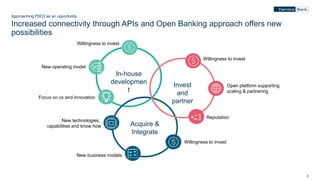

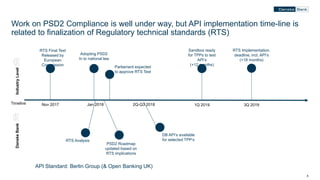

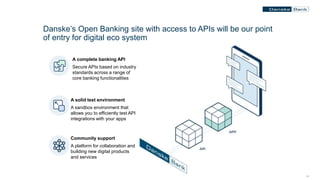

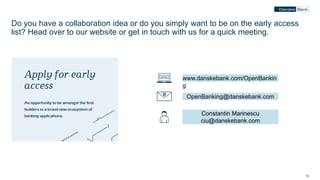

The document discusses Danske Bank's implementation of PSD2 and opportunities for open banking. It outlines Danske Bank's timeline for PSD2 compliance and API implementation. It also discusses the bank's initiatives to organize internally and partner with fintechs to capitalize on opportunities from open banking like developing new financial services and tools. The document encourages interested parties to contact Danske Bank to discuss collaboration ideas or sign up for early access to their APIs.