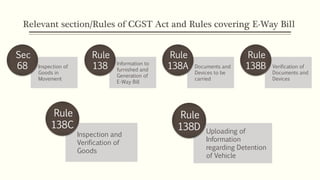

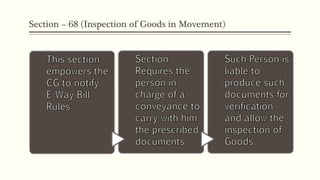

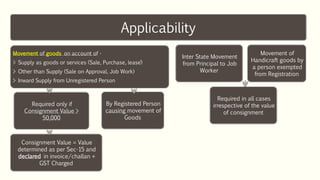

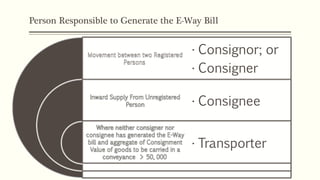

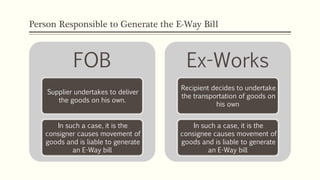

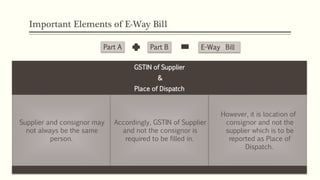

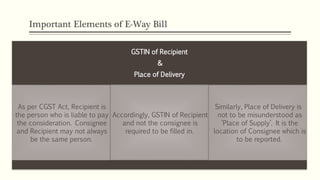

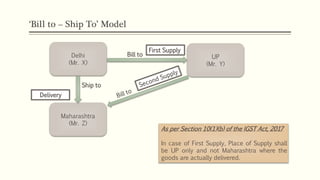

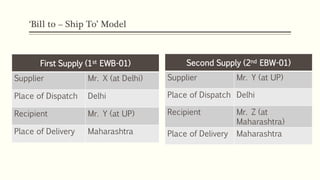

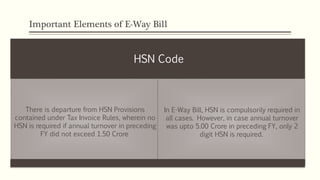

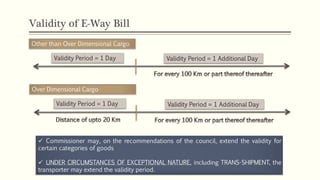

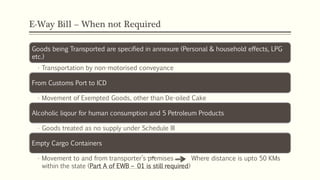

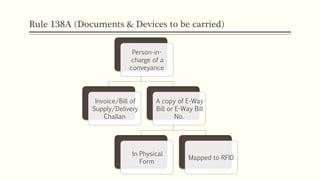

The document provides an overview of the e-way bill system under GST in India, detailing the responsibilities for generating the bill and the necessary information required for its validity. It covers aspects such as the applicability of e-way bills, important elements like GSTINs and HSN codes, and scenarios where e-way bills are not required. Additionally, it discusses the validity periods and exceptions for specific goods in transit.