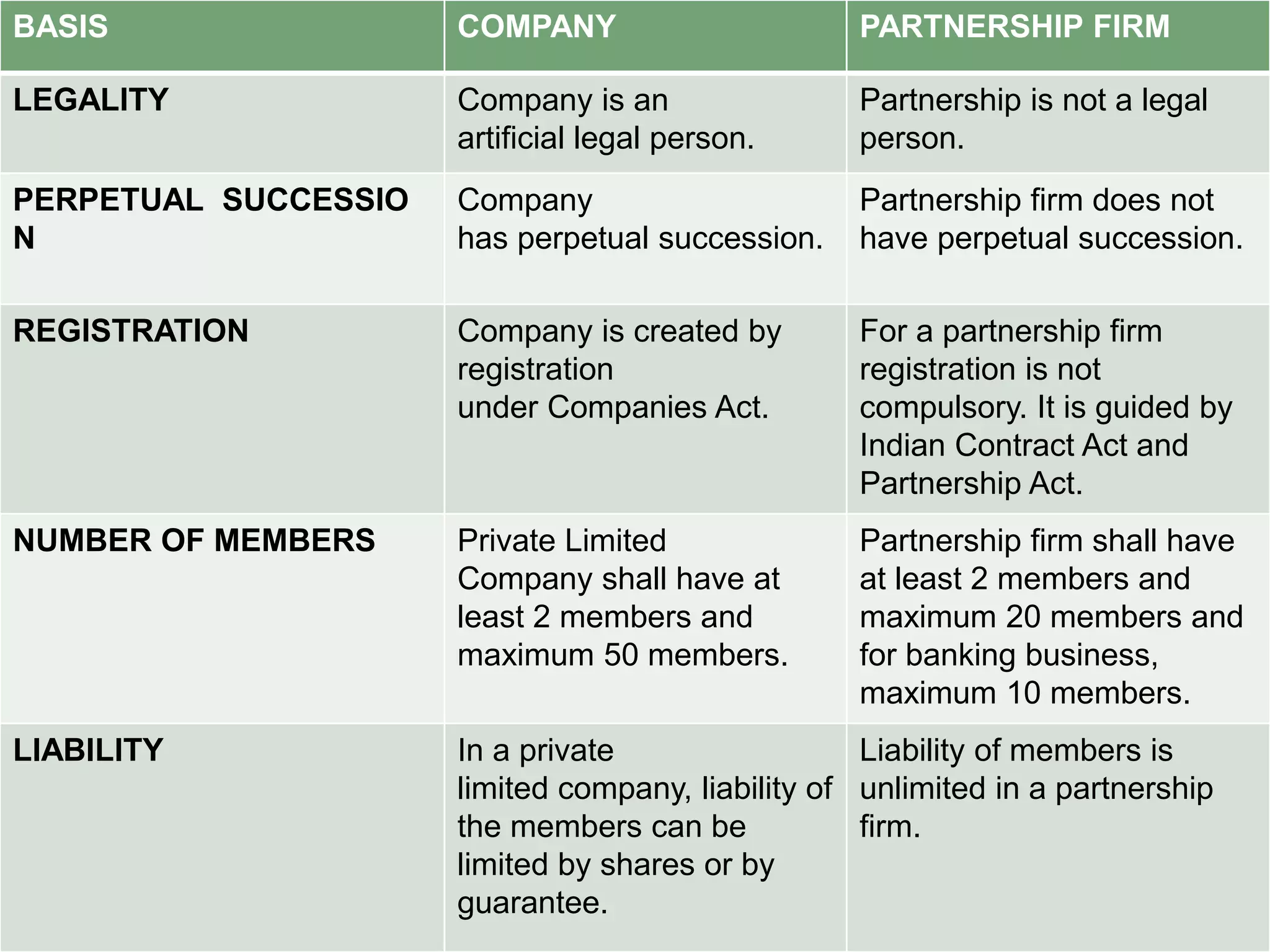

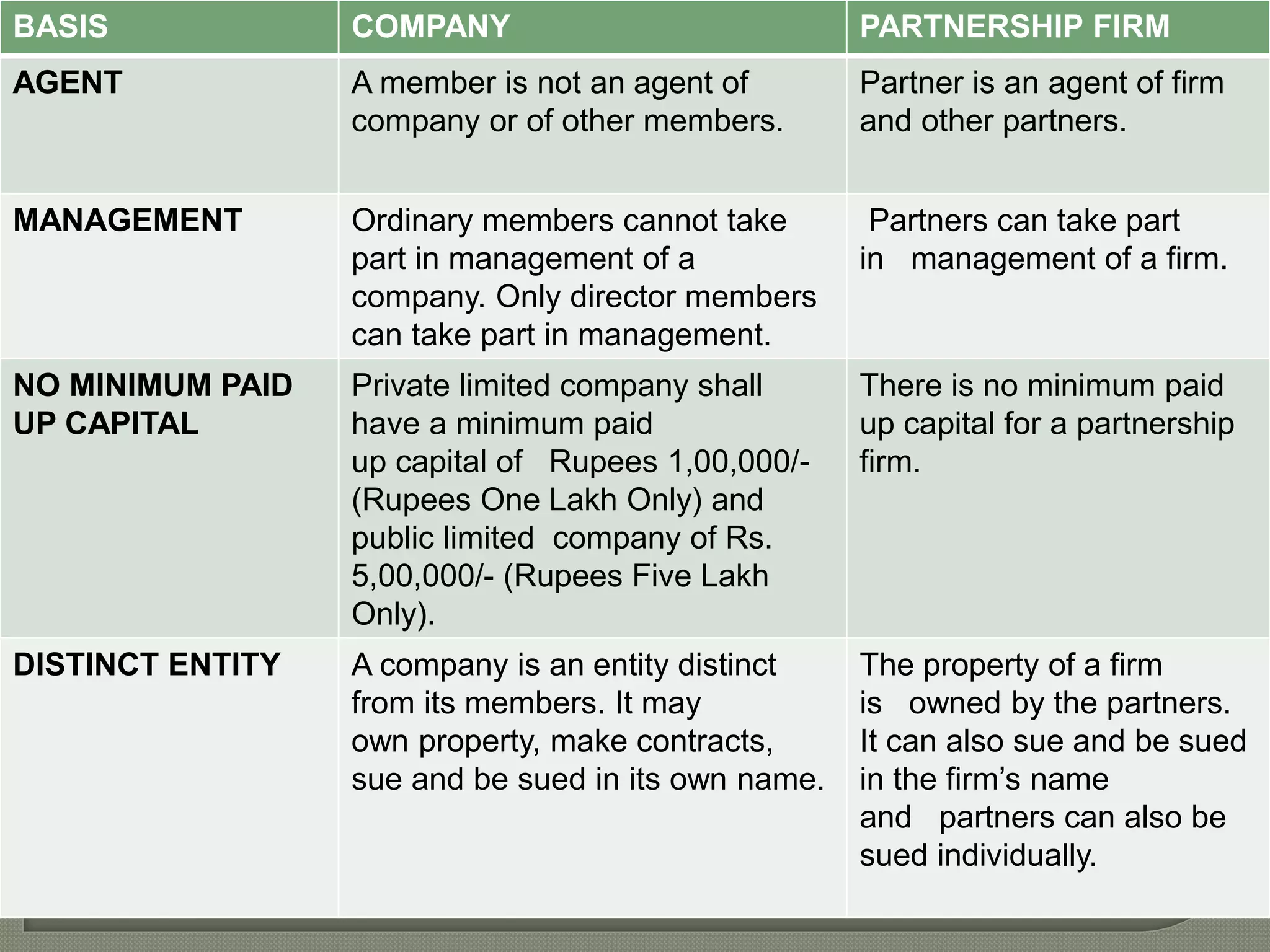

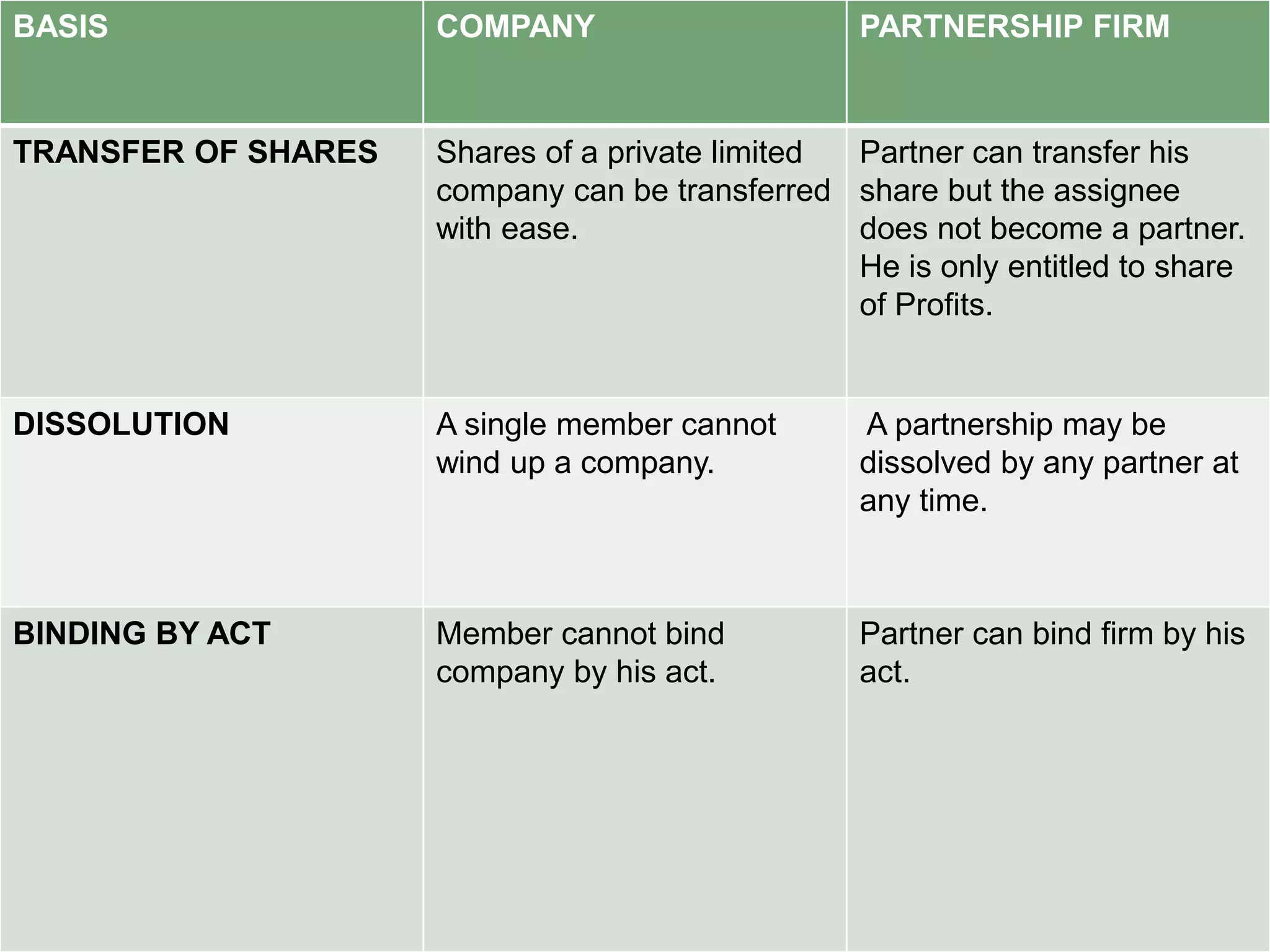

A company is a legal entity created through registration that can exist indefinitely and has limited liability for its members. A partnership firm is not a separate legal entity, does not have perpetual existence, and members have unlimited liability. Some key differences are that a company must be registered, has a minimum number of members and paid up capital, and members cannot bind the company with their own actions, whereas a partnership firm does not require registration, has no minimum member or capital rules, and partners can bind the firm through their own actions.