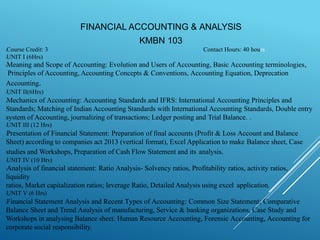

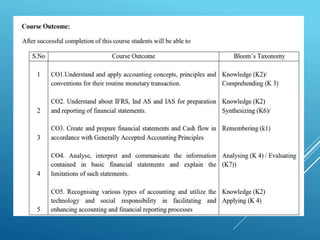

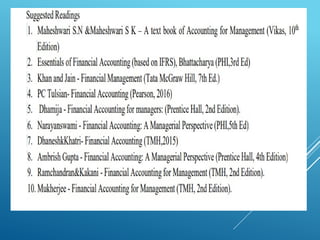

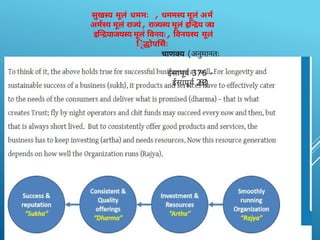

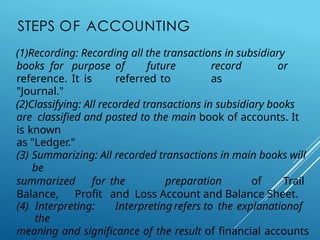

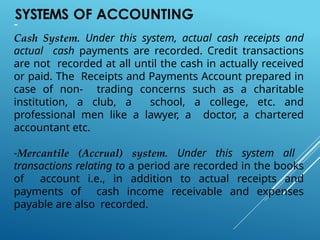

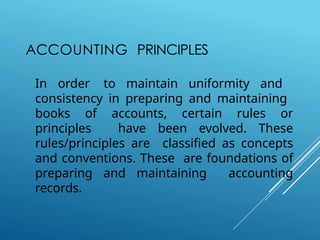

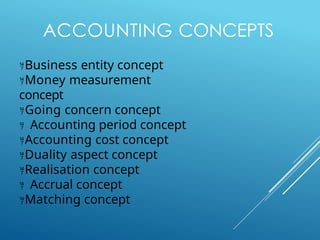

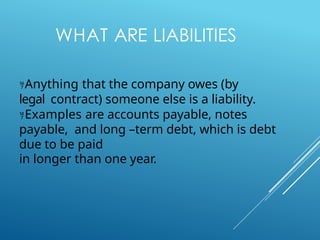

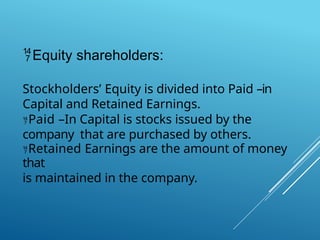

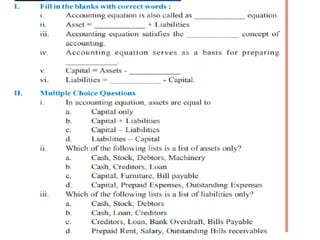

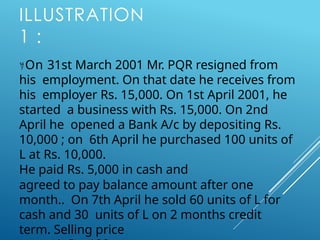

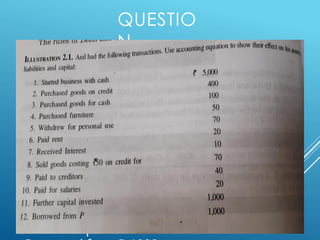

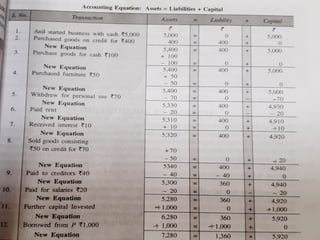

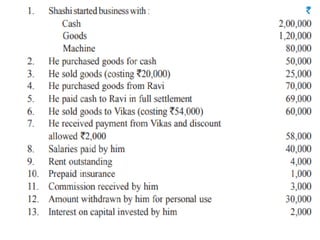

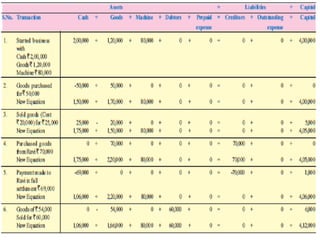

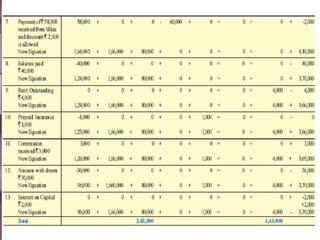

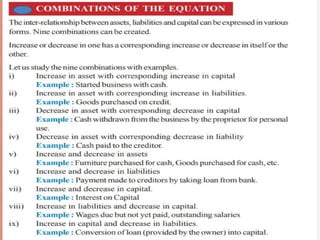

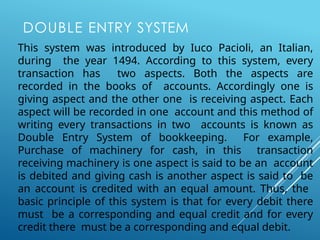

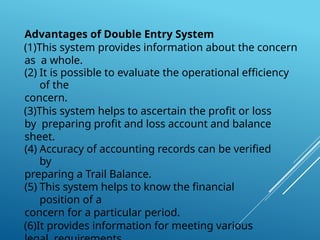

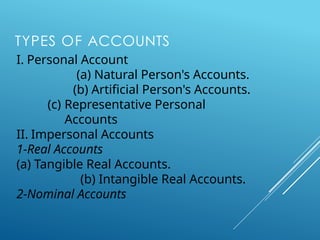

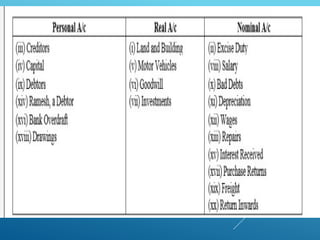

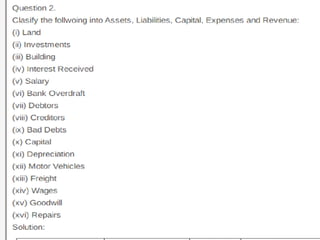

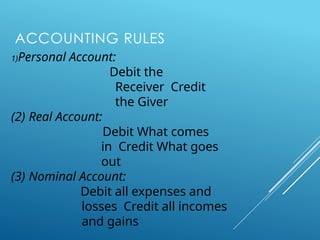

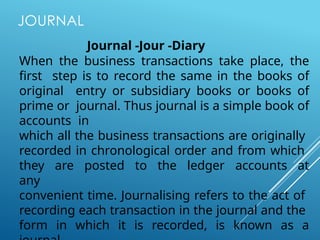

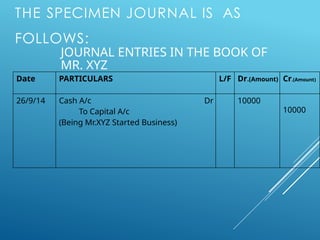

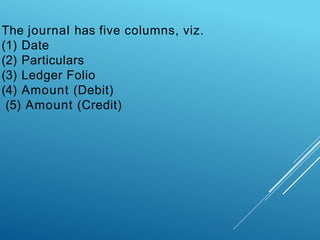

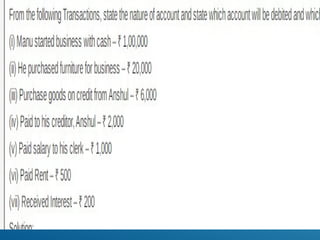

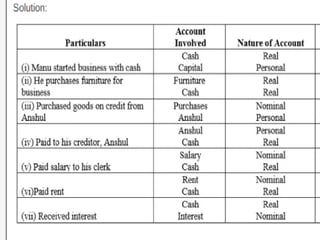

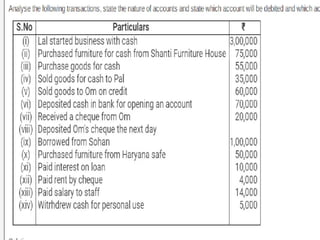

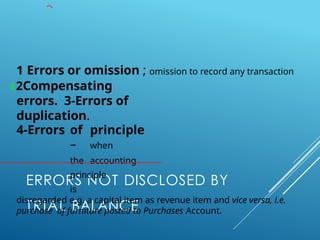

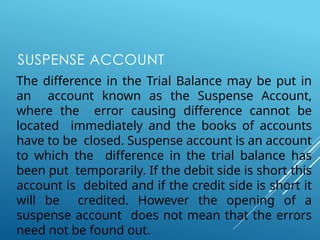

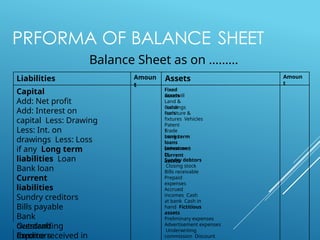

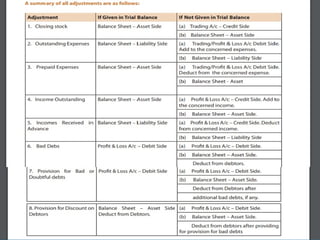

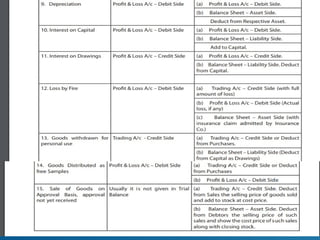

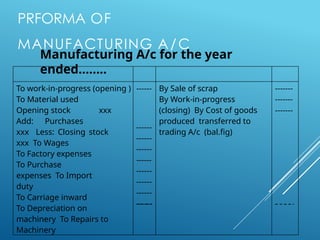

The document outlines the Financial Accounting and Analysis course (KMBN-103) which covers various aspects of accounting, including its principles, mechanics, financial statement presentation, and analysis. It includes topics such as accounting terminology, preparation of financial statements according to the Companies Act 2013, ratio analysis, and recent developments in accounting practices. Additionally, it introduces accounting concepts, principles, and systems, emphasizing the evolution of accounting and its importance in business operations.