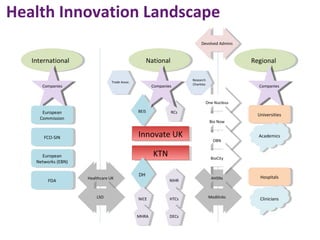

The Knowledge Transfer Network (KTN) stimulates innovation in the UK through linking organisations, exchanging knowledge, and providing access to funding and support. It has over 60,000 members across various sectors including health, manufacturing, and infrastructure. The KTN offers events, partnering opportunities, and help finding funding from sources like Innovate UK, SBRI Health, NIHR i4i, and EU programs like Horizon 2020. Key goals are setting up collaborations, linking the innovation landscape, and accelerating growth in priority sectors like emerging technologies, life sciences, and more.