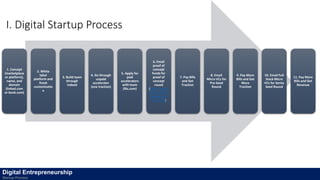

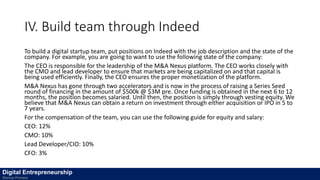

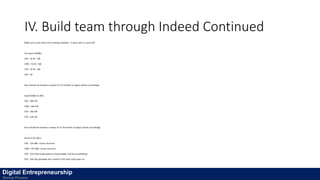

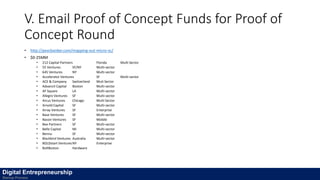

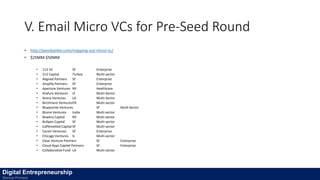

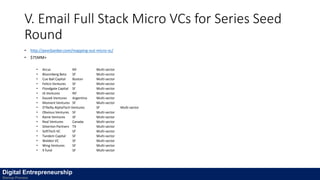

The document outlines the typical process for starting a digital startup, including developing a concept and domain name, customizing a white label platform, building a team through job sites like Indeed, applying to accelerators, raising proof of concept funding, paying bills and growing traction, raising pre-seed funding from micro VCs, raising a seed round from full stack micro VCs, and generating revenue. It notes the typical progression of funding amounts from accelerators providing $30k up to seed rounds from VCs of $7M.