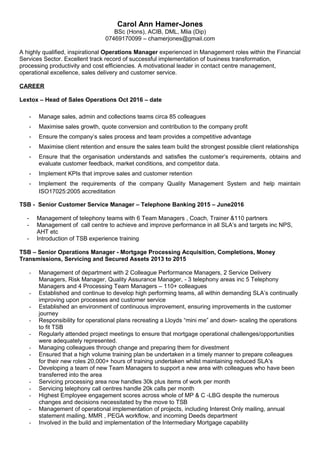

Carol Ann Hamer-Jones has over 30 years of experience in financial services operations management. She is currently the Head of Sales Operations at Lextox, where she manages an 85 person team and focuses on sales growth, customer retention, and process improvement. Previously, she held several senior operations and customer service management roles at TSB and Lloyds Banking Group, where she delivered business transformations, improved performance metrics, and implemented training programs. She has a proven track record of successful leadership, optimization of processes, and achievement of targets.