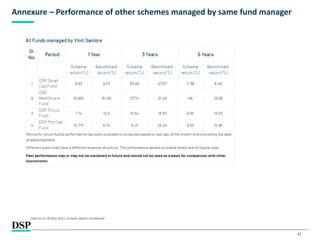

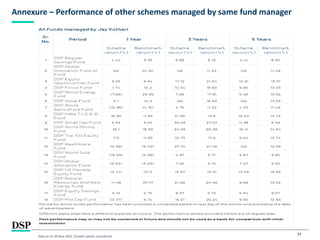

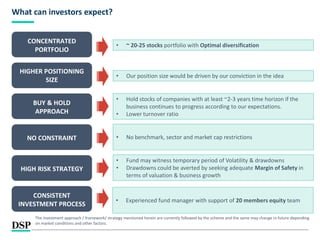

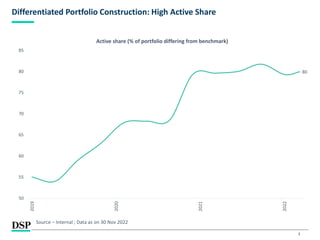

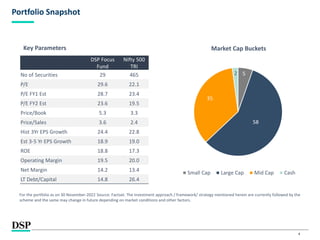

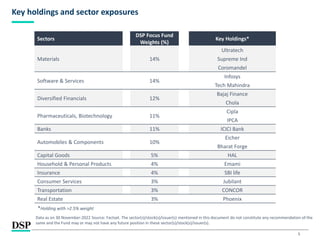

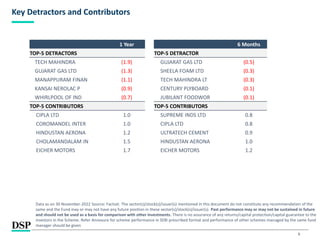

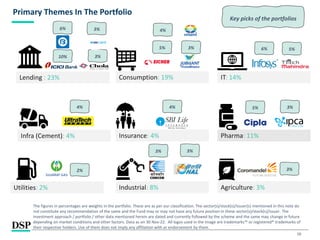

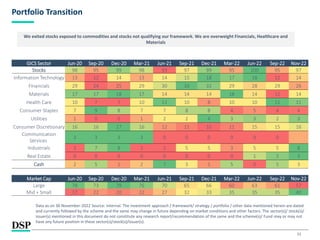

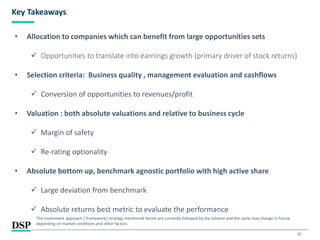

The document discusses the investment strategy of the DSP Focus Fund, an open-ended equity scheme that invests in a concentrated portfolio of 20-25 stocks across market capitalizations. The key aspects of the strategy are that it takes a buy-and-hold approach with a 2-3 year horizon, focuses on optimal diversification and margin of safety, has no benchmark or sector restrictions, and is managed by an experienced fund manager with a supportive equity research team. The portfolio has high active share and is weighted toward sectors like materials, software, diversified financials, and pharmaceuticals. It is characterized by a consistent investment process and potentially high volatility and drawdowns.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

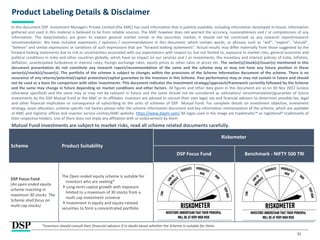

DSP Focus Fund

An open-ended equity scheme investing in maximum 30 stocks. The Scheme shall focus on multi-cap stocks

| People | Processes | Performance | Portfolio](https://image.slidesharecdn.com/dspfocusfunddec2022-230726175930-b22a49fd/85/DSP-Focus-Fund-1-320.jpg)

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

INVESTMENT FRAMEWORK

| People | Processes | Performance | Portfolio](https://image.slidesharecdn.com/dspfocusfunddec2022-230726175930-b22a49fd/85/DSP-Focus-Fund-15-320.jpg)