Based on the information provided:

- The demand function is in log-linear form, with the coefficients representing the elasticities.

- The price elasticity of demand (PED) is given as -1.5. This means demand is price elastic (PED > 1 in absolute value).

- The income elasticity of demand (YED) is given as 1.3. This means demand is income elastic (YED > 1).

So in summary, the key aspects of the demand for Nike sportswear based on the given expression are:

1) Demand is price elastic

2) Demand is income elastic

3) The function allows us to estimate how quantity demanded responds to changes in price and

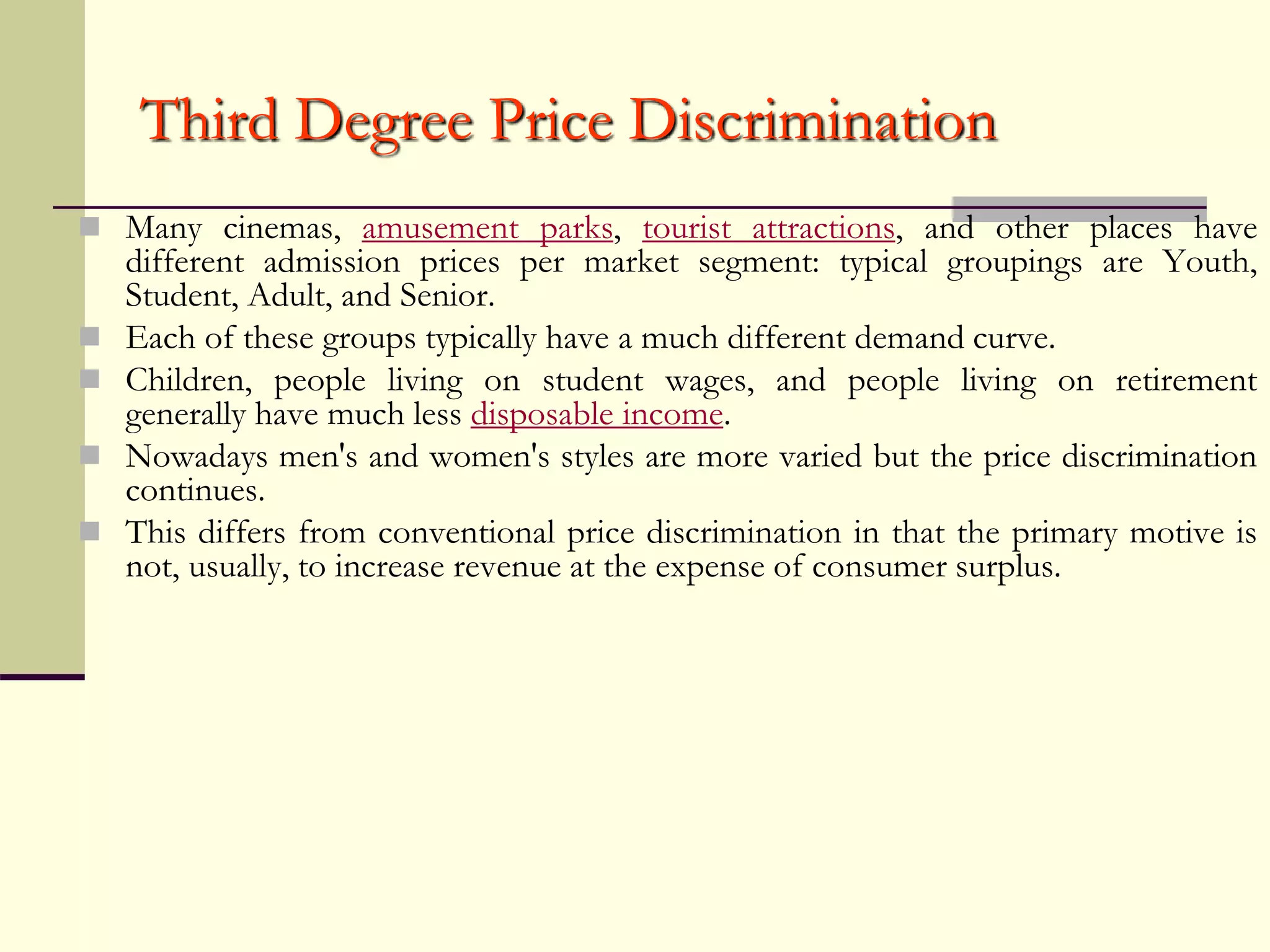

![Other Forms of Price Discrimination

Inter-temporal Pricing: If at peak rush hour, the toll is

higher than at the off-peak, we are using different prices at

different time periods. The peak toll can encourage shifting

travel patterns to off-peak times or discourage some

commuting altogether. Inter-temporal pricing appears more

frequently than one thinks. Example- night rate electricity is

cheaper, peak versus off-peak phone charges.

Bundling: McDonalds sells Extra Value Meals, as a bundle

of [burger, fries, and a soft drink] for less than it sells them

separately. Selling both bundles and items separately is

mixed bundling.](https://image.slidesharecdn.com/monopolymarket-230822011901-9202c4eb/75/Monopoly-Market-ppt-21-2048.jpg)

![Sample Questions

Q4: A monopolist has the following Total Cost function: TC = 10 + 5Q, the price

elasticity of demand has been estimated to be -2 [Ep = -2].

Estimate the monopoly price?

Solution:

So p =

If demand is more price elastic i.e. Ep = -2 then

Then p =

5

Q

TC

MC )

2

1

1

(

5

P

)

1

1

(

p

E

P

MC

unit

/

10

€

5

.

0

5

)

4

1

1

(

5

P

unit

/

67

.

6

€

75

.

0

5

](https://image.slidesharecdn.com/monopolymarket-230822011901-9202c4eb/75/Monopoly-Market-ppt-27-2048.jpg)