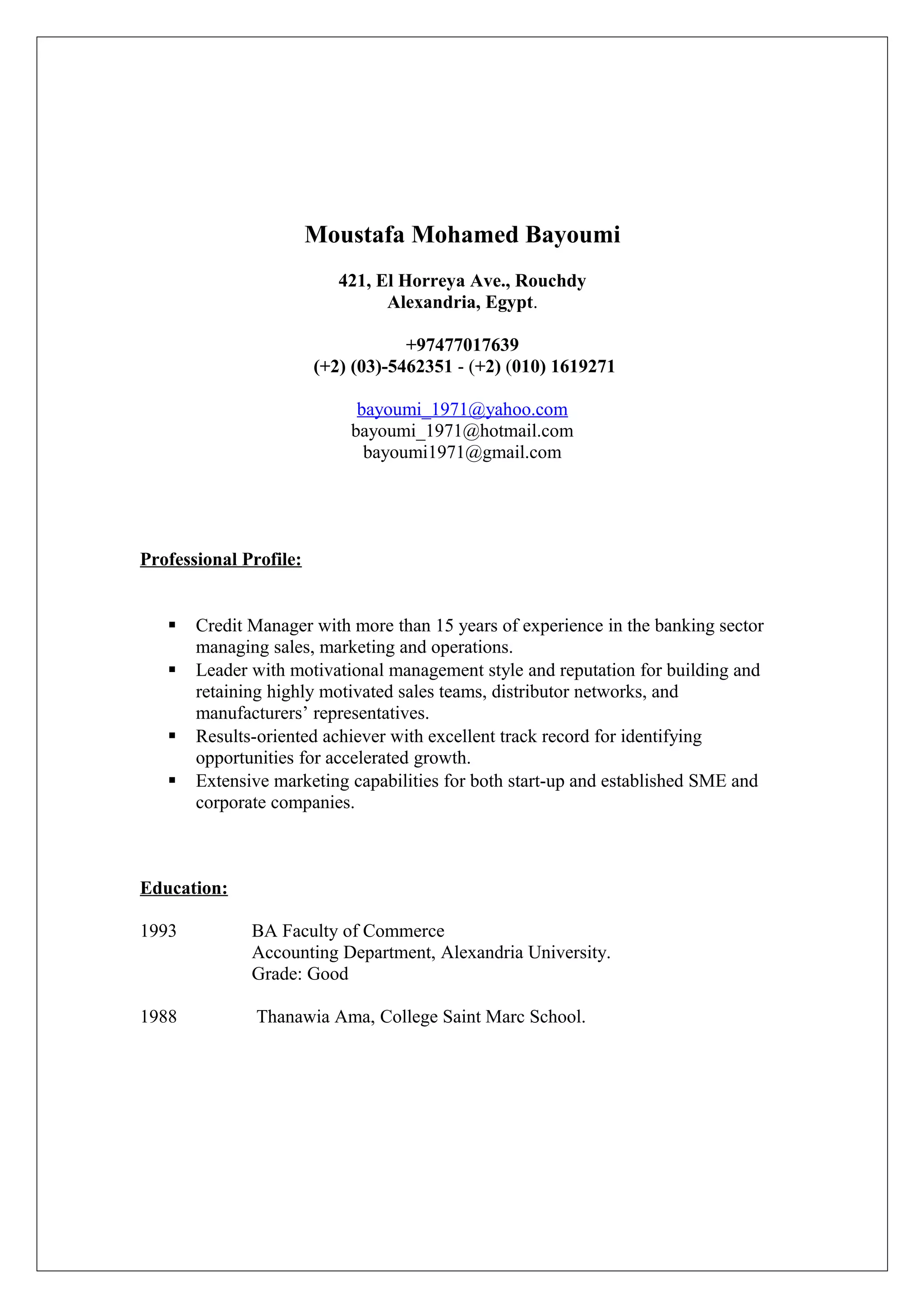

Moustafa Mohamed Bayoumi is a credit manager with over 15 years of experience in banking. He has held several roles managing sales, marketing, and operations at major banks in Egypt and Qatar. Bayoumi has a track record of identifying growth opportunities and building highly motivated teams. He holds a BA in accounting from Alexandria University and postgraduate diplomas in business administration and SME credit.