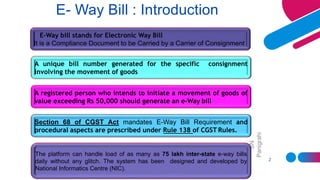

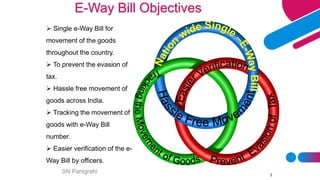

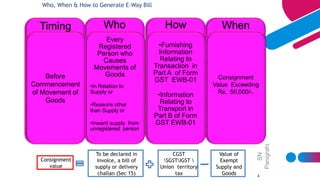

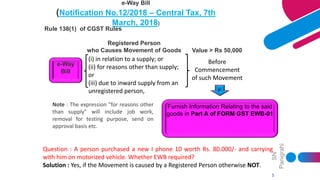

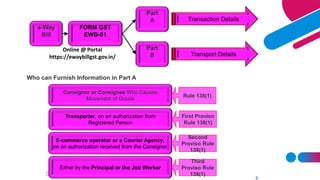

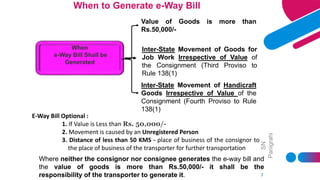

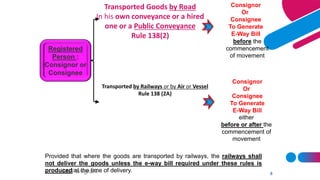

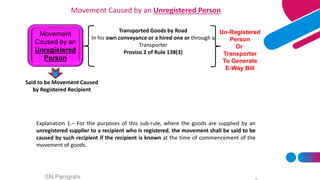

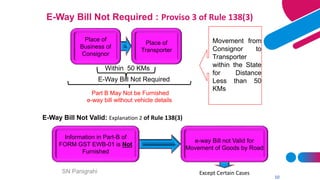

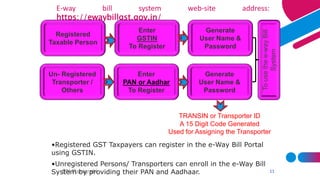

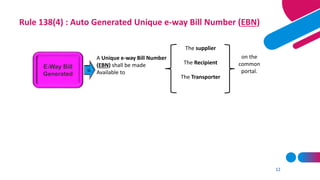

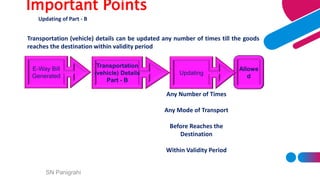

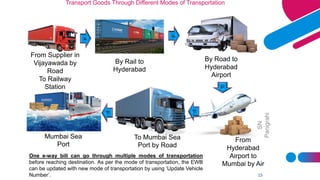

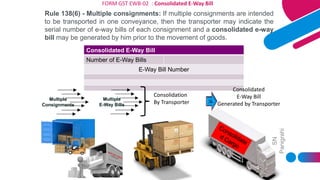

The document discusses the introduction and objectives of e-way bills in India, which are electronic documents that must accompany the transportation of goods valued over 50,000 INR to track movement and prevent tax evasion; it outlines the procedures for generating e-way bills, including who is responsible, when they are required, and how transportation details can be updated; the last part covers consolidating multiple e-way bills into a single document for transporting multiple consignments.