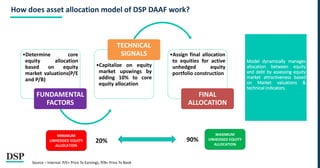

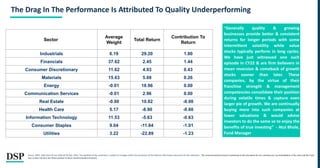

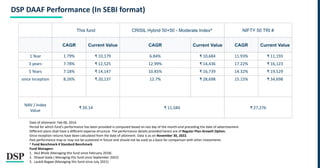

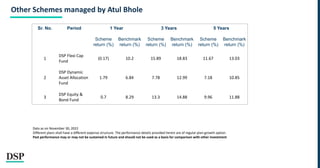

The DSP Dynamic Asset Allocation Fund (DAAF) dynamically manages allocation between equity and debt based on an internal model that assesses equity market attractiveness using factors like market valuations and technical indicators. The fund has navigated market cycles since 2020 with lower volatility by holding a conservative equity allocation of 40% currently. While this approach has led to underperformance in bull markets, it has reduced drawdowns and volatility for investors.