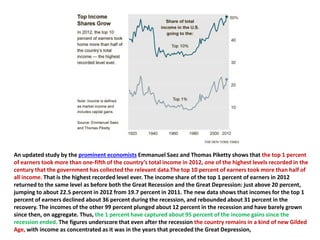

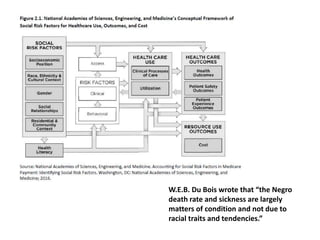

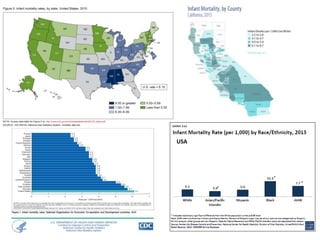

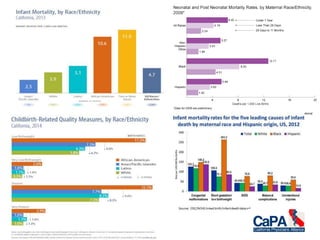

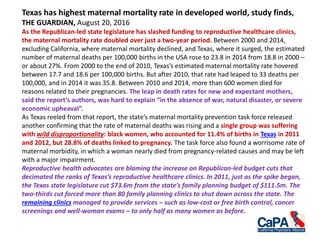

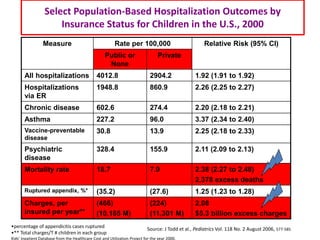

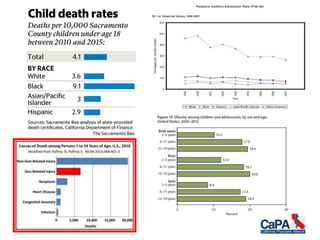

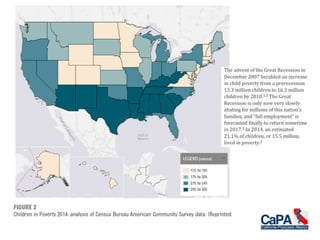

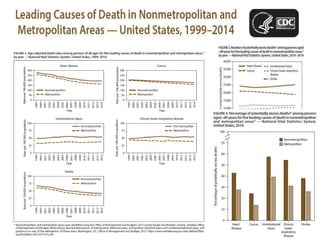

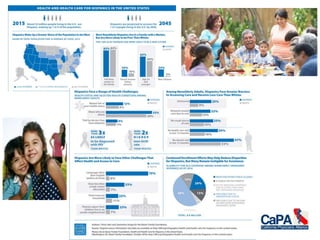

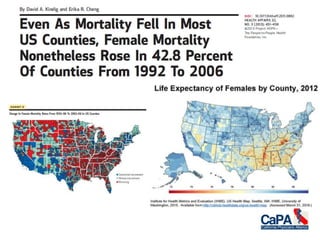

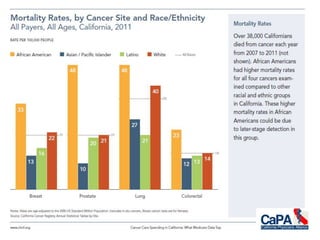

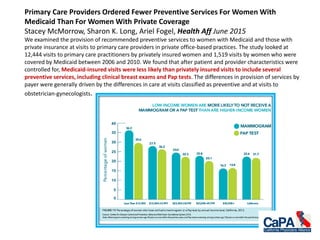

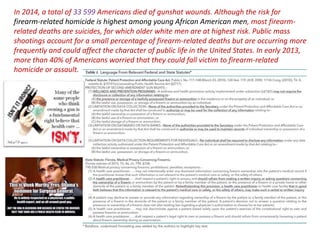

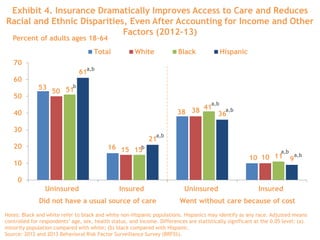

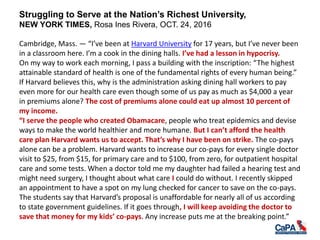

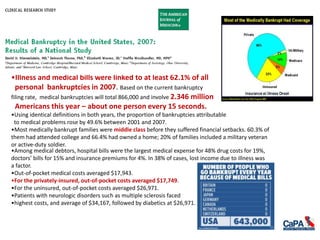

The document highlights significant disparities in maternal mortality rates among American women, particularly affecting black women and those in rural areas. It discusses the impact of healthcare access and socioeconomic factors, revealing alarming trends in states like Texas, where budget cuts have worsened outcomes. Additionally, it explores broader racial and ethnic disparities in health care, including mental health services and chronic illness treatment among various populations.

![Insurance Expansion Improved Care for Colorectal Cancer, October 04, 2016

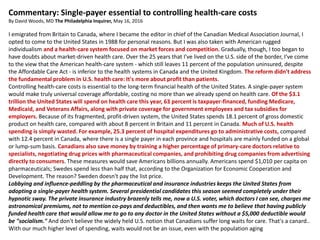

Past research had shown that patients without health insurance typically presented with more

advanced colorectal cancer disease and had lower survival rates compared with patients with

private insurance. The expansion of healthcare in Massachusetts in 2006 was associated with

increased rates of resection, and a decreased likelihood of emergent resection, for patients with

colorectal cancer, according to the results of a study published in the Journal of Clinical Oncology. The

study identified 17,499 patients with government-subsidized, self-pay, or private insurance

admitted to the hospital between 2001 and 2011 in Massachusetts and compared them with

144,253 control patients from three states.

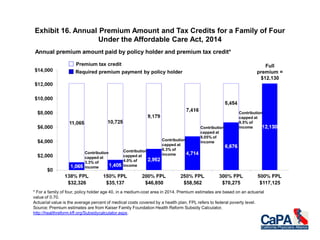

The 2006 Massachusetts health insurance expansion provided Medicaid coverage for people living

below 150% of the federal poverty limit, created a state-subsidized insurance program for people with

income less than 300% of the federal poverty limit but who remained ineligible for Medicaid, and

established an individual mandate requiring all residents to have health insurance.

The comparison showed that prior to the 2006 health insurance reform, those patients with

government-subsidized or self-pay insurance had significantly lower rates of resection for colorectal

cancer compared with patients with private insurance.

The health insurance reform was independently associated with a 44% increased rate of resection

for government-subsidized or self-pay patients (incident rate ratio [IRR], 1.44 [95% CI, 1.23–1.68]; P <

.001). More specifically, the reform was associated with a 49% increased rate of resection for colon

cancer and a 34% increase in resection for rectal cancer. The Massachusetts insurance expansion

was also associated with a 6.21 percentage point decreased probability of emergent admission (95%

CI, −11.88 to −0.54; P = .032) and an 8.13 percentage point increased probability of an elective

admission (95% CI, 1.34–14.91; P = .019) compared with the control states.](https://image.slidesharecdn.com/disparities-170615150659/85/Disparities-88-320.jpg)