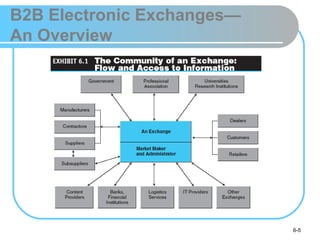

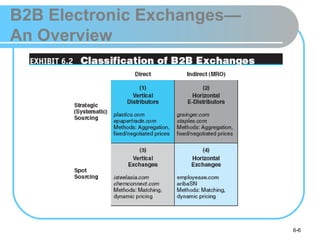

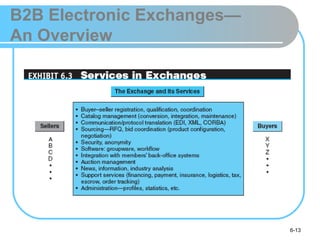

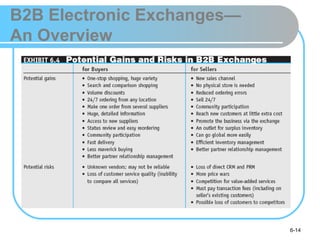

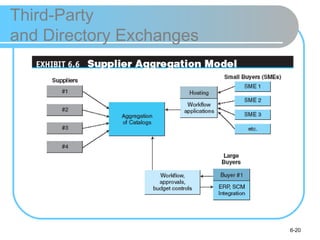

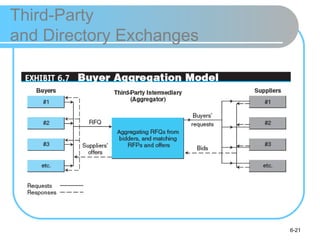

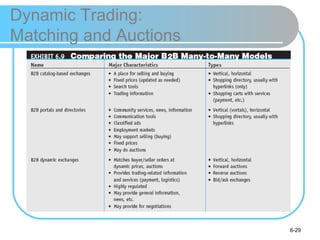

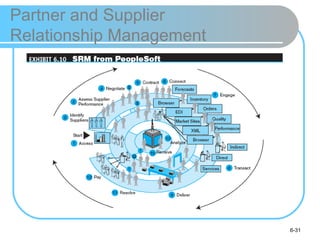

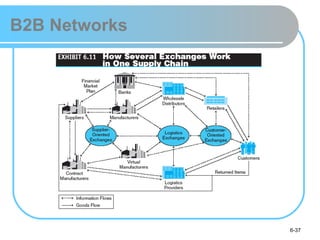

The document discusses business-to-business (B2B) electronic exchanges and support services. It defines different types of exchanges, such as public exchanges, vertical exchanges, and horizontal exchanges. It also describes ownership models, revenue models, and functions of exchanges. Additionally, it covers topics like B2B portals, third-party exchanges, consortium exchanges, dynamic trading/auctions, integration issues, and critical success factors for managing exchanges.