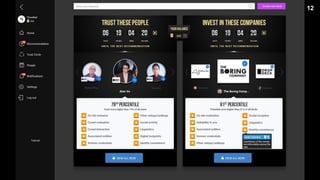

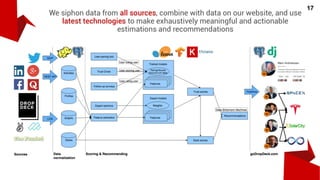

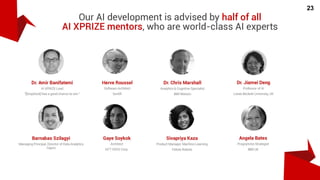

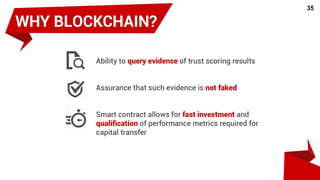

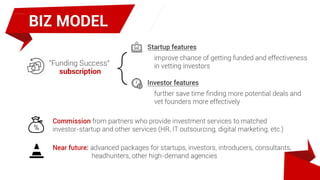

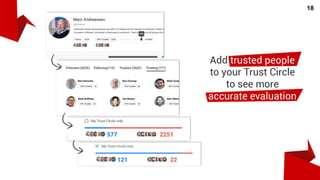

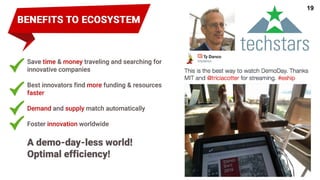

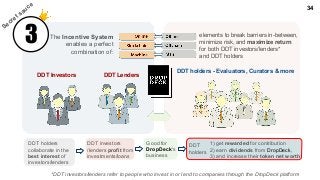

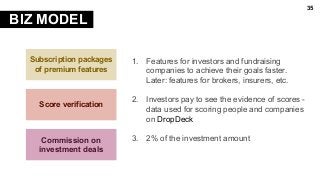

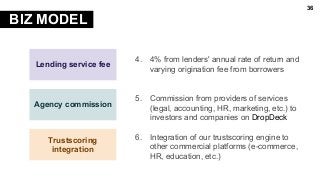

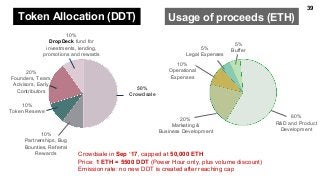

DropDeck is a decentralized financing platform aimed at streamlining investments in startups and SMEs through AI and blockchain technology. It facilitates frictionless connections between investors and innovators by providing trust and potential scores for companies and their founders. The platform offers an incentive system for data contribution and aims to disrupt traditional financing methods while giving users the tools to invest or lend efficiently.