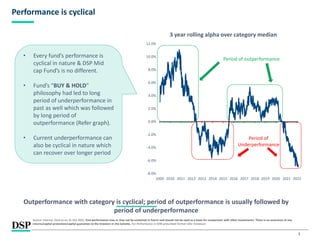

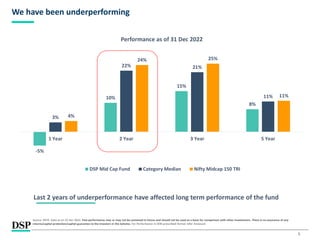

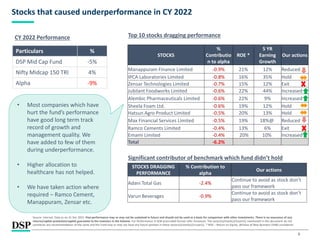

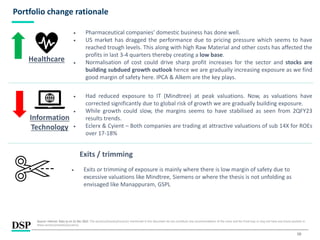

1) The fund has recently underperformed its category benchmark due to cyclical downturns in mid-cap stocks it holds and certain stocks dragging performance. However, the fund manager believes current underperformance may be cyclical and recovery could follow as with past periods.

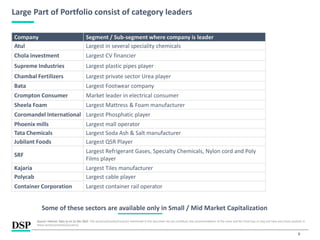

2) The fund's portfolio consists of many category-leading companies with strong long-term growth potential. While some sectors and stocks have faced short-term issues, the fund manager believes their quality and market positions provide long-term alpha potential.

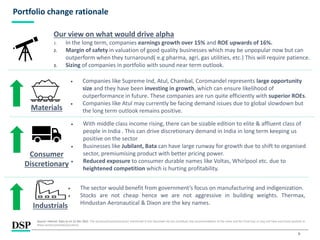

3) The fund manager continues evaluating the portfolio based on their investment framework, exiting positions where warranted but also adding to cyclically downturn stocks with good long-term prospects trading at attractive valuations now

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

| People | Processes | Performance |

DSP Mid Cap Fund

Mid Cap Fund - An open ended equity scheme predominantly investing in mid cap stocks

#INVESTFORGOOD

Jan 2023](https://image.slidesharecdn.com/dspmidcappresentation-jan23-230216093440-0a4f82fb/75/DSP-Midcap-Fund-1-2048.jpg)

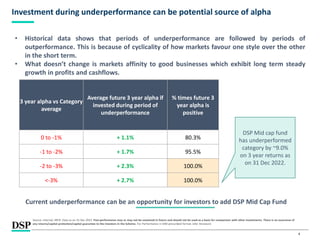

![• We analysed data from Indian Large cap, Mid cap and Small cap companies over the past decade to understand

their return potential

• Historically in the Indian markets, a combination of healthy ROE and high earnings growth has resulted in superior

price performance

21

Why we select companies with High ROE and Earnings growth

Strictly For Use By Intended Recipients Only

Source: Elara Capital, [MOSL Wealth Creation Studies in India]; * companies with an average 10Y RoE > = 16%, used so as to categorize companies within Small Caps; Constituents of Nifty

500 Index as on 31 July 2022 are back tested from the peak of 2008. All returns in INR terms. To understand the table better, we take an example of the third row. We considered all the

stocks in the Nifty 500 index, and classified them as Small Cap, Mid Cap and Large Cap based on MSCI definition – please see Appendix. Over the period Jan 2008 market peak to November

2021, we found that 28 companies grew from being Small Caps to Large & Mid Caps, with an average price appreciation of 25.0%, Profit pool increase of 15.6% and an average RoE of 22.6%.

%.. Past performance is not a reliable indicator of future results

Large & Mid Cap SmallCap

No of

stocks

moved

Profit pool

increase (%

CAGR)

11.5%

15.6%

11.4%

Average

ROE

18.0%

22.6%

21.5%

6.7%

6.0%

Market cap classification

(as on 31 July 2022)

L&M

C

L&M

C

SC

SC

SC

Market cap classification

(as on Jan 2008)

L&M

C

L&M

C

SC

SC

SC

No of stocks

moved

53

28

139*

119

38 NEGATIVE

8.5%

There is a sizable pool of high-quality companies that have the potential to provide superior returns

Elimination

is

Key

10.5%

25.0%

17.5%

8.0%

-0.8%

Average

price

appreciation

Market peak

before GFC](https://image.slidesharecdn.com/dspmidcappresentation-jan23-230216093440-0a4f82fb/85/DSP-Midcap-Fund-21-320.jpg)