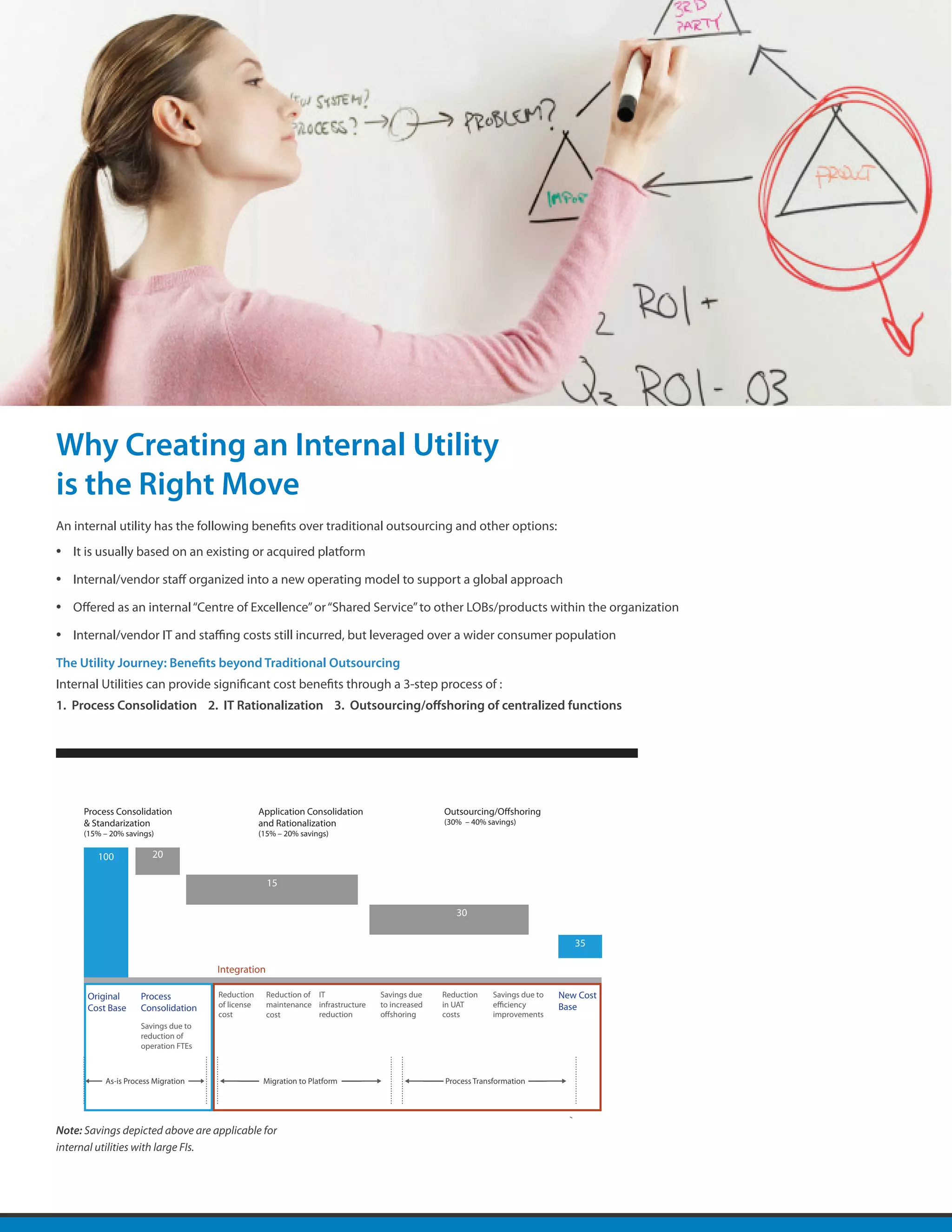

The document discusses the creation of internal utilities by financial institutions to improve efficiency. It explains that internal utilities centralize functions across business lines to reduce costs through standardization and scale. Key benefits include lower operational risk, improved regulatory compliance, and allowing staff to focus on core activities versus utility functions. Challenges in setting up utilities include complex existing systems, lack of automation, inability to scale capacity, and pressure to reduce costs. Internal utilities are becoming more common as financial institutions seek process efficiencies.