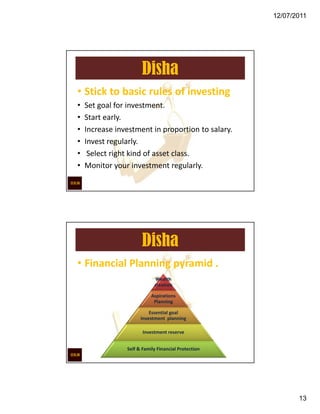

The document discusses various aspects of financial planning and tax planning. It provides tips for using tax planning tools for long-term strategic goals like retirement. It emphasizes the importance of setting financial goals, allocating funds appropriately based on goal duration, and regularly monitoring investments. The document also cautions against guarantees in investing and stresses the need to respect hard-earned money by making it work through a sound financial plan.