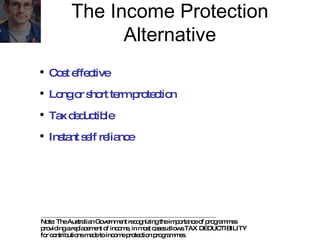

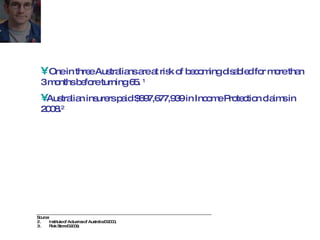

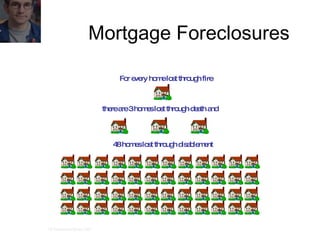

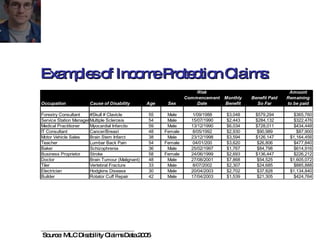

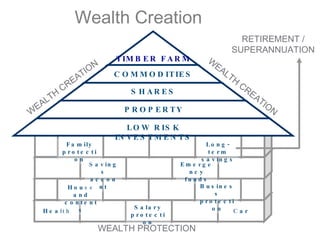

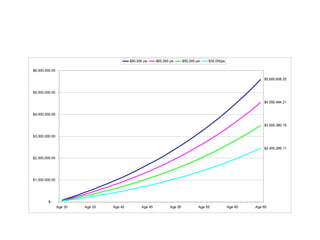

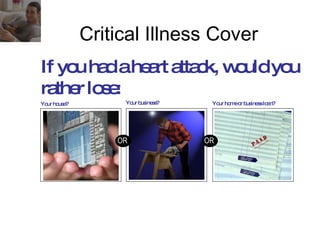

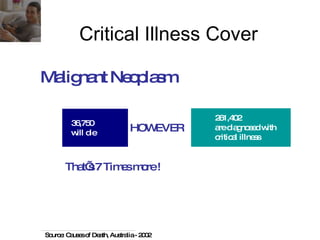

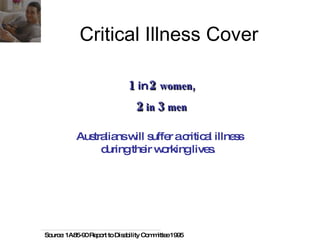

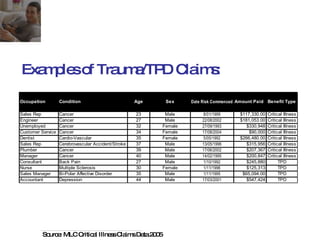

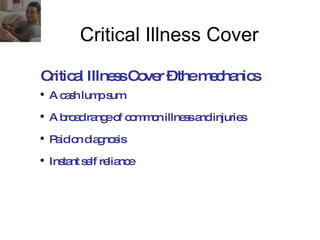

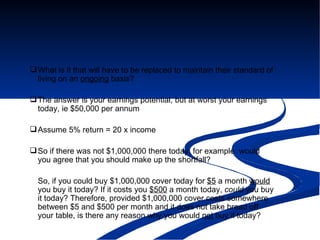

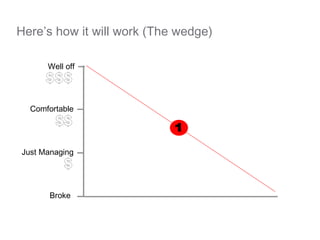

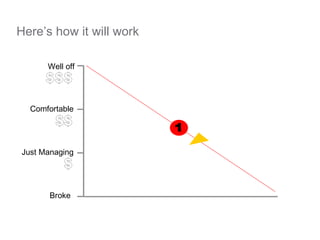

The document discusses the importance of protecting one's assets and income through insurance policies. It notes that only about 10% of the working population has income protection and over a third of Australians risk becoming disabled for over 3 months before retirement. Various types of insurance like income protection, critical illness coverage, life insurance, and trauma insurance are presented as ways to financially protect oneself and one's family from risks relating to health issues, death, or disability. The document advocates lessening the financial impact of such risks through insurance rather than taking on the risks oneself.