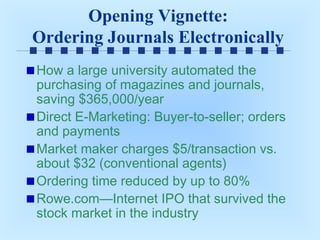

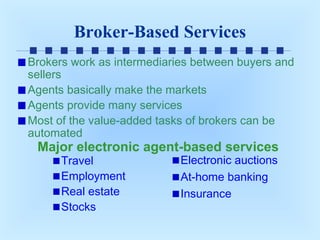

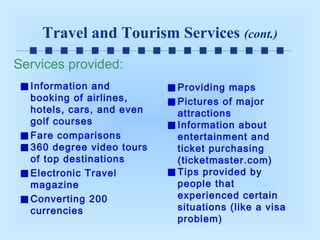

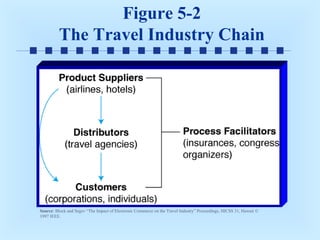

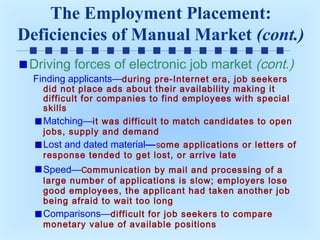

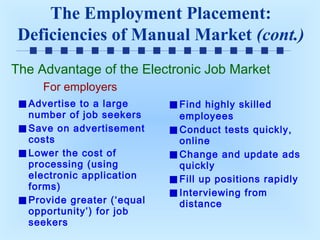

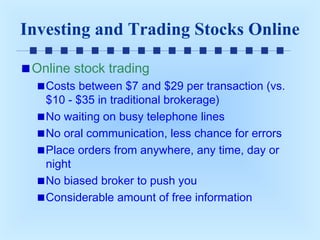

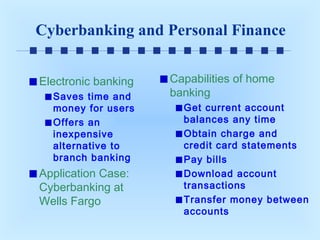

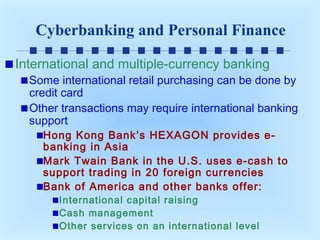

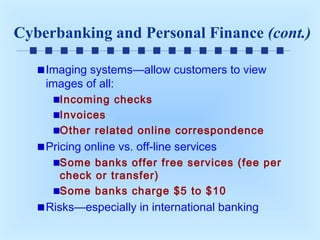

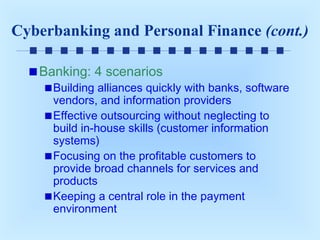

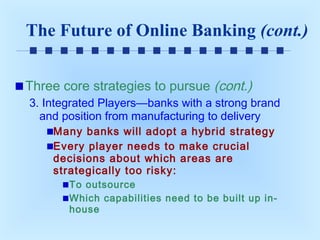

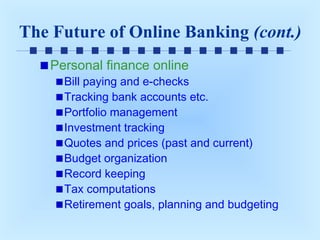

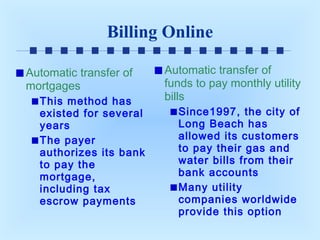

This document discusses various service industries that have been impacted by electronic commerce, including travel/tourism, employment placement, real estate, investing/trading stocks online, cyberbanking/personal finance, billing online, online publishing, knowledge dissemination, and disintermediation/reintermediation. It provides details on how each industry has been transformed through opportunities like online research/booking, electronic job posting/applications, virtual property tours, online trading platforms, digital banking services, electronic bill payment, and distance learning/online education. The roles of intermediaries are changing as well, with some being disintermediated and others taking on new functions as cybermediaries.