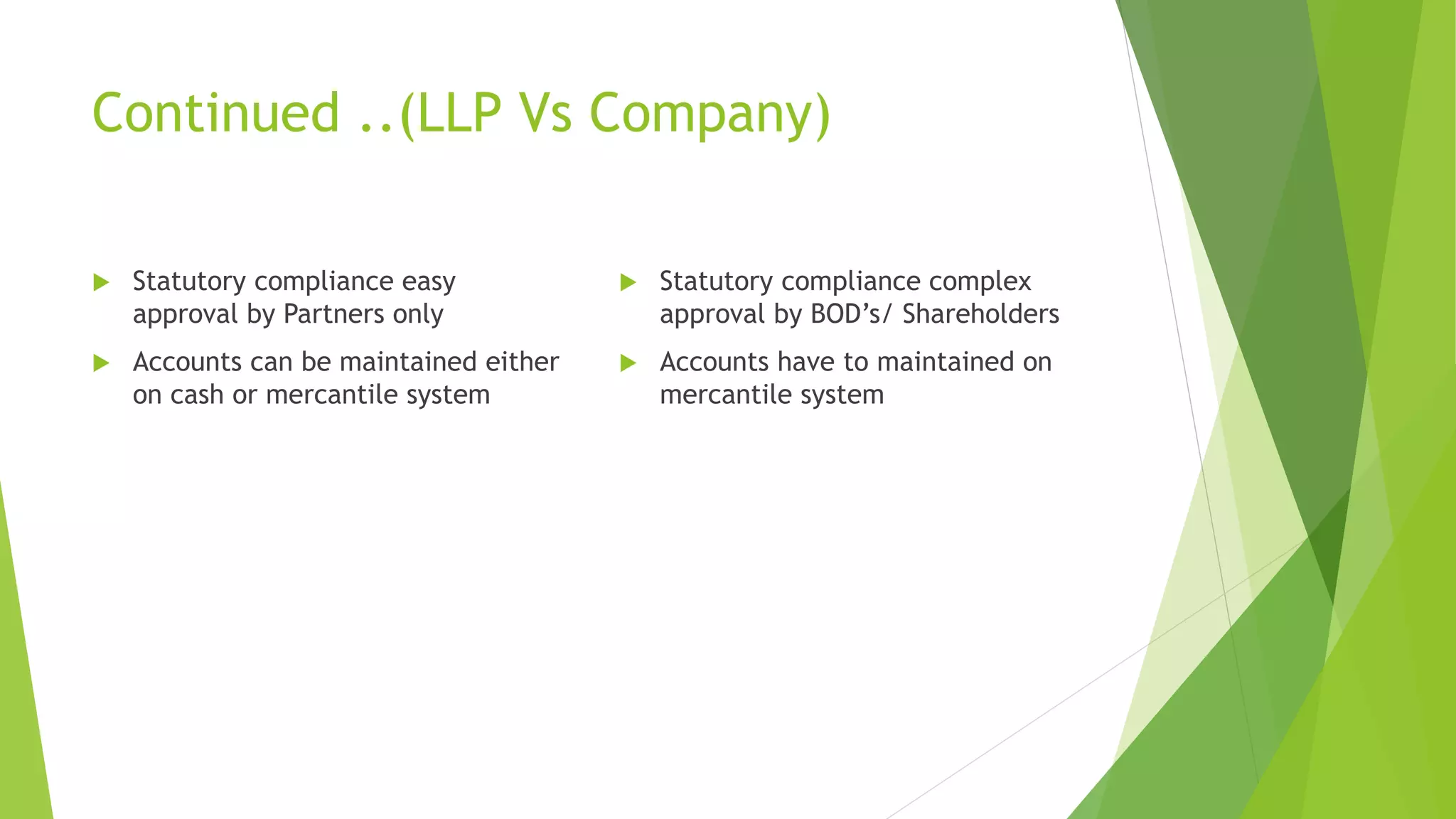

The document discusses the Indian Partnership Act of 1932, defining partnership, its nature, types, and the processes of reconstitution and dissolution of a firm. It also covers the Limited Liability Partnership (LLP) Act of 2008, highlighting its advantages, such as limited liability and separate legal entity, as well as key requirements for forming an LLP. Additionally, it provides a case study on the taxation of partnership profits involving a minor partner and compares LLPs with traditional partnerships.