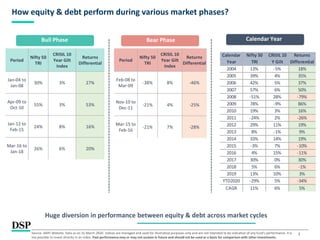

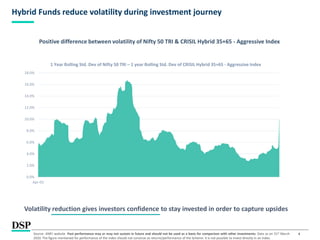

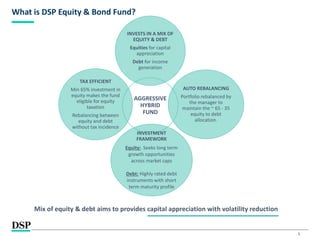

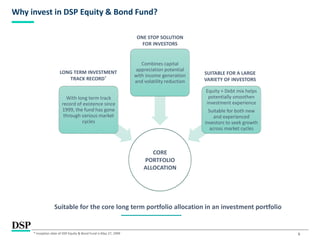

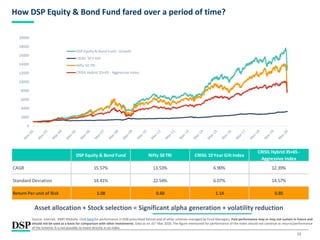

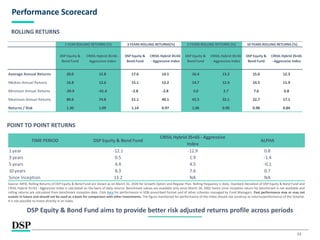

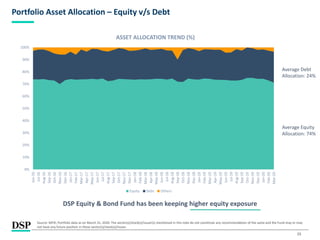

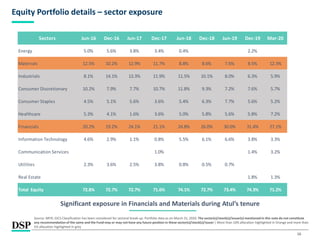

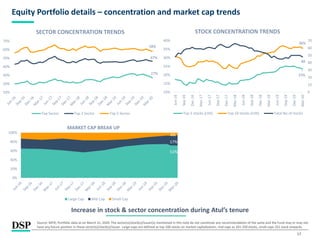

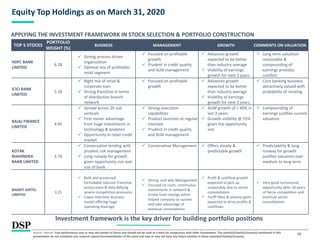

This document discusses the performance of equity and debt markets over different time periods and market phases. It shows that equity markets see much larger gains in bull phases but also larger losses in bear phases compared to debt markets. The document then discusses how a hybrid fund like DSP Equity & Bond Fund aims to provide better risk-adjusted returns than pure equity funds by maintaining a mix of around 65-75% in equities and 25-35% in high-quality debt securities. The fund has outperformed hybrid benchmarks with higher returns and lower volatility over various periods due to its robust framework for equity selection, asset allocation and rebalancing.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients OnlyDate

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

March 2020

| People | Processes | Performance |

DSP Equity & Bond Fund](https://image.slidesharecdn.com/dspequitybondfund-mar2020-200623181652/85/DSP-Equity-Bond-Fund-1-320.jpg)