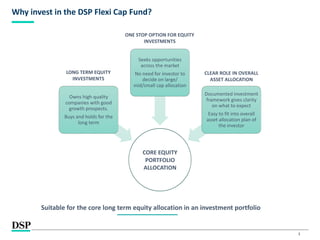

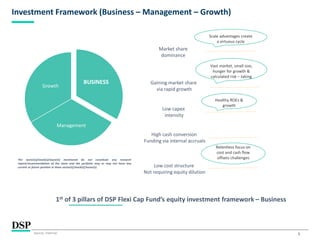

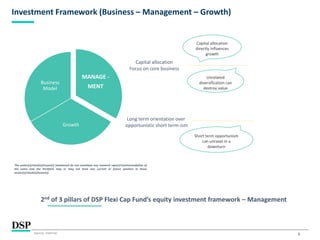

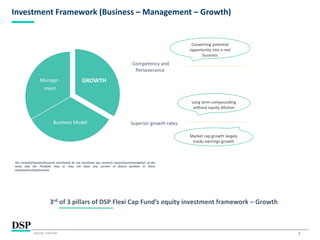

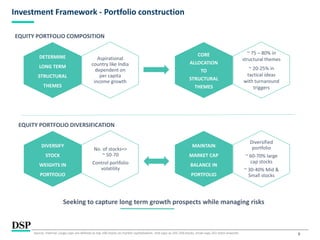

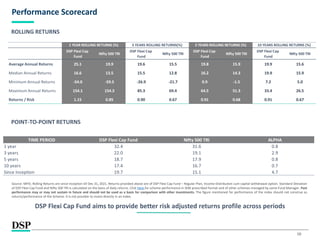

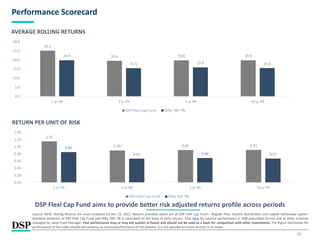

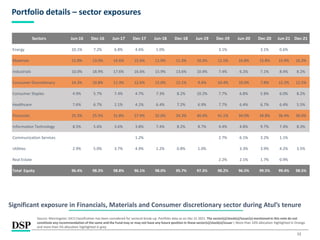

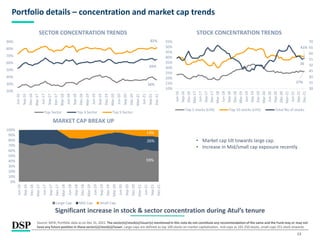

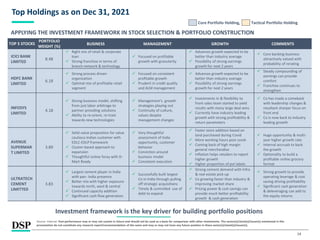

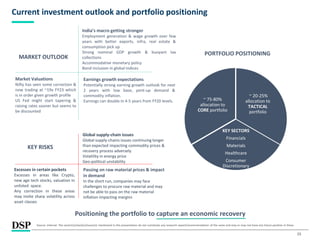

The document provides an overview of the DSP Flexi Cap Fund, a flexi cap mutual fund scheme that invests across large, mid, and small cap stocks. The fund follows a core-satellite approach, with 75-80% in a core portfolio of high quality stocks based on long term themes, and 20-25% in tactical opportunities. The fund manager aims to identify quality businesses with strong growth prospects using a framework that evaluates the business model, management quality, and growth potential. Since inception in 2016, the fund has outperformed its benchmark index with average annual returns of 25.1% versus 19.9% for the index. The fund's portfolio has increased concentration in financials, materials, and consumer discretion

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients Only

Date

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

Dec 2021

| People | Processes | Performance |

DSP Flexi Cap Fund (erstwhile DSP Equity Fund)

#INVESTFORGOOD](https://image.slidesharecdn.com/flexifund-240302190541-013924bd/85/DSP-Flexi-Fund-Presentation-Dec-2021-pdf-1-320.jpg)