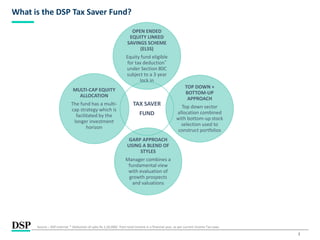

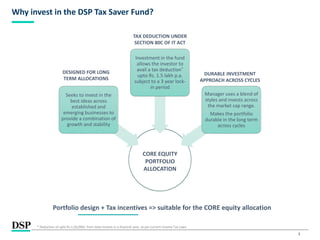

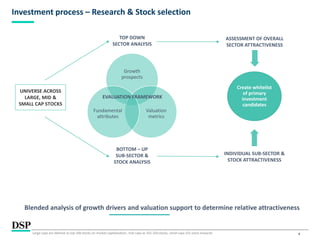

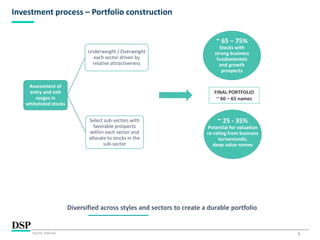

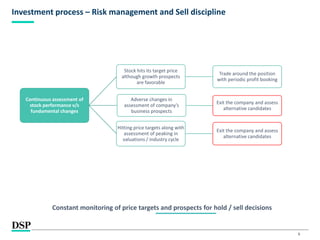

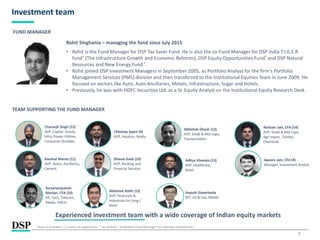

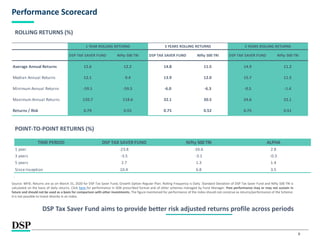

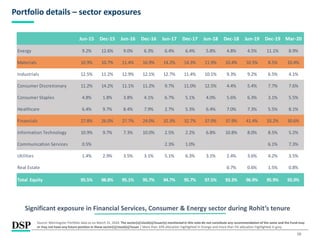

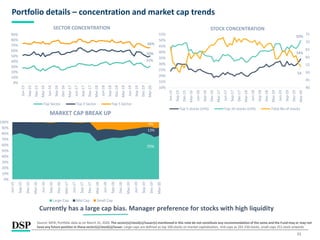

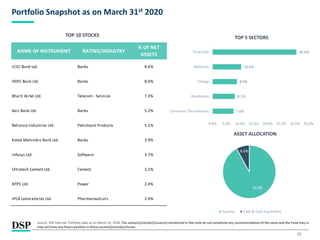

The document provides an overview of the DSP Tax Saver Fund, an open-ended equity linked savings scheme (ELSS) that aims to provide long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments across market capitalizations. The fund uses a blend of top-down and bottom-up approaches, investing across sectors based on macro analysis and selecting stocks based on fundamental research. It has outperformed its benchmark index on a risk-adjusted basis over the past 1, 3 and 5 years under the management of Rohit Singhania since July 2015. The current portfolio has a large cap bias and is concentrated in the financial services, healthcare, energy and materials sectors.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients OnlyDate

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

March 2020

| People | Processes | Performance |

DSP Tax Saver Fund](https://image.slidesharecdn.com/dsptaxsaverfund-mar2020-200623182348/85/DSP-Tax-Saver-Fund-1-320.jpg)