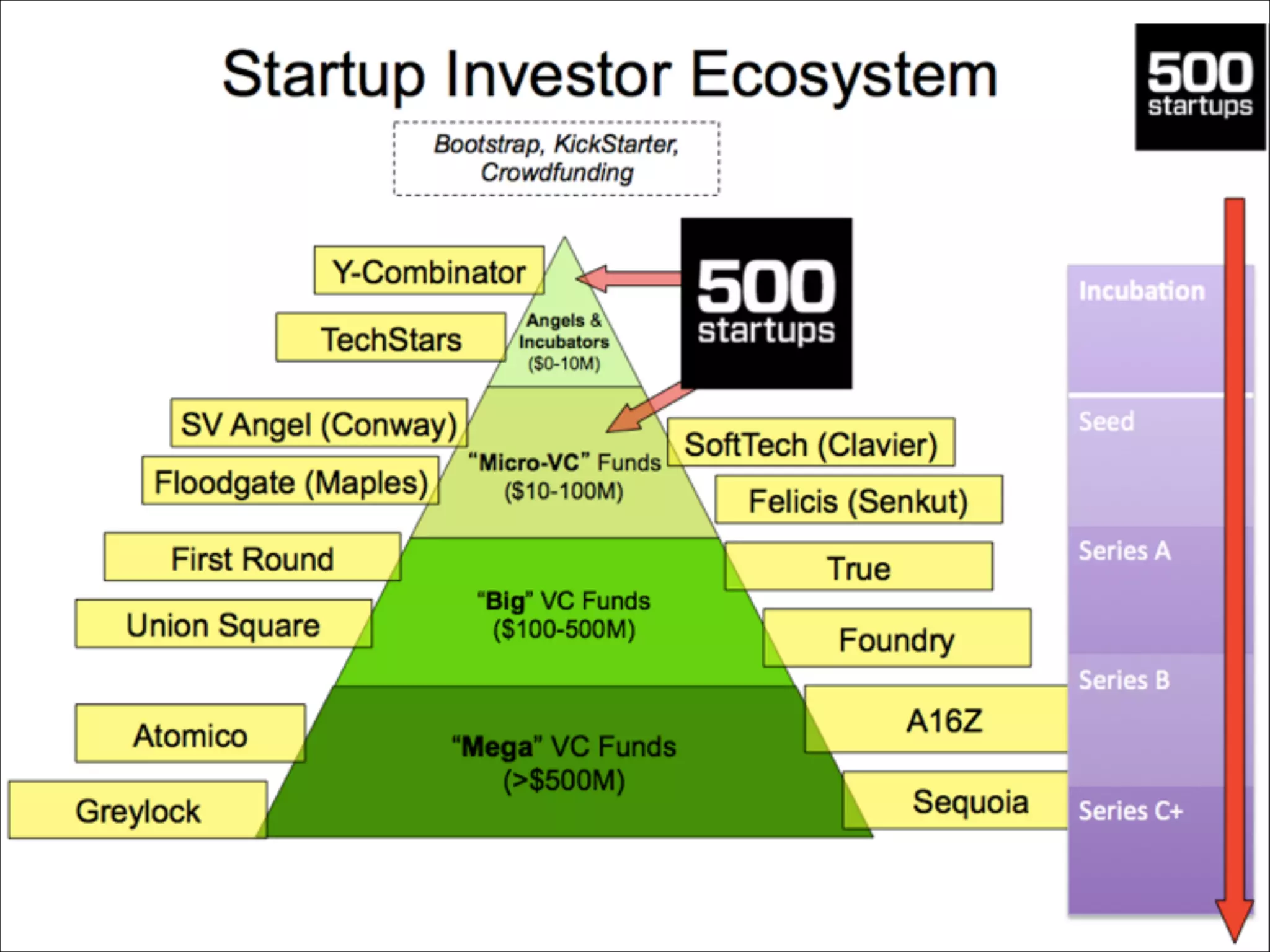

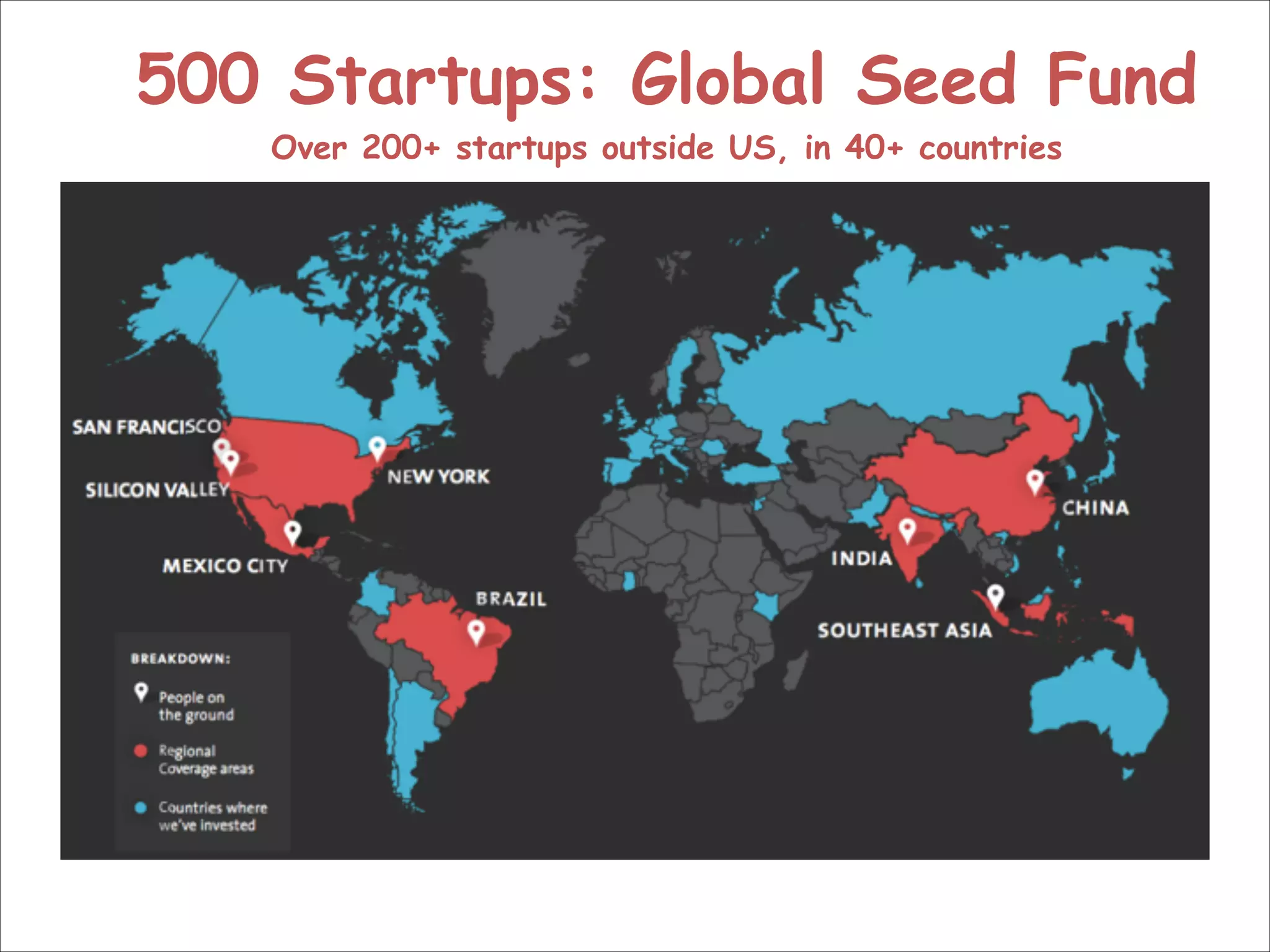

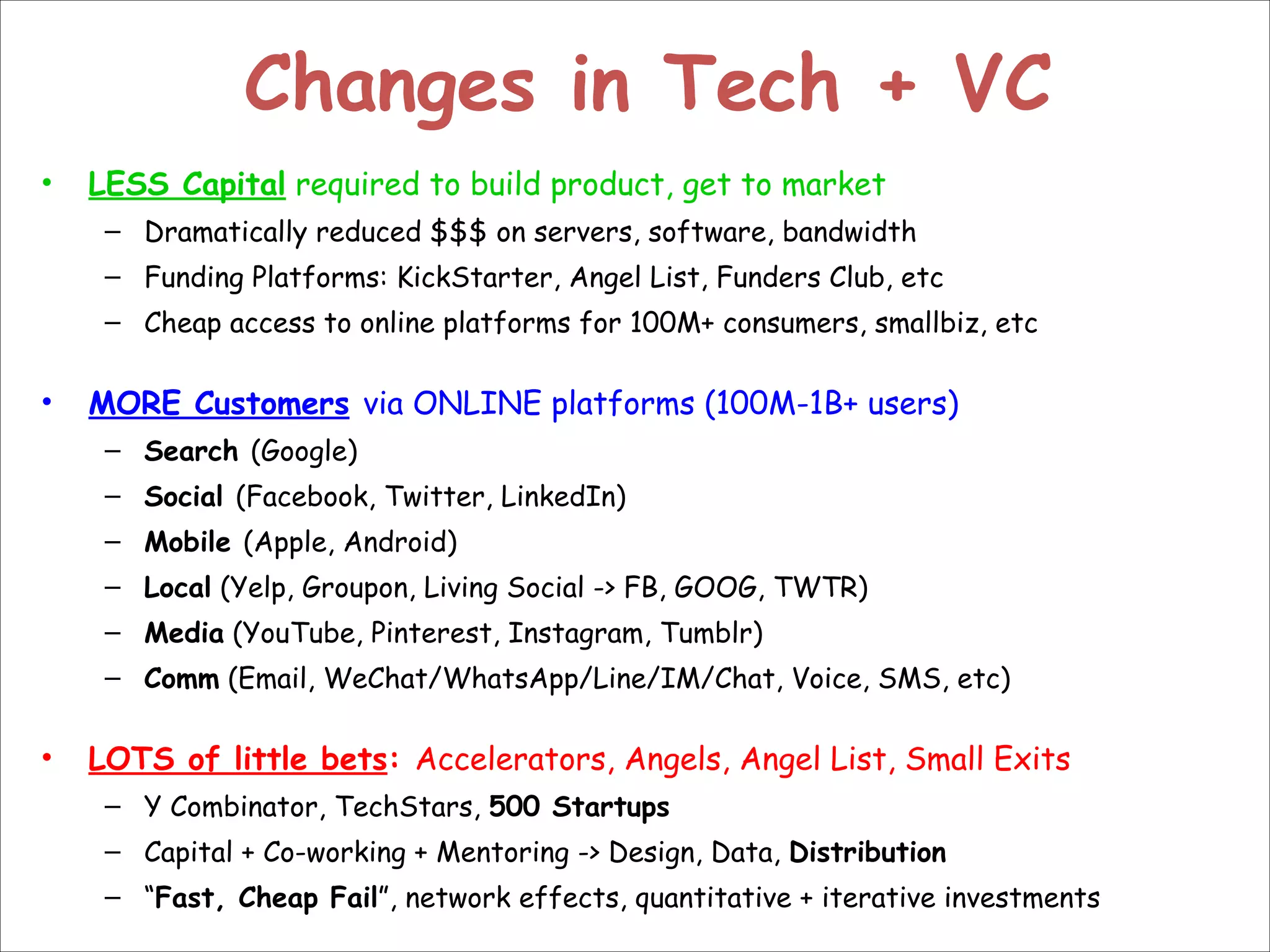

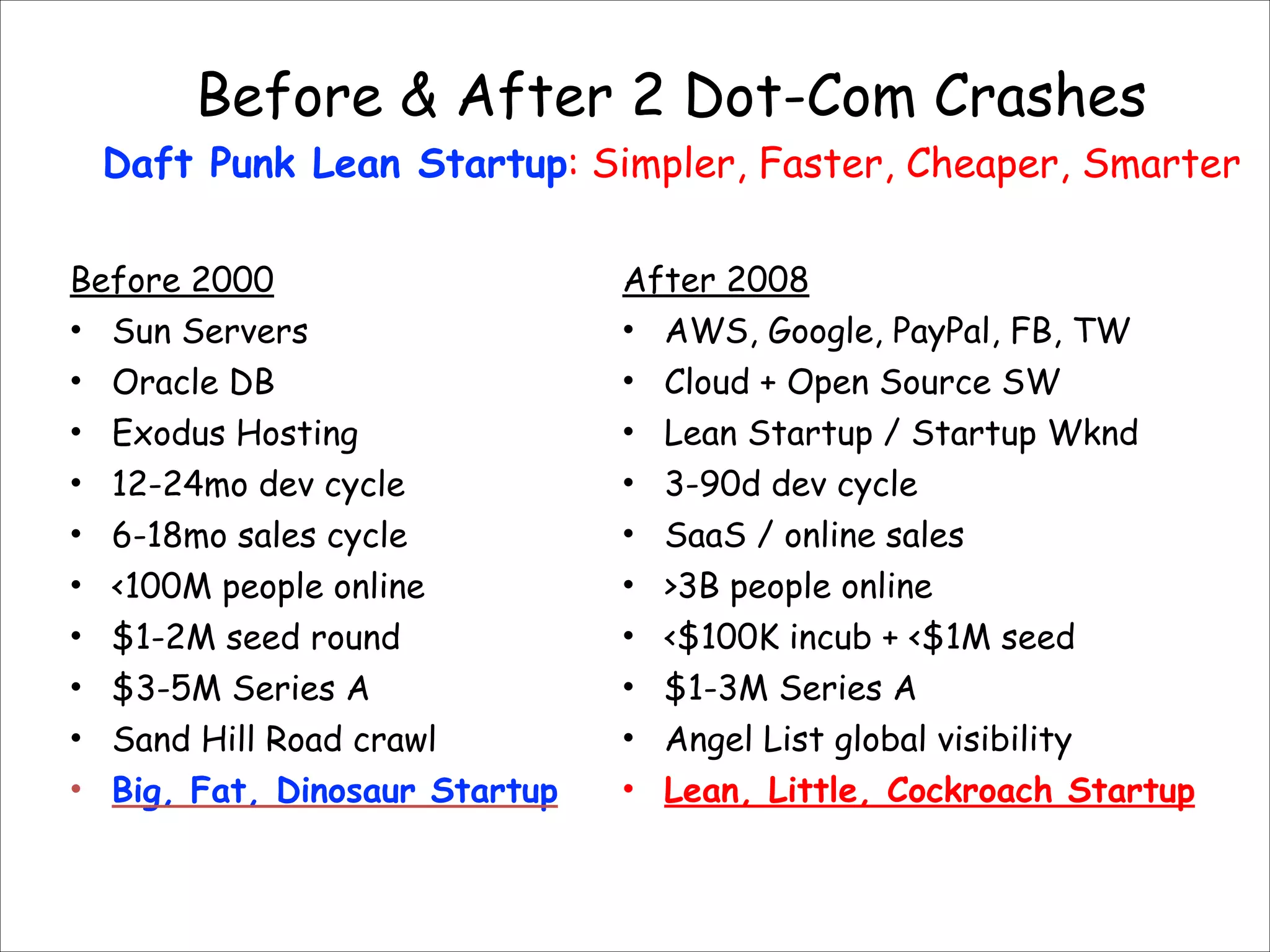

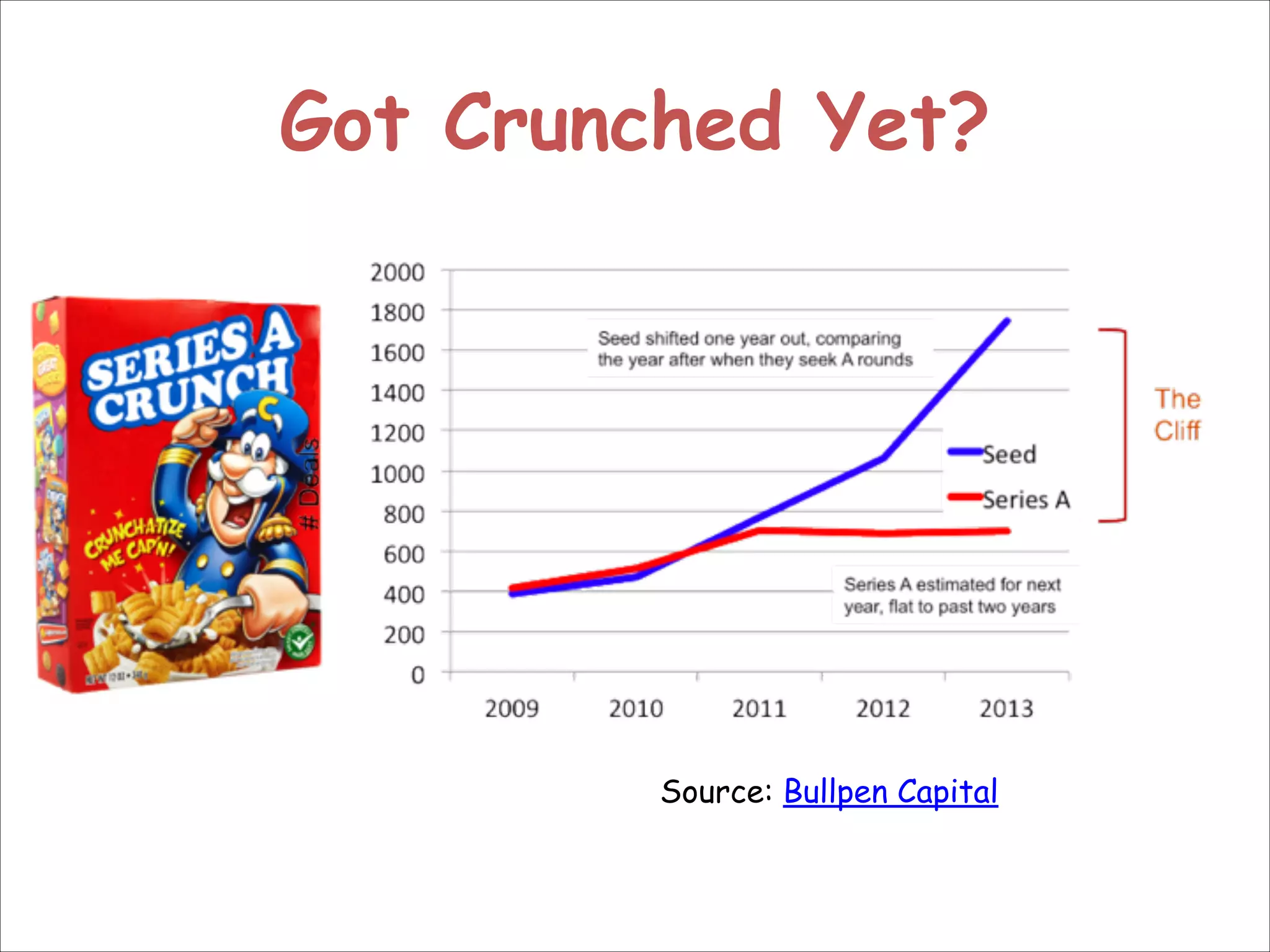

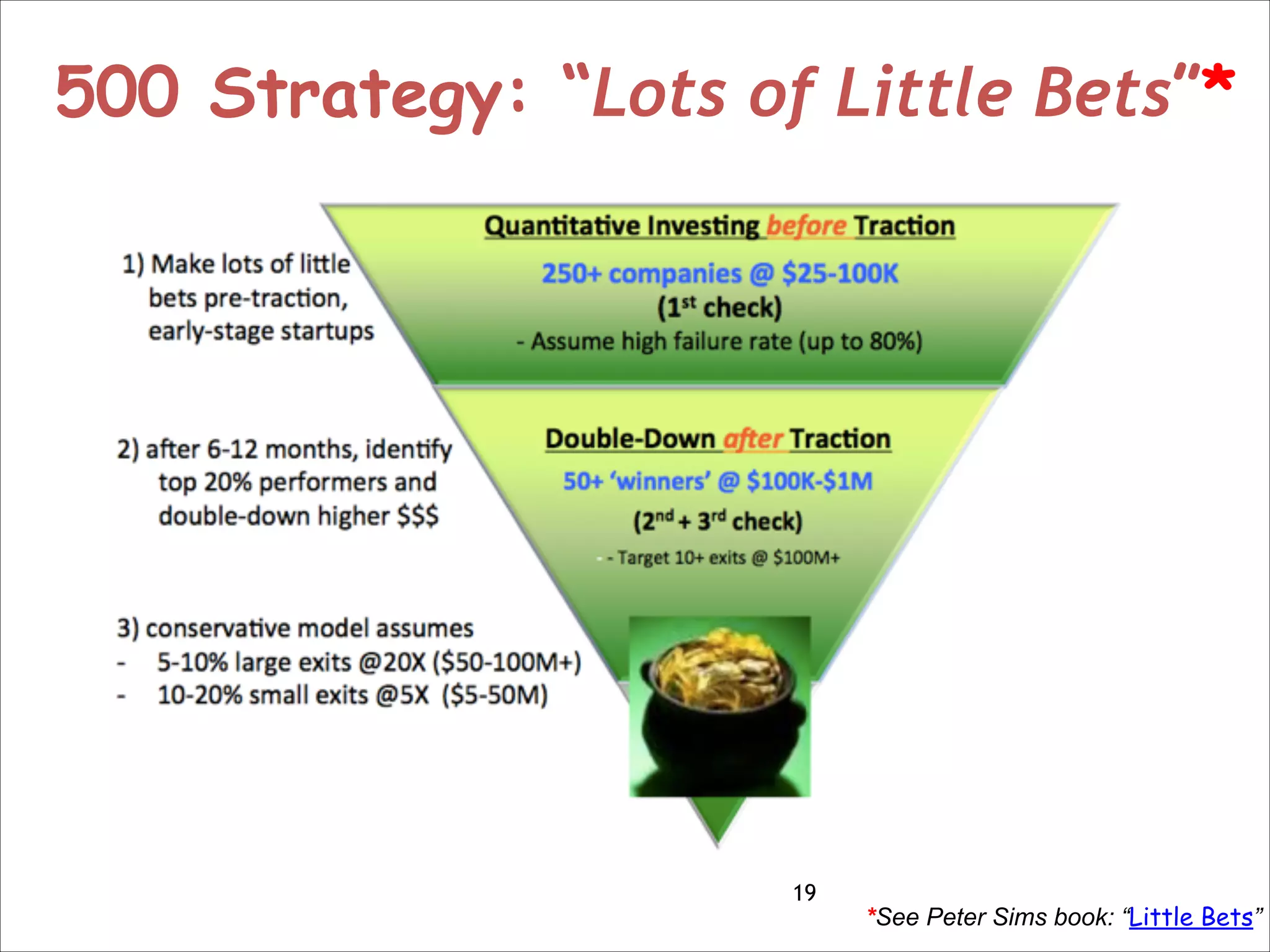

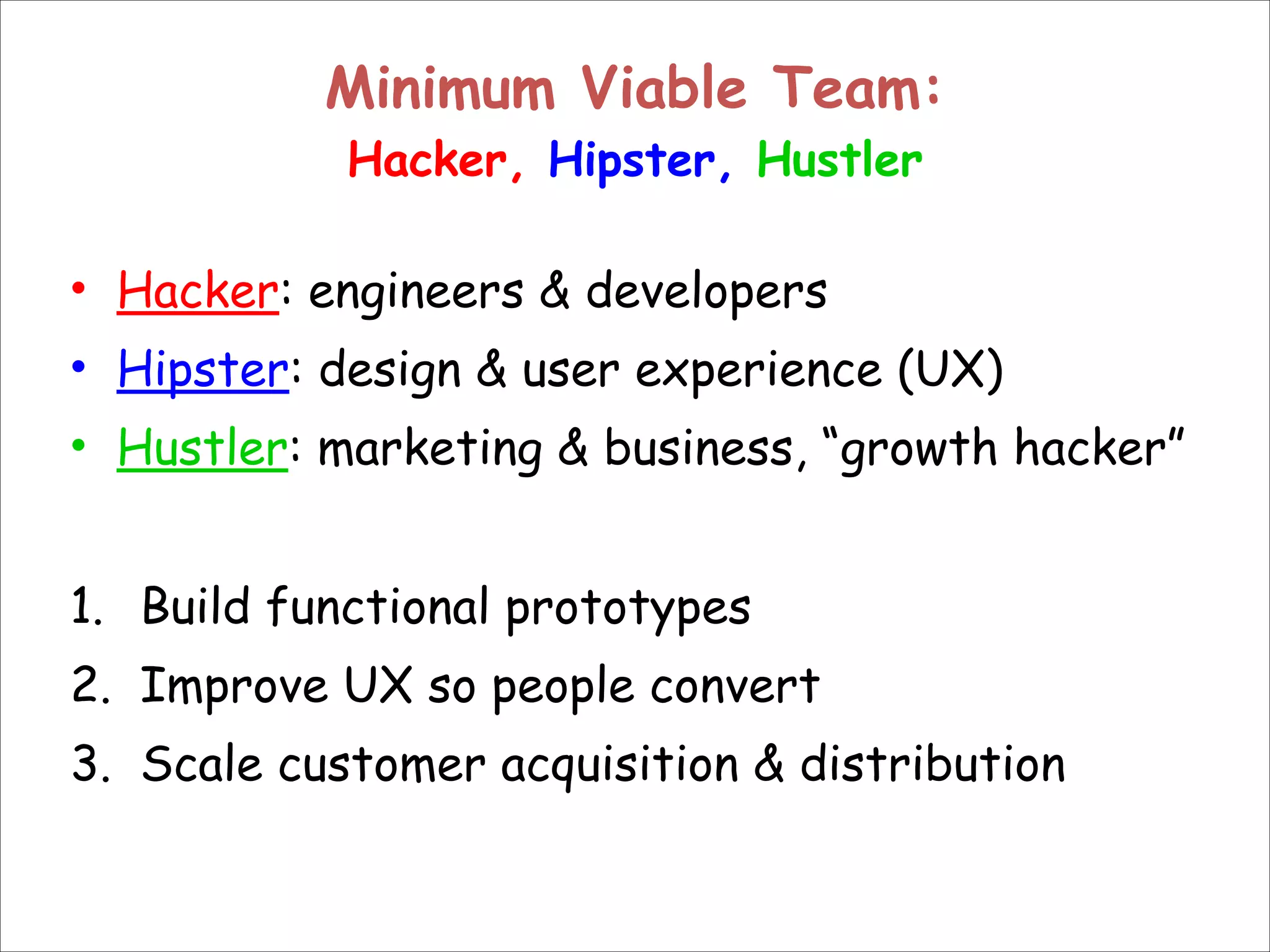

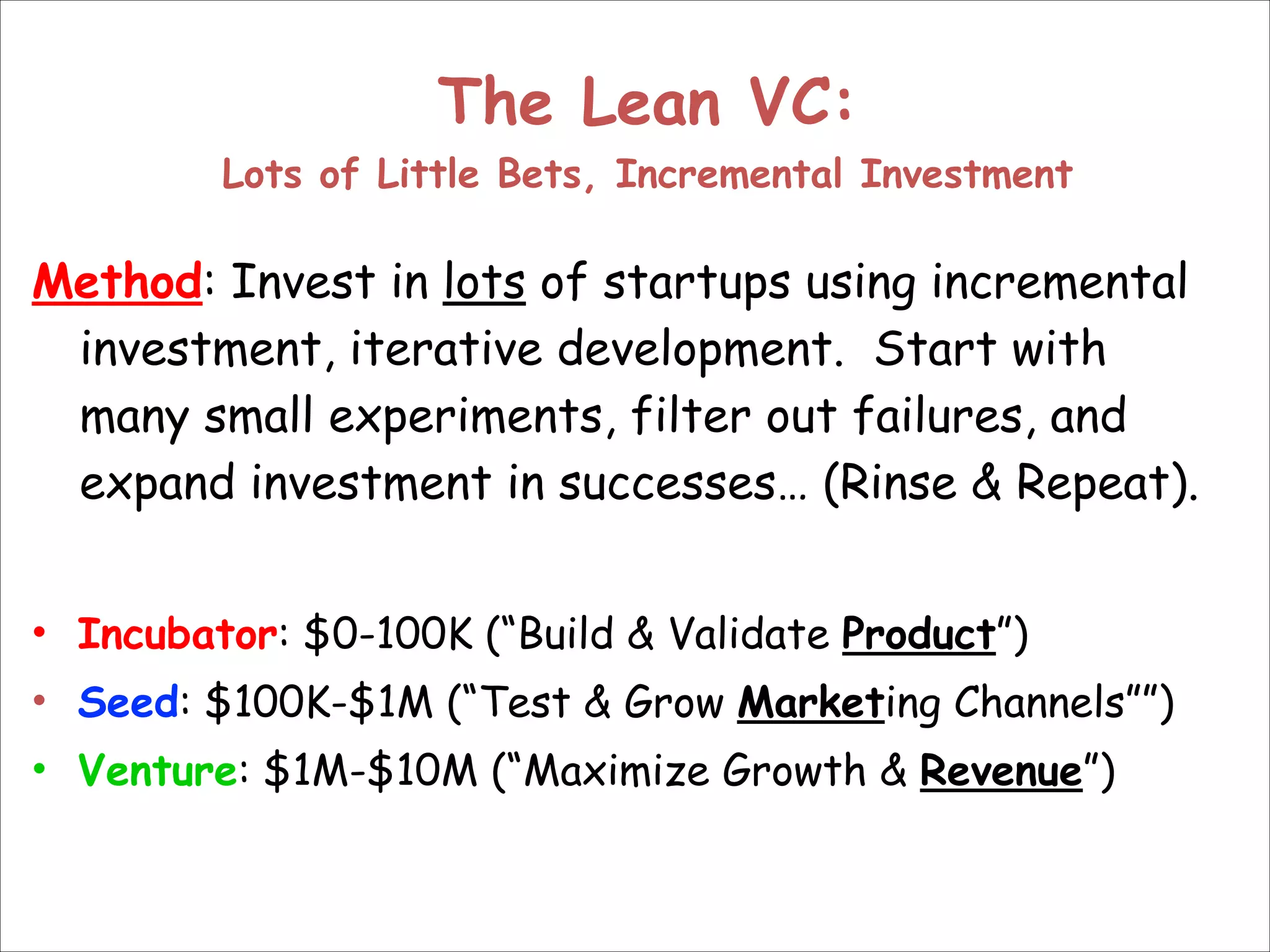

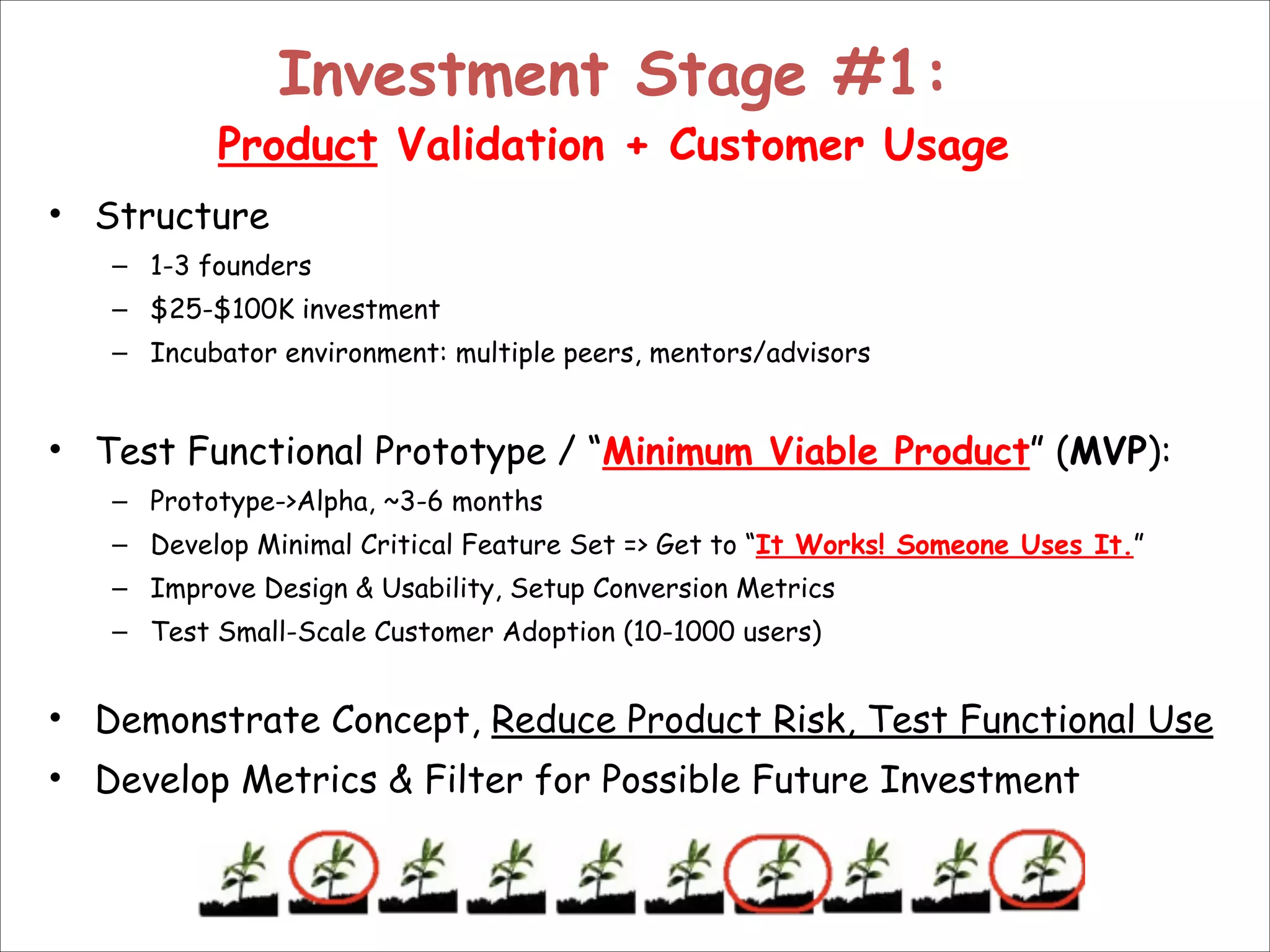

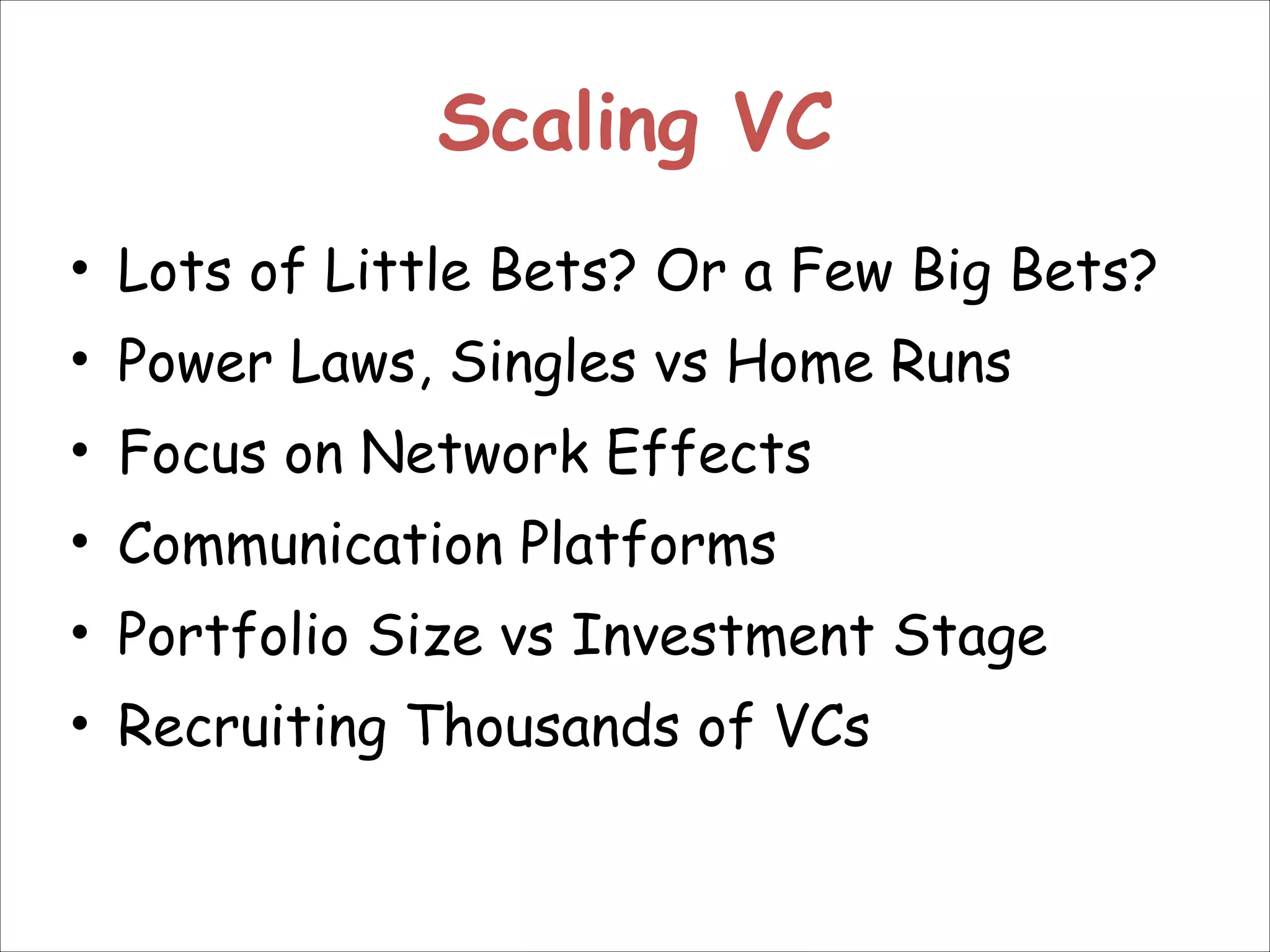

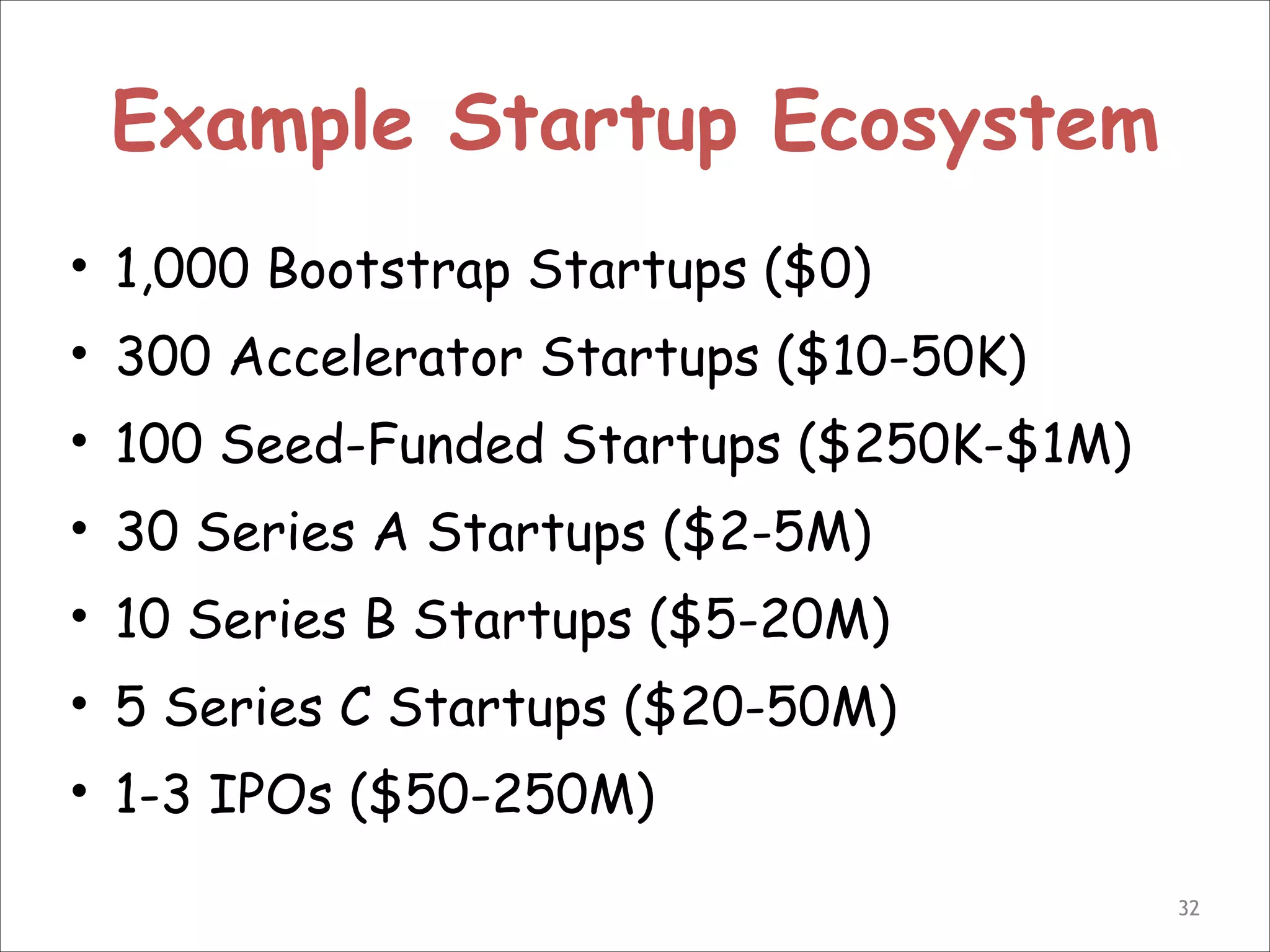

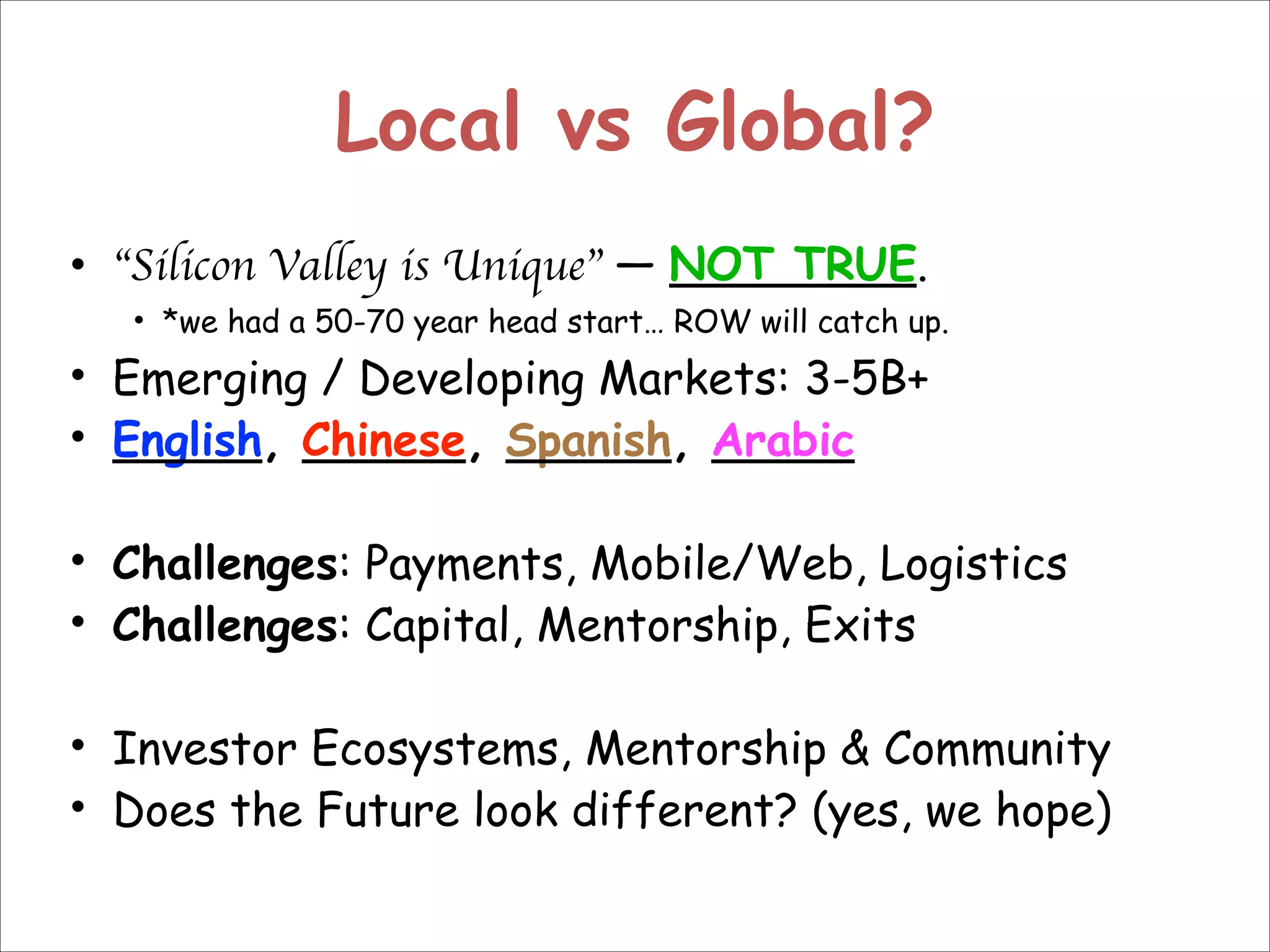

This document provides an overview of a talk given by Dave McClure, the Founding Partner and Chief Troublemaker of 500 Startups. The talk discusses what 500 Startups is, changes in technology and venture capital, the concept of "The Lean VC" which involves making lots of small bets on startups, and building the 500 Startups ecosystem globally. It also outlines 500 Startups' investment stages and approach to deal flow, portfolio development, follow-on strategy, and using feedback loops and metrics.