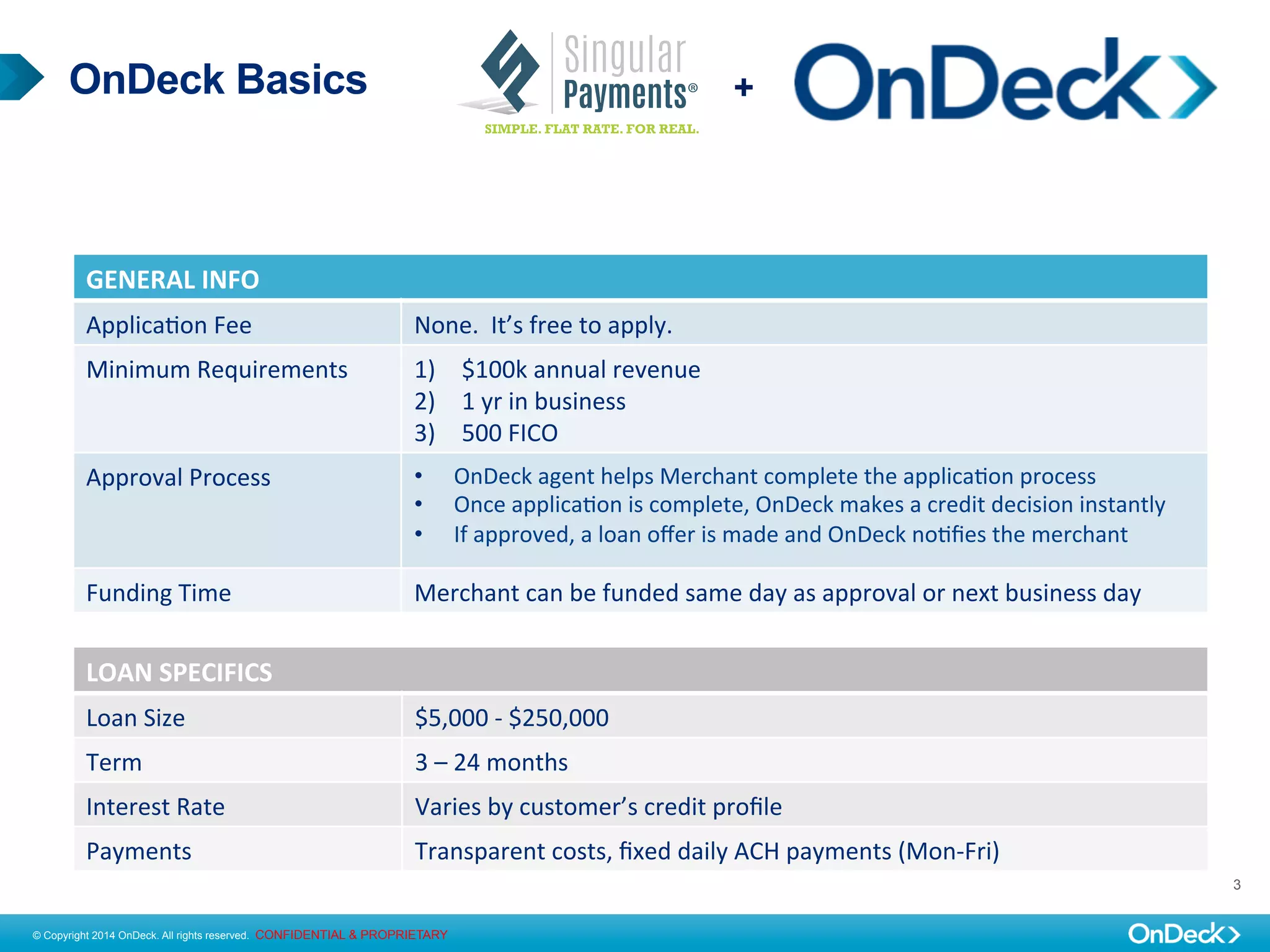

OnDeck is a direct lender that provides small businesses with short term loans ranging from $5,000 to $500,000 with terms of 3 to 36 months. OnDeck uses cash flow, not just credit scores, to make instant credit decisions and can fund loans the same day. It has delivered over $2 billion in loans to over 700 industries in all 50 US states and other countries.