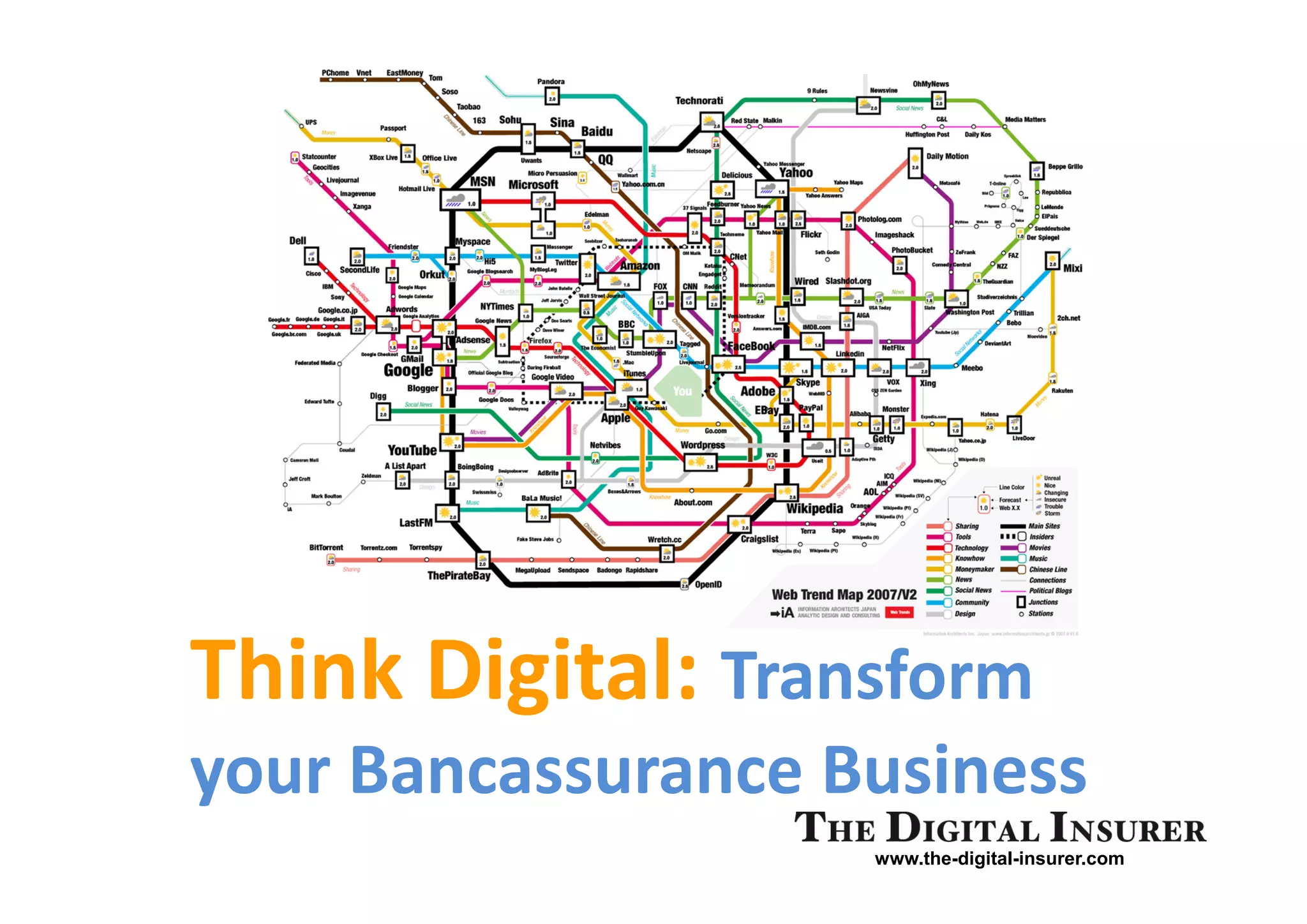

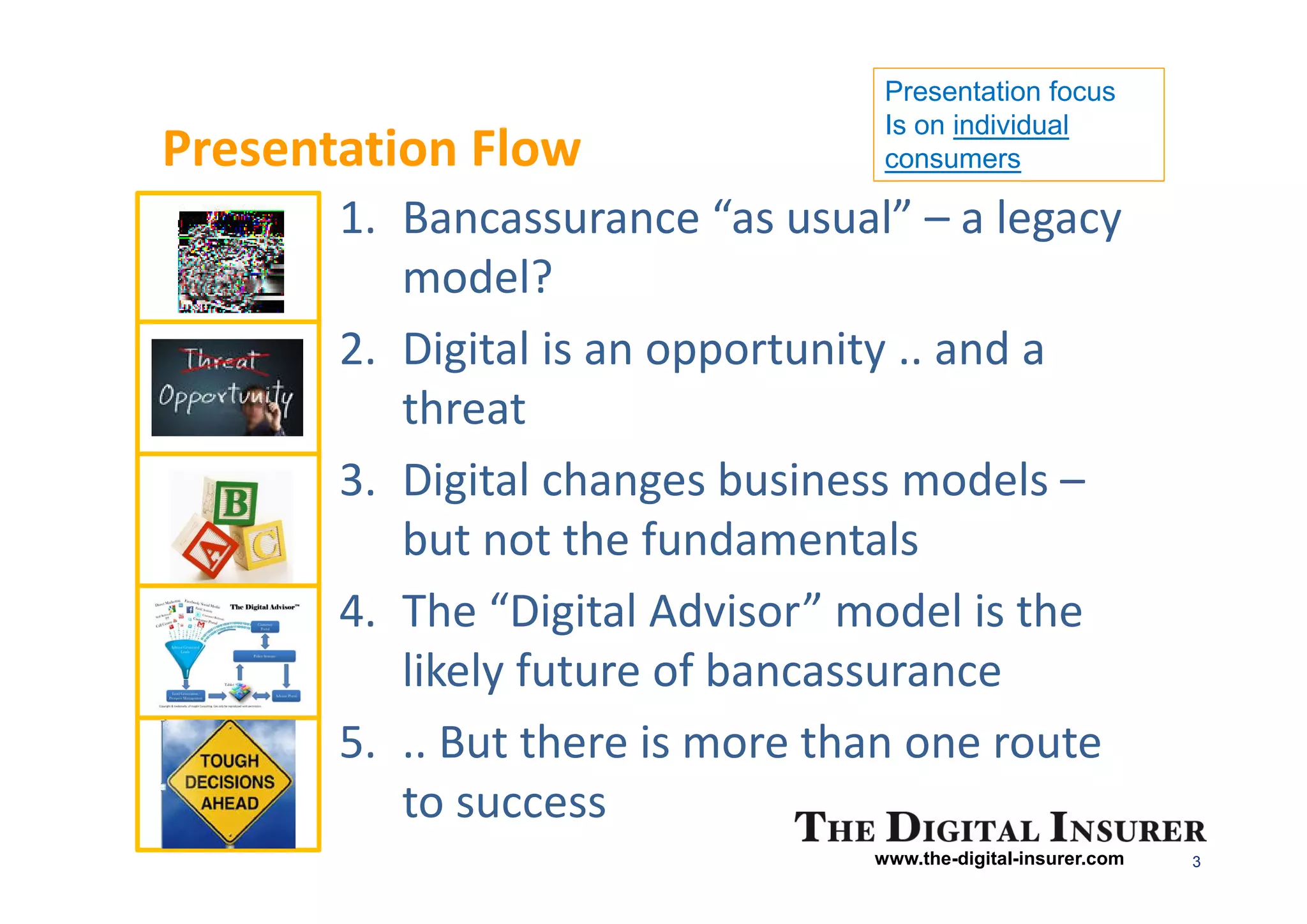

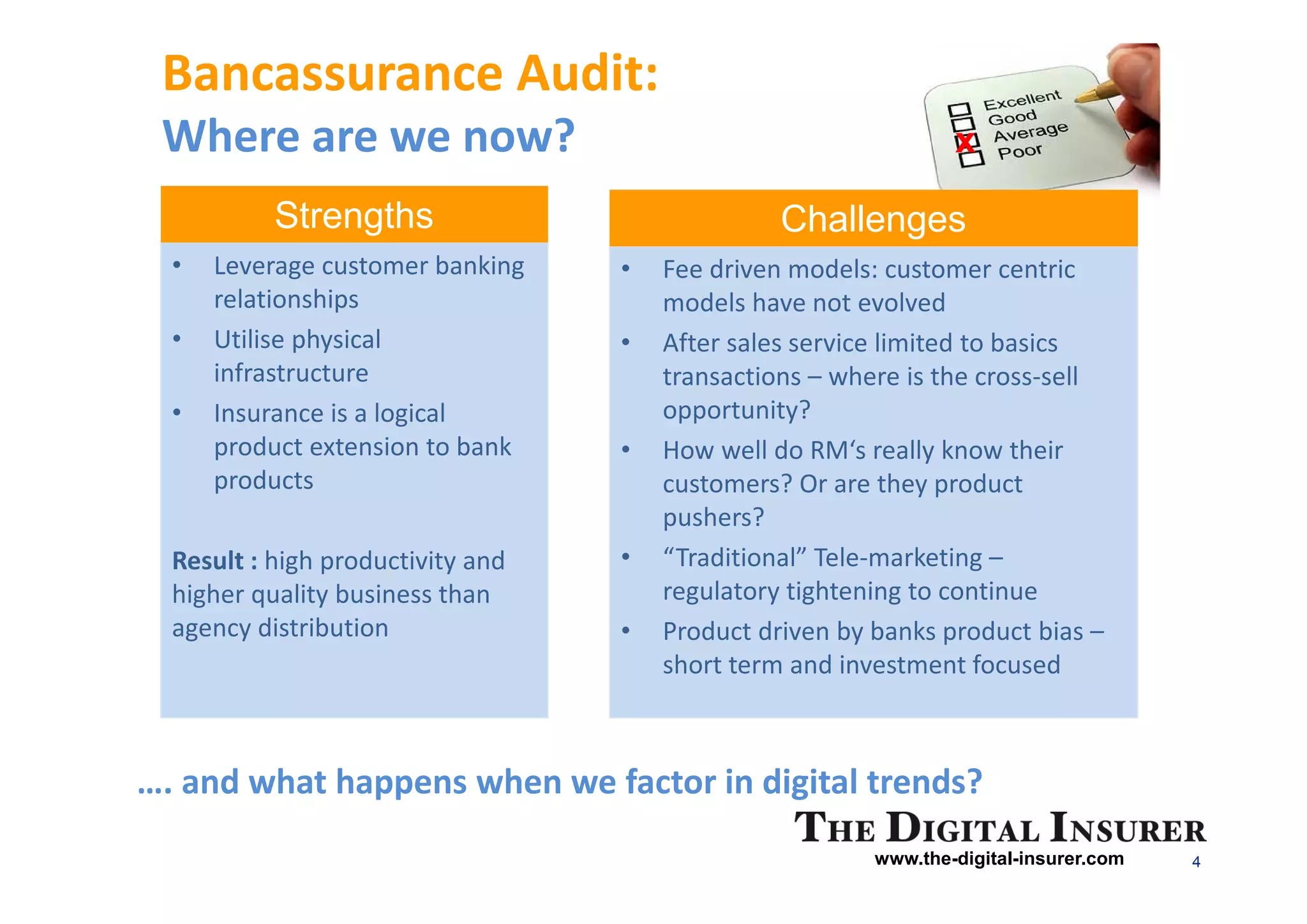

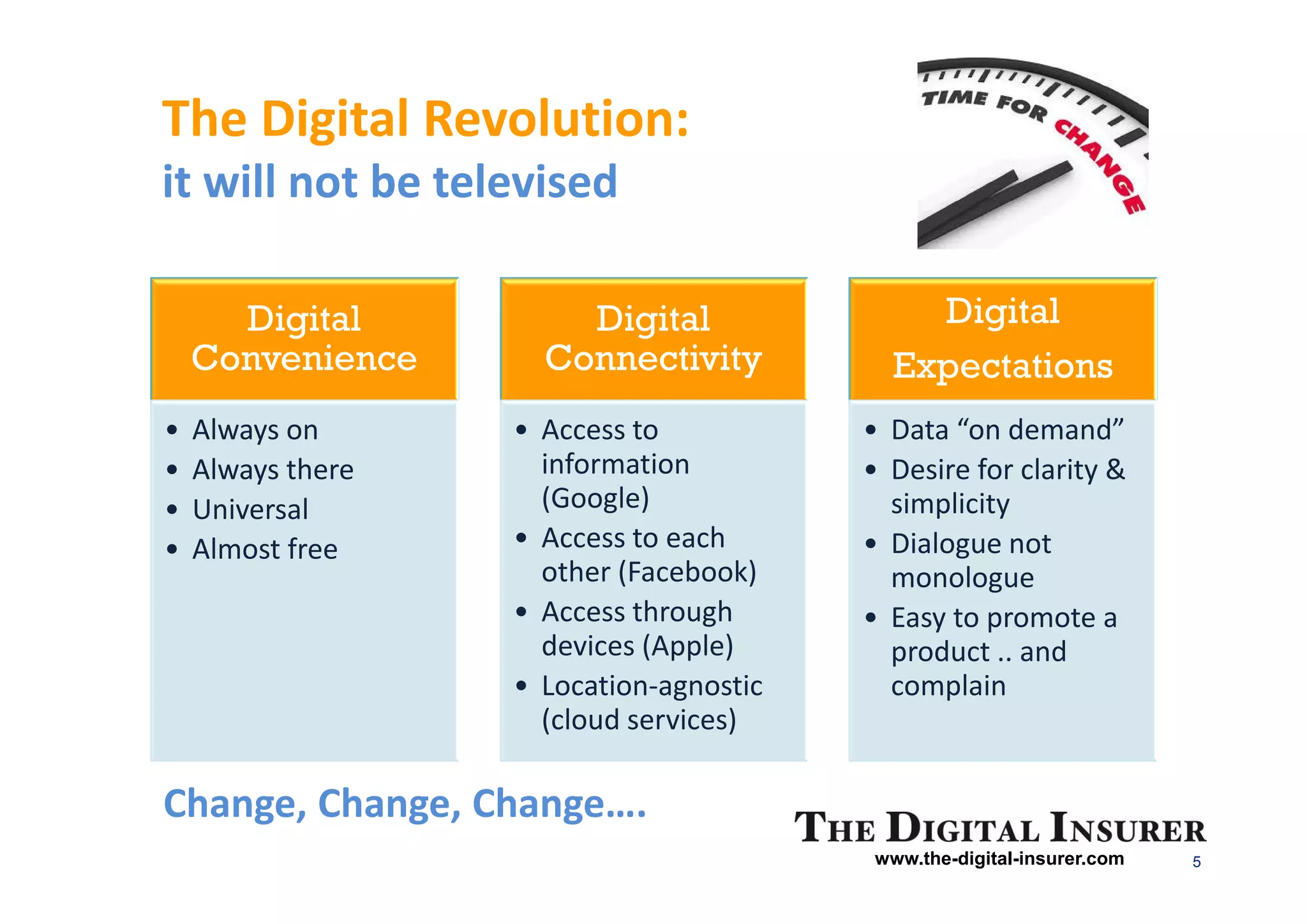

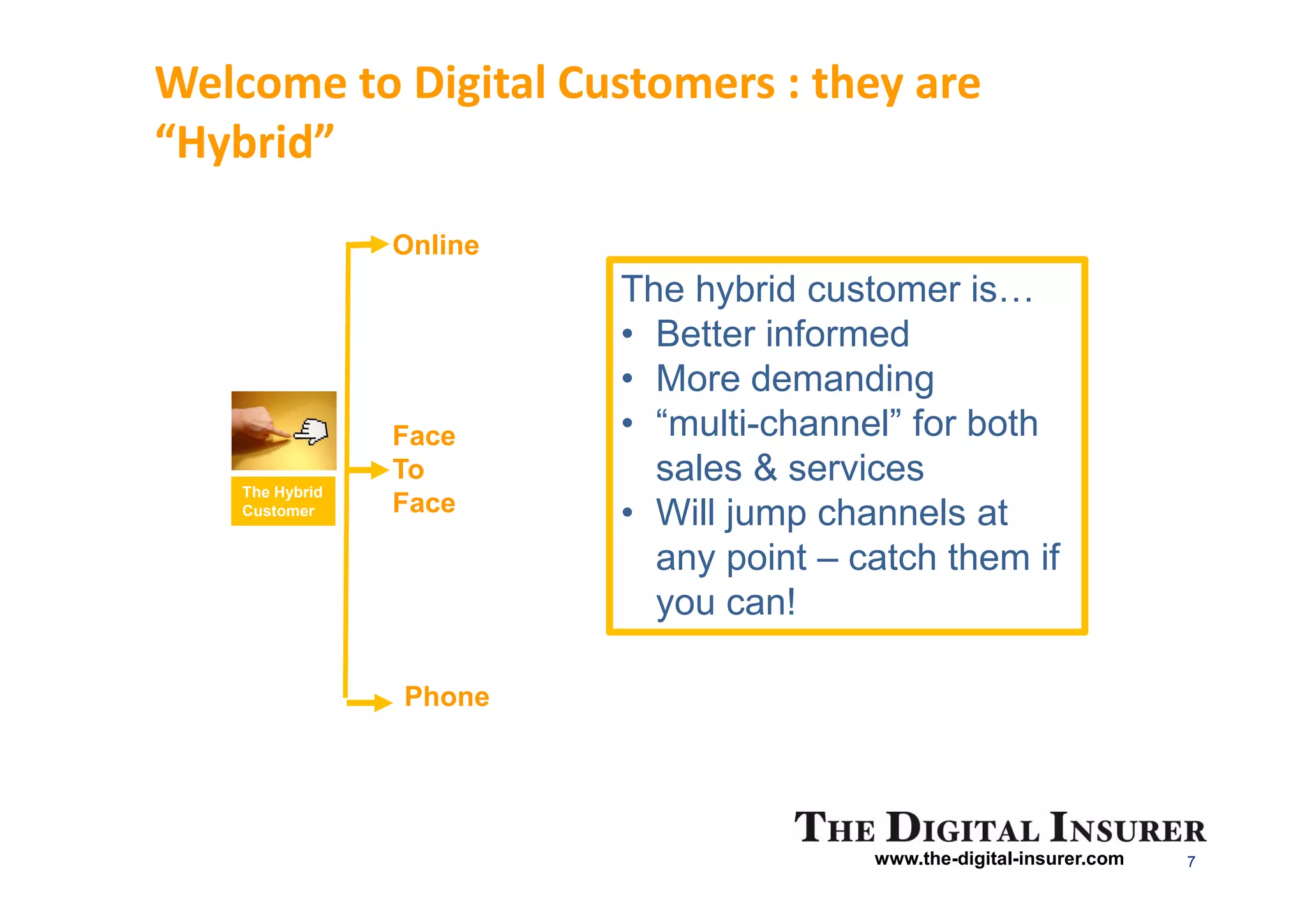

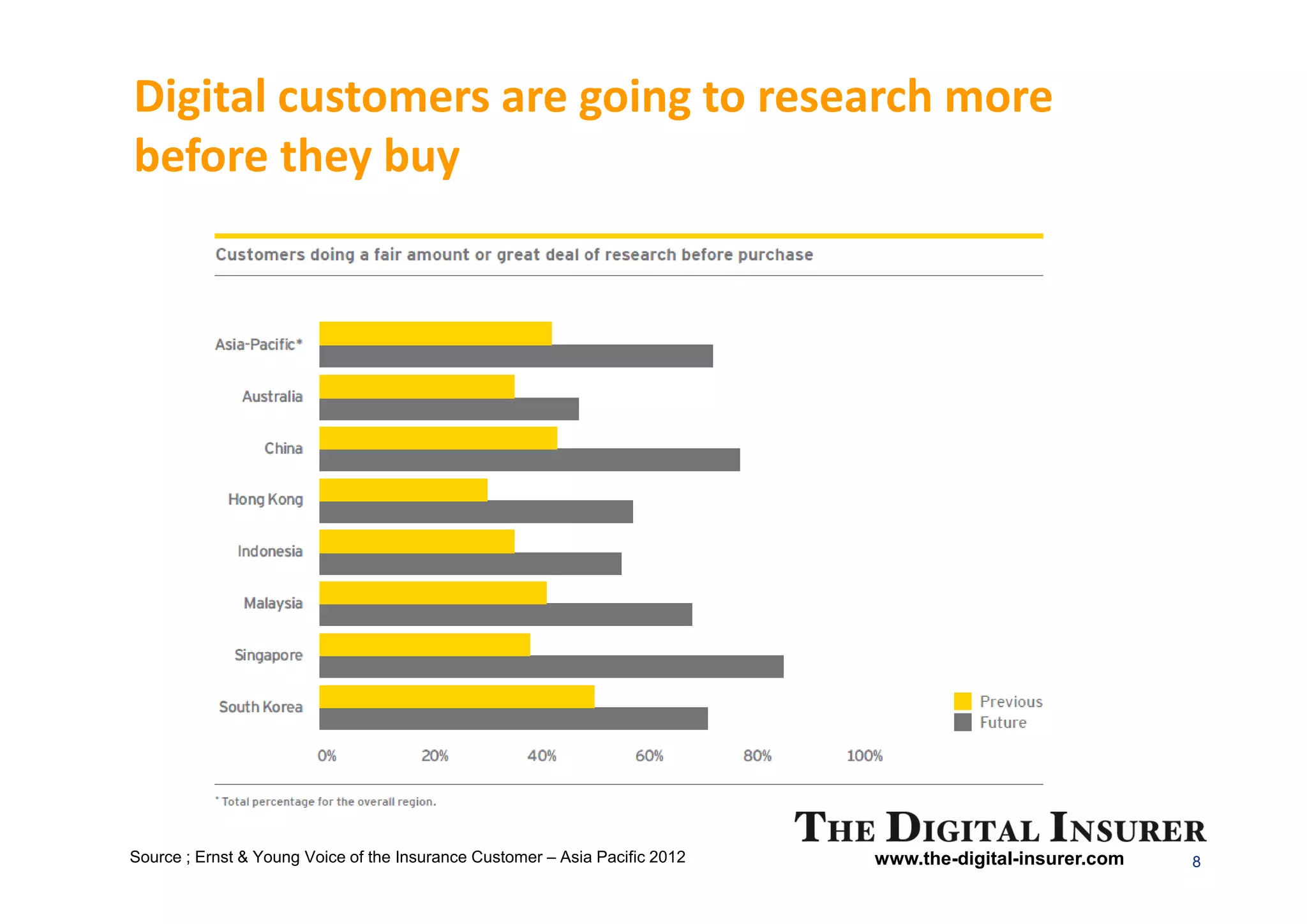

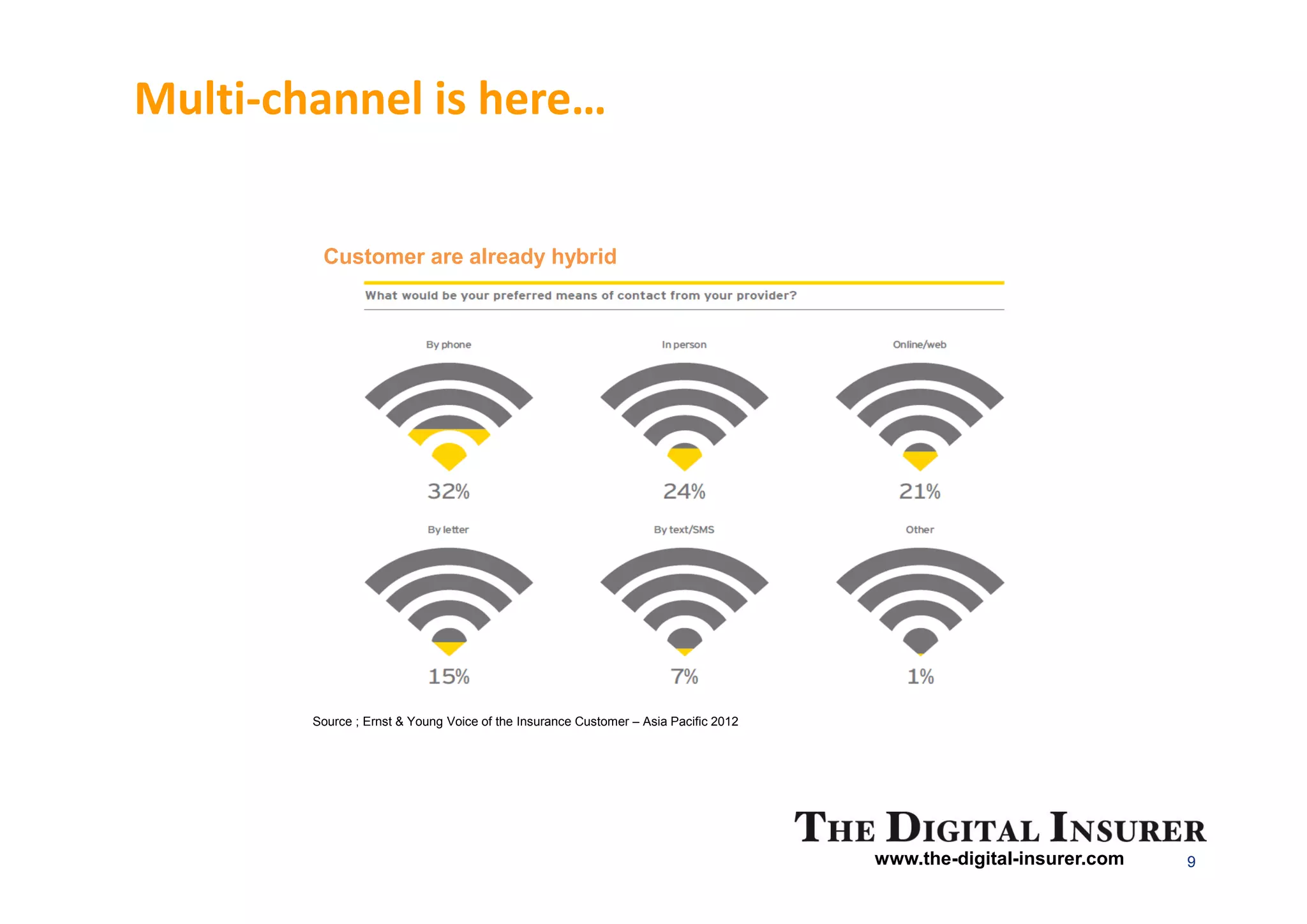

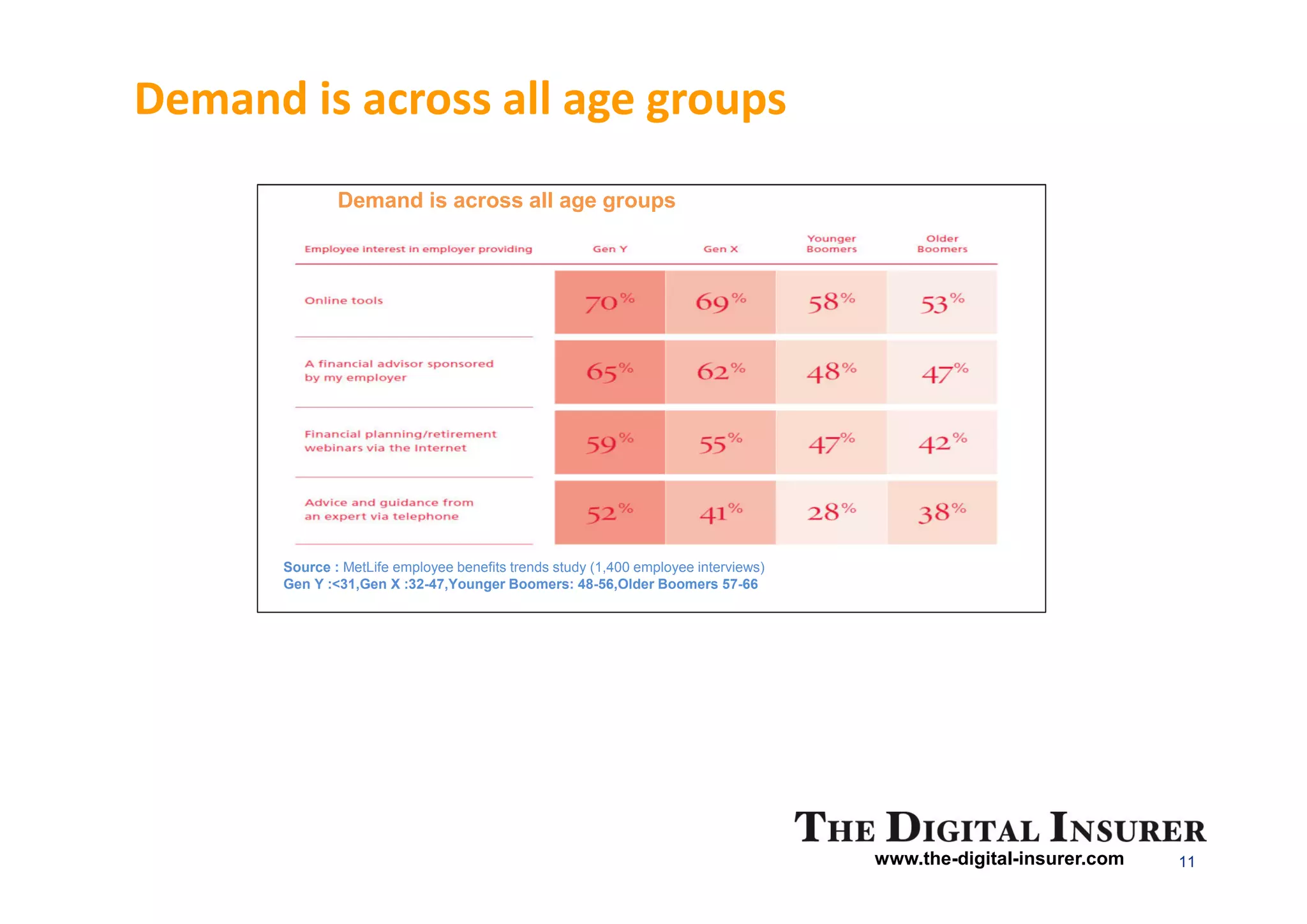

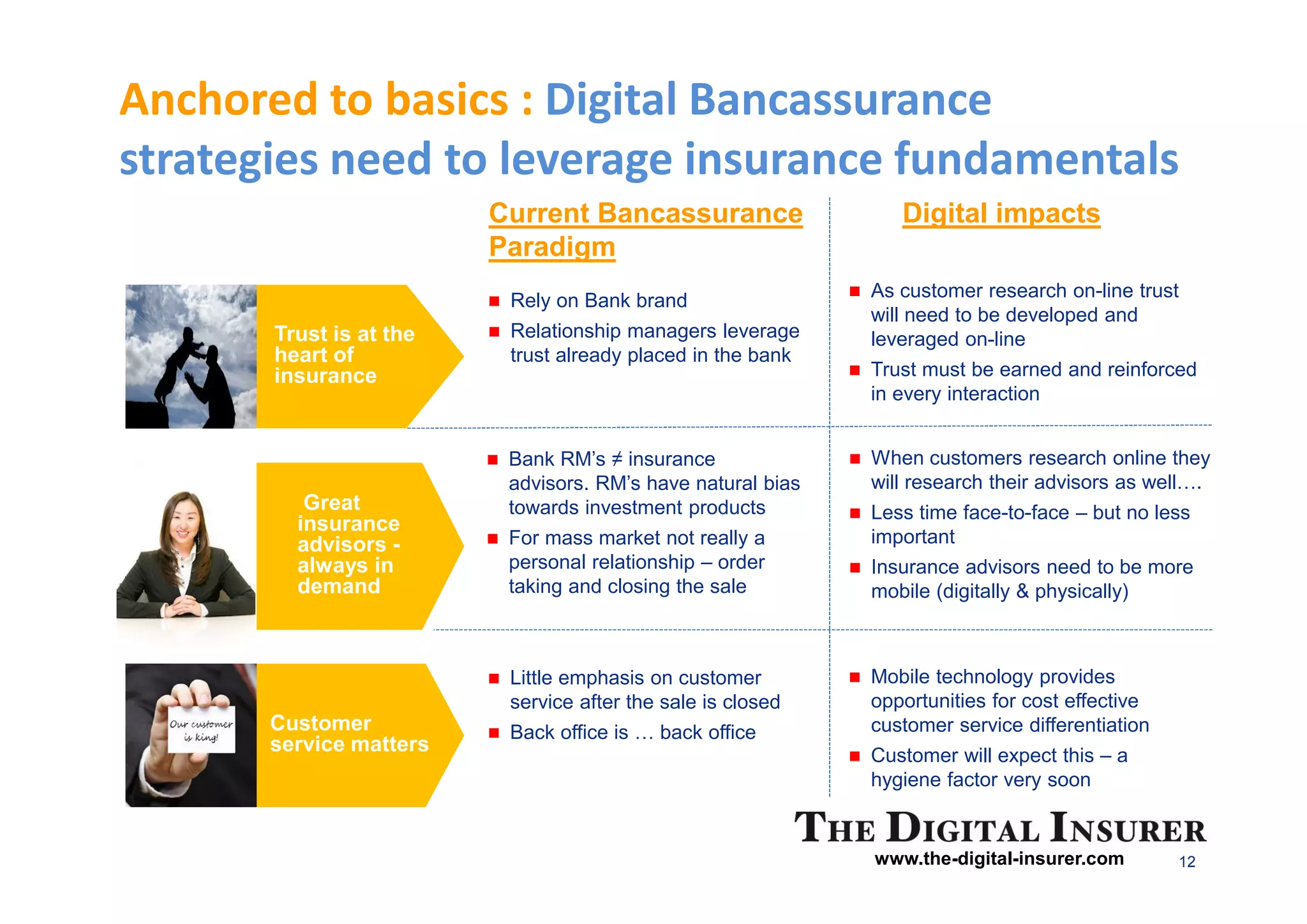

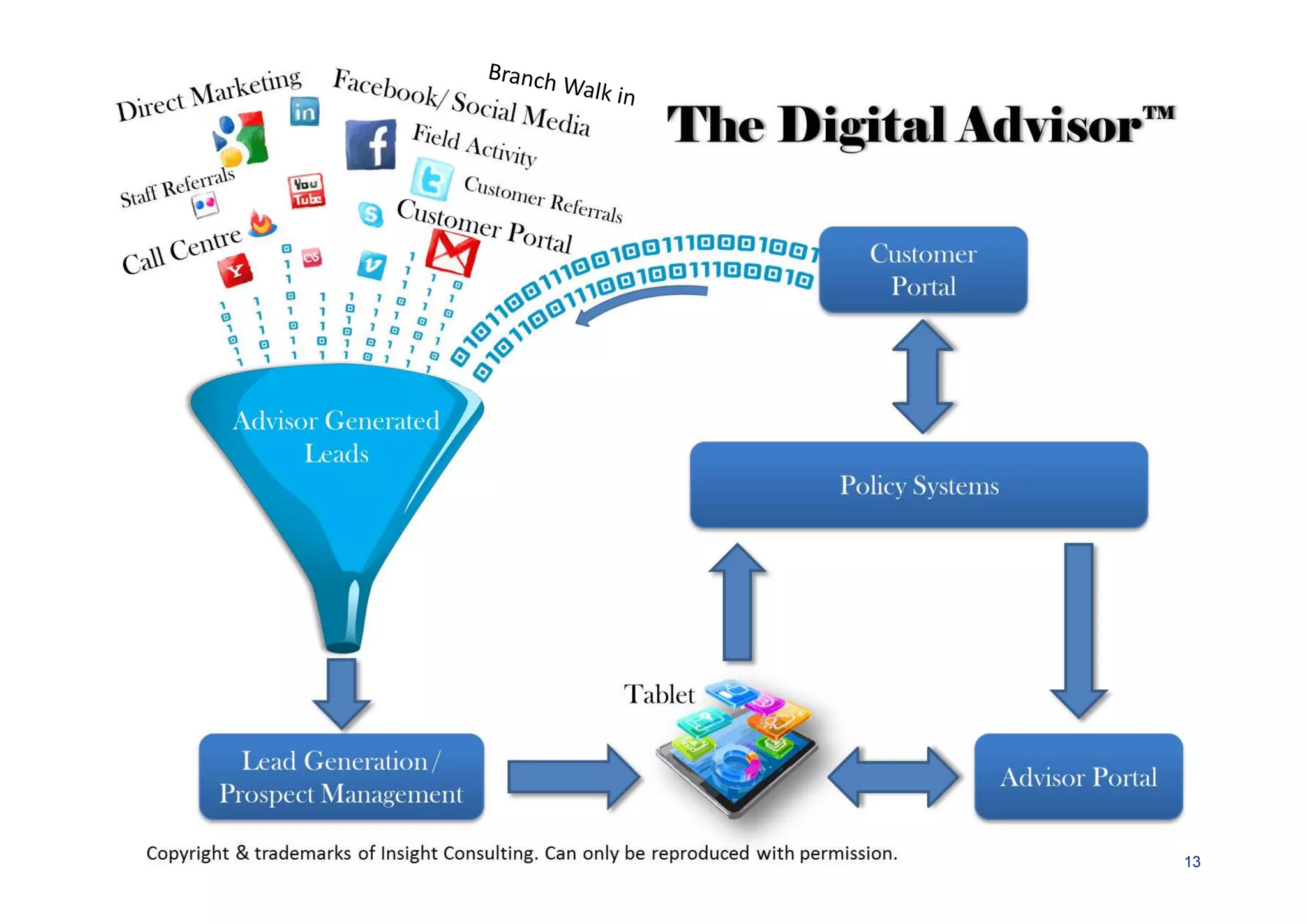

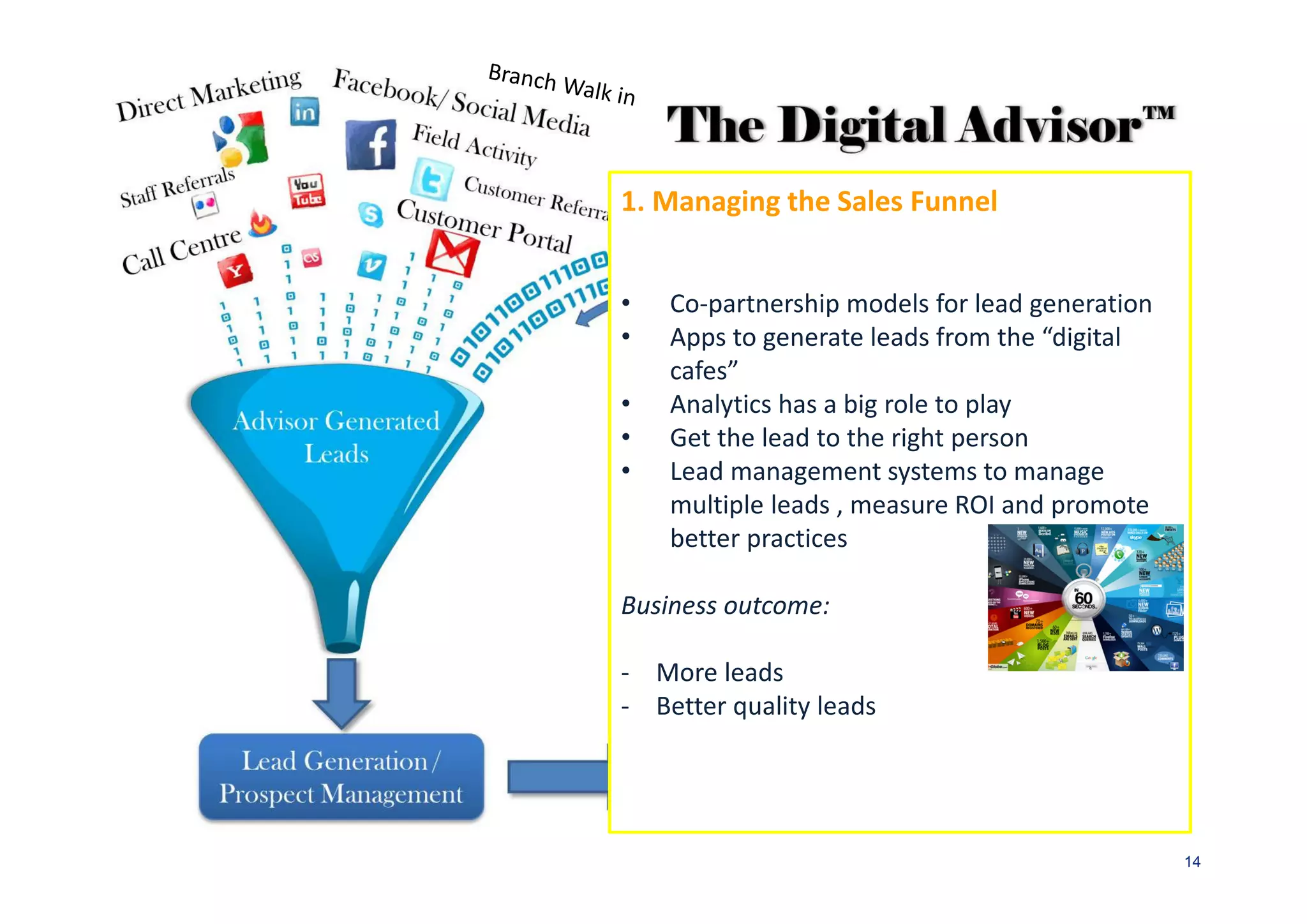

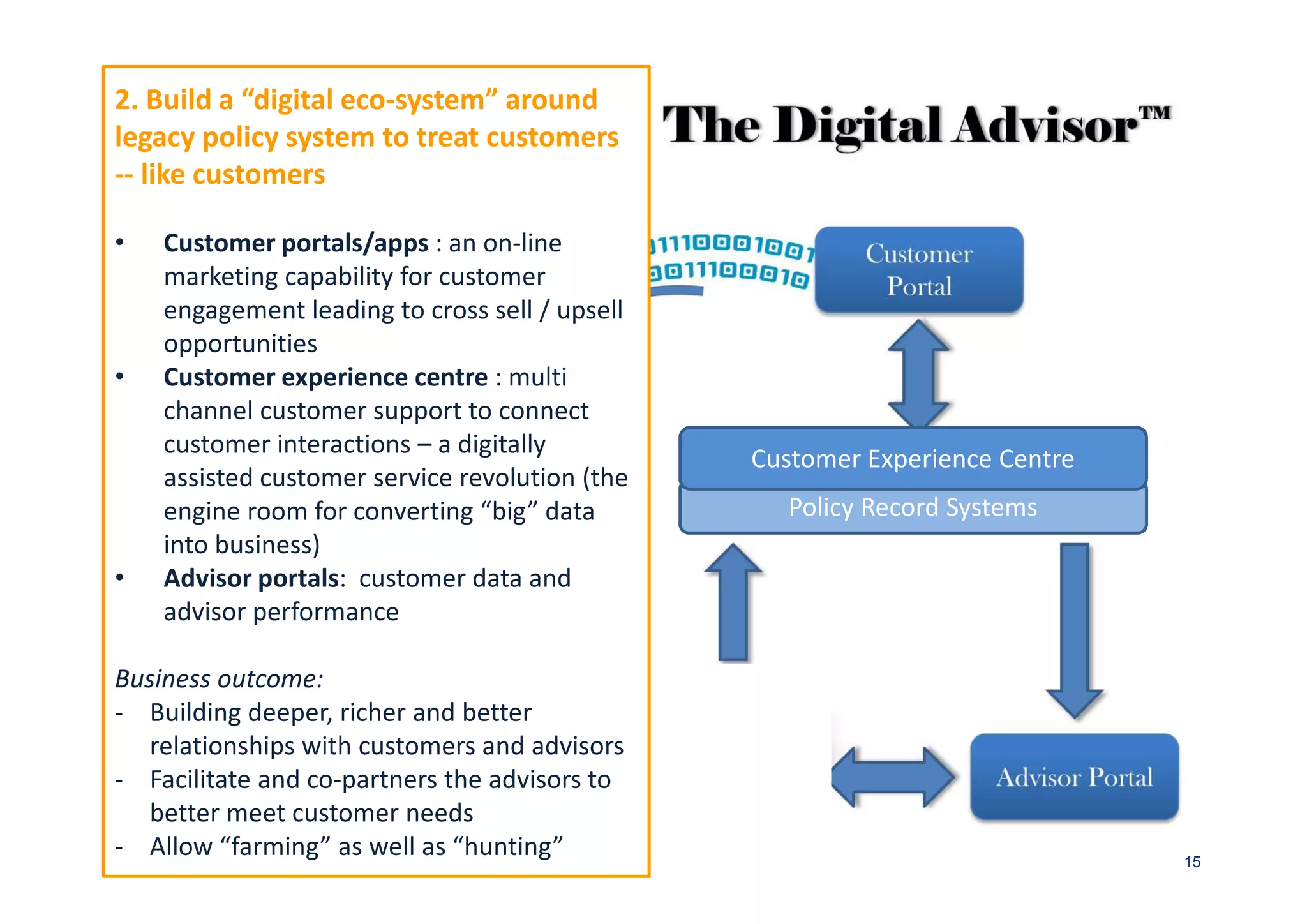

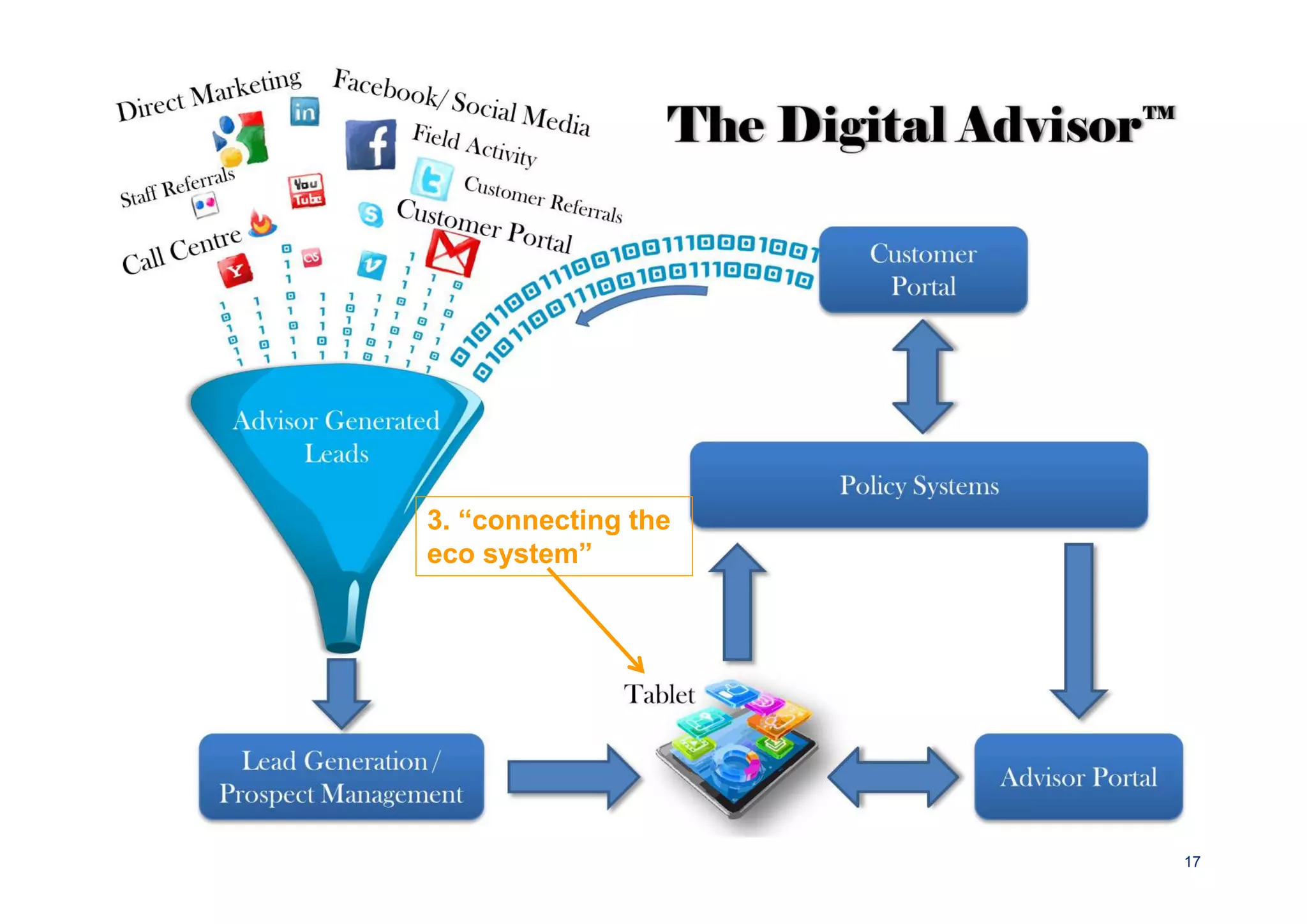

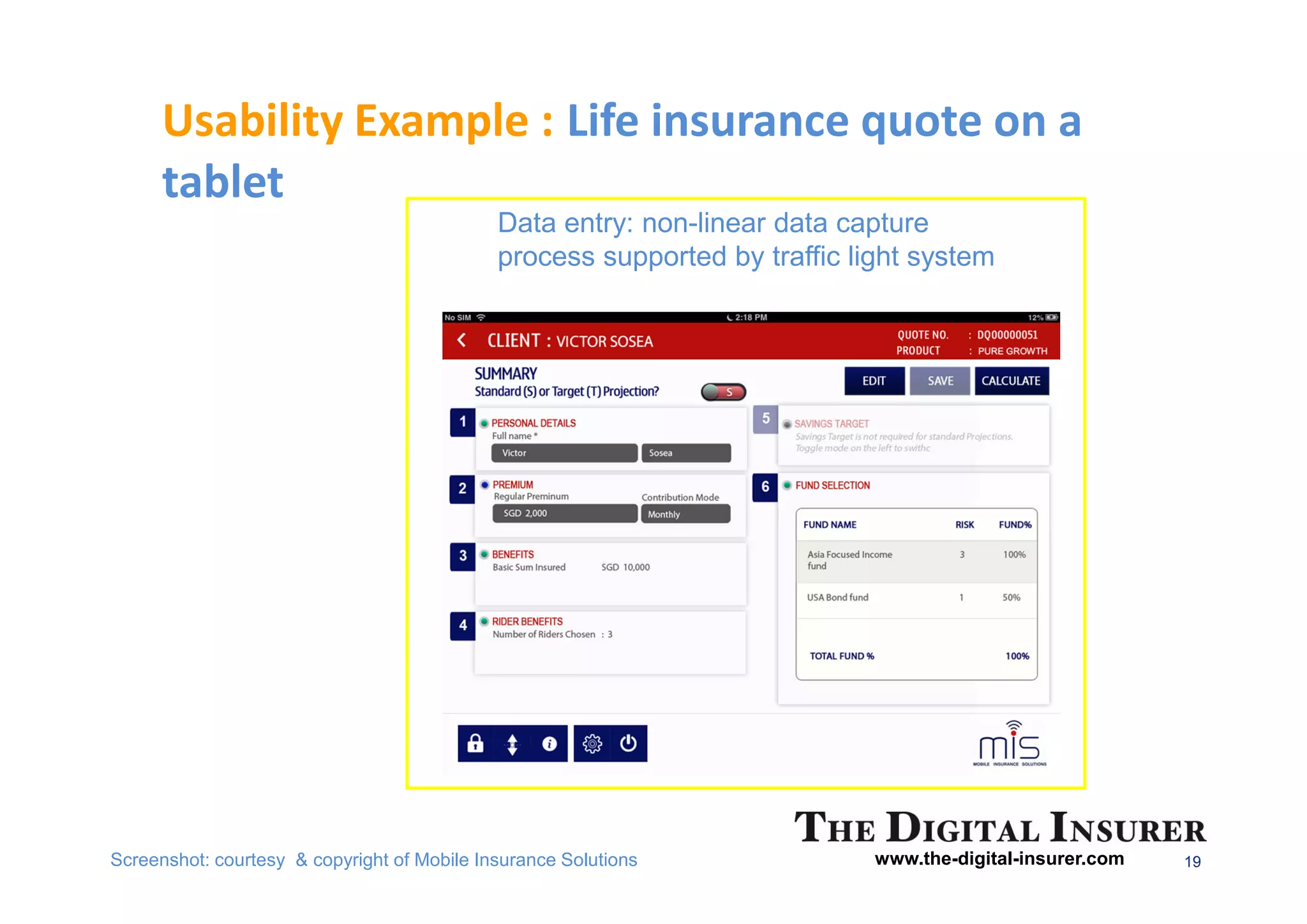

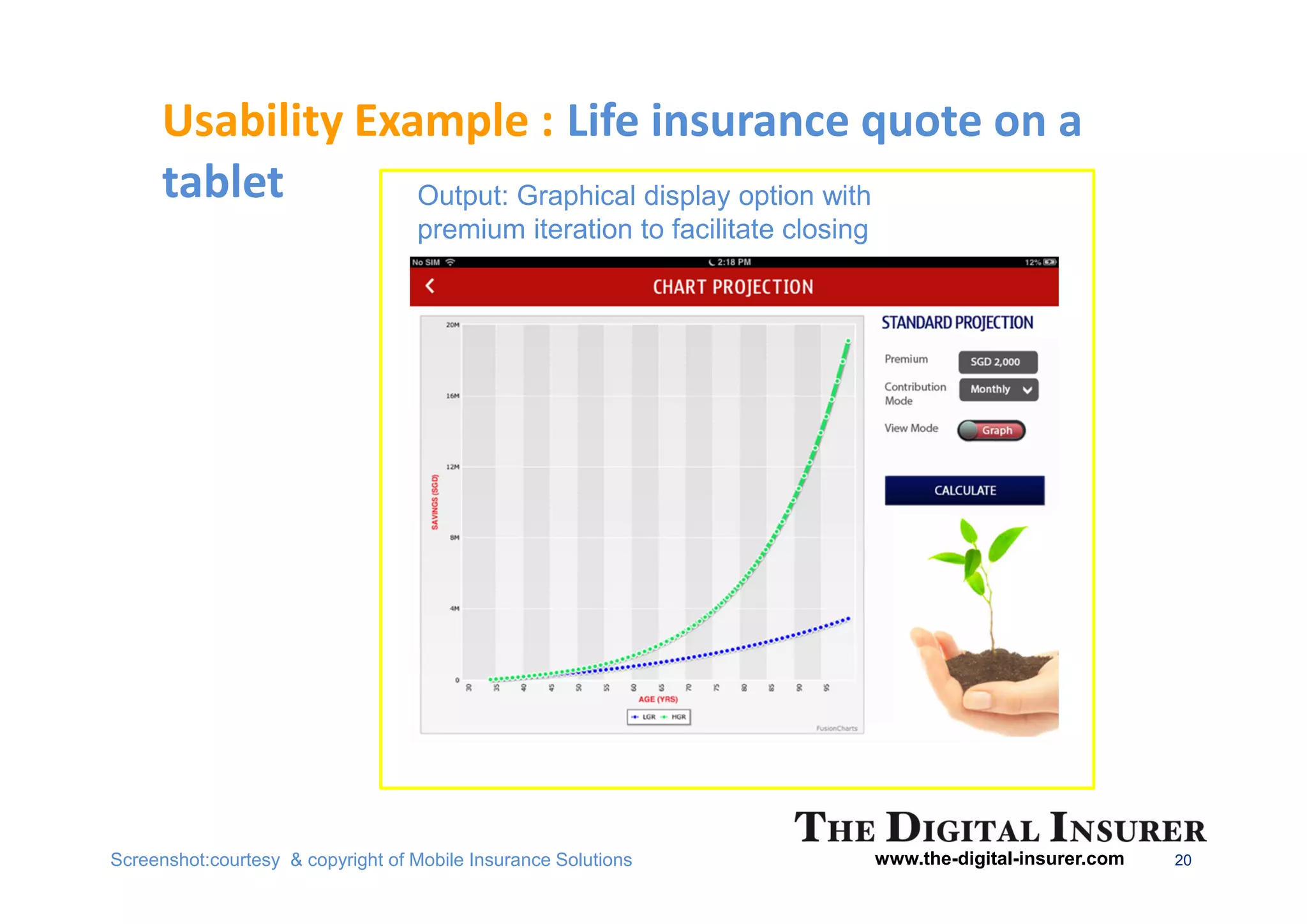

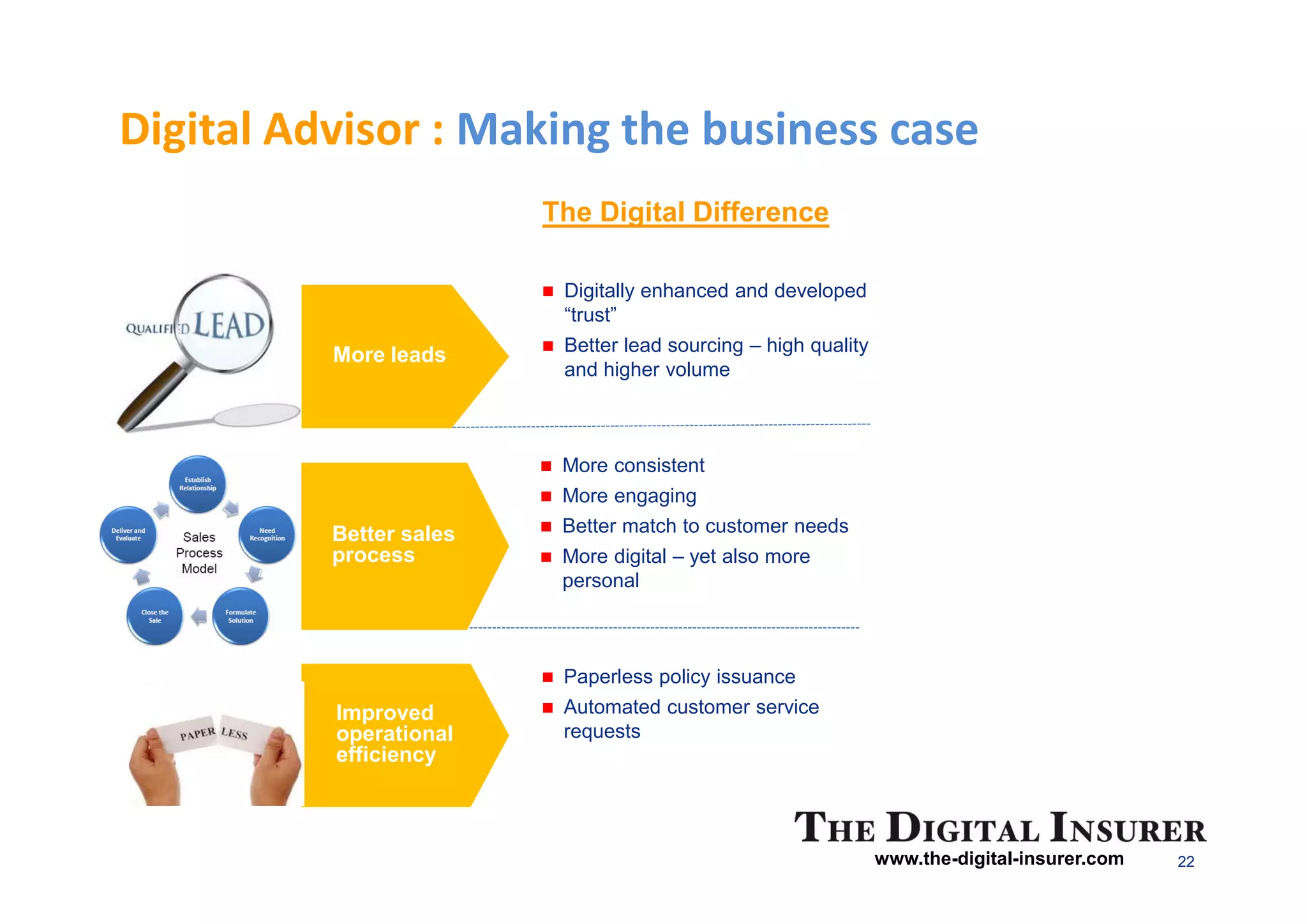

The document discusses the transformation of bancassurance businesses in the Asia Pacific region, highlighting the impact of digital trends and changing consumer behaviors on traditional models. It emphasizes the importance of leveraging technology to meet consumer demands while also providing insights on developing a digital ecosystem for customer engagement and lead generation. As the industry evolves, it underscores the need for banks and insurers to adapt quickly or risk being left behind by competitors who embrace digital innovation.