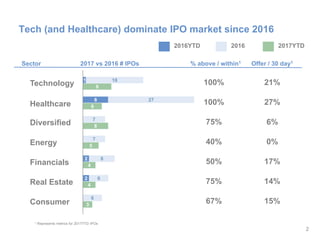

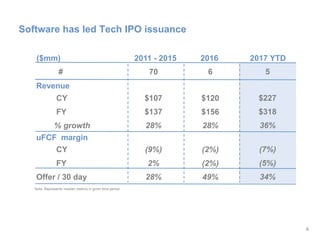

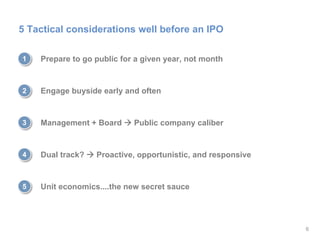

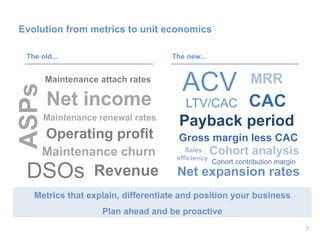

The document discusses tactical considerations for companies preparing for an IPO, highlighting trends in the tech and healthcare sectors, which have been dominant since 2016. Key factors for investor focus include scale, profitability, M&A potential, and competitive advantage. It emphasizes the importance of proactive management and detailed unit economics in the IPO preparation process.