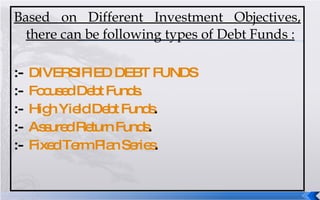

Debt funds are investment pools that invest primarily in fixed income securities like bonds. The aim is to provide regular income to investors through interest payments. There are various types of debt funds like diversified funds, fixed term plans, and high yield funds that invest in higher risk bonds. Within debt funds, investments can be made in government bonds, corporate bonds, and money market instruments. Factors like risk tolerance, return expectations, and portfolio diversification should be considered when choosing debt funds.