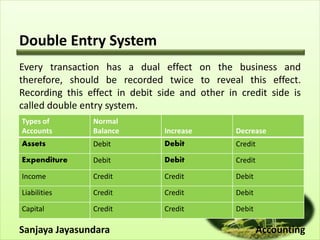

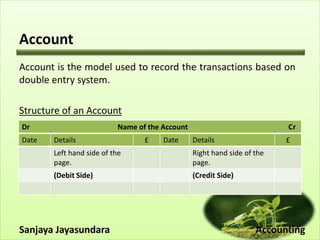

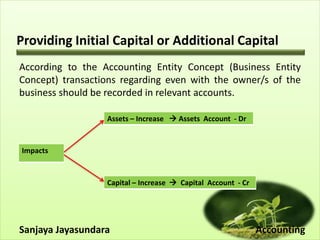

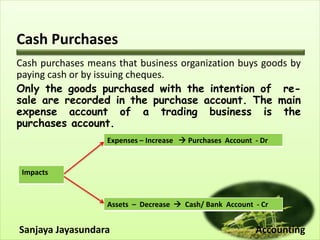

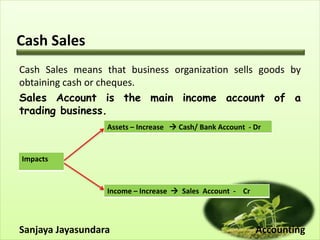

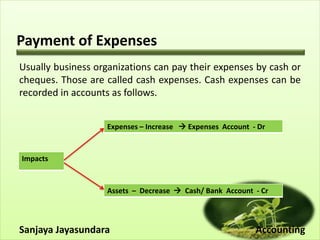

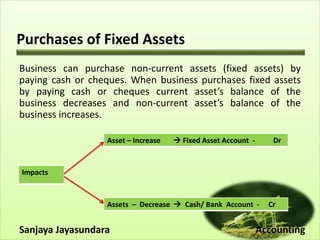

The document discusses the double entry system of accounting and how it applies to various cash transactions. It explains that every transaction has a dual effect that is recorded with debits on one side and credits on the other. It then provides examples of how initial capital, cash purchases, cash sales, payment of expenses, and purchases of fixed assets would be recorded through debits and credits to different accounts like assets, income, expenses, and capital. The purpose is to illustrate the double entry system and how it reveals the dual effects of common cash-based transactions.