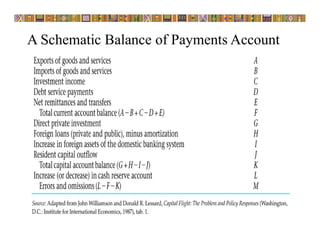

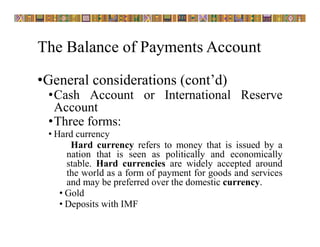

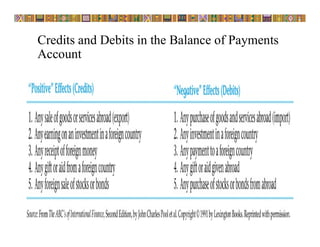

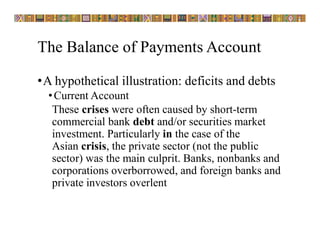

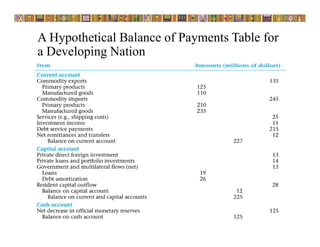

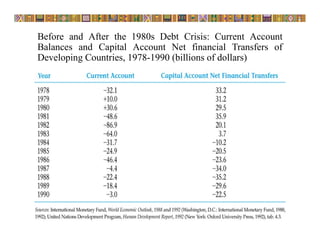

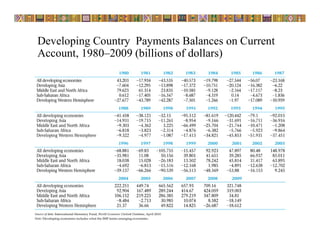

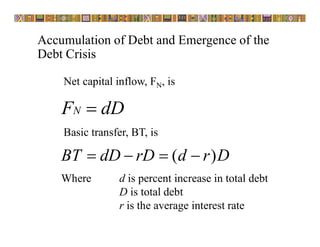

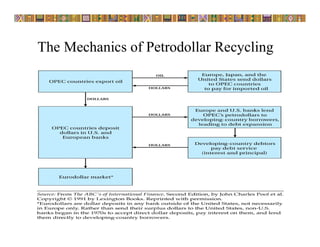

This document discusses the development of economics, focusing on balance of payments, debt crises, and stabilization policies. It provides background on major debt crises that emerged in the 1980s, often caused by short-term commercial bank debt and securities market investment. The private sector, not the public sector, was usually the main culprit, as banks, corporations, and non-banks overborrowed while foreign lenders overlent. It also examines concepts like balance of payments accounts, current accounts, capital accounts, and international reserves.