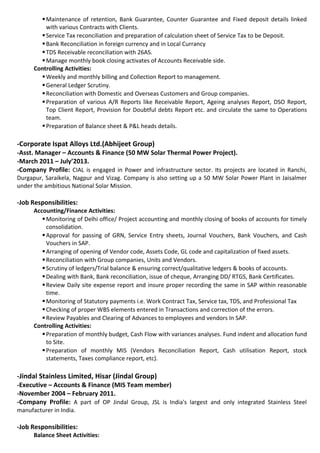

Manoj Gupta has over 16 years of experience in accounting, finance, taxation, and auditing. He is currently working as an Assistant Manager of Accounts & Finance at URS Consulting India Pvt. Limited, where he is responsible for accounting, finance, audit, and controlling activities. Previously, he held roles at Corporate Ispat Alloys Ltd., Jindal Stainless Limited, Agarwal Duplex and Board Mills Ltd., and M/s Rohtas & Hans. He has expertise in SAP, Oracle, and other accounting software. Manoj holds a B.Com degree and is a CA Inter qualified professional seeking to contribute his skills to a challenging role.