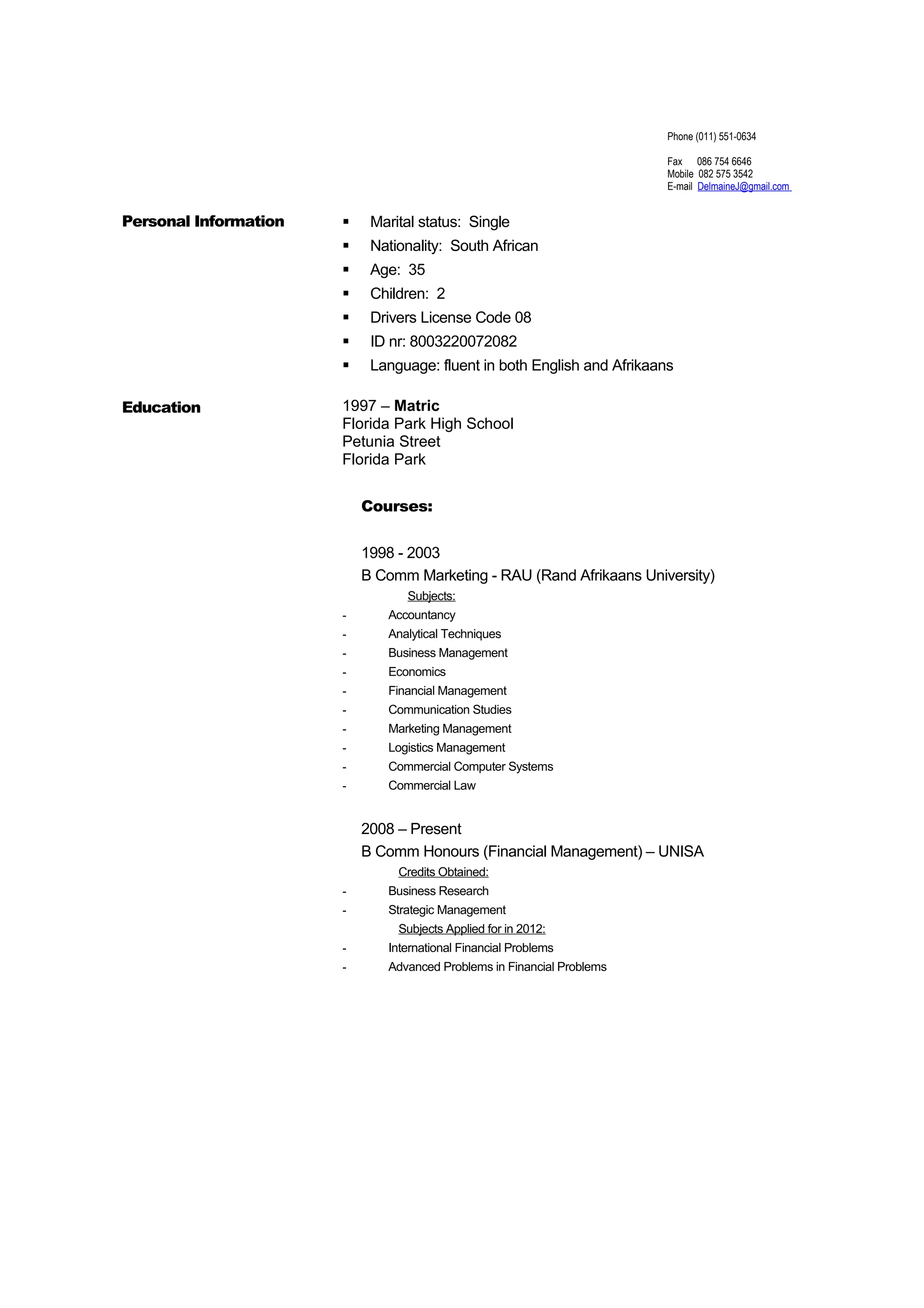

Delmaine J has over 15 years of experience in credit analysis and underwriting. She currently works as an Underwriter at Lombard Insurance, where she analyzes client financials and risks to provide insurance quotes and facilities between R10m to R500m. Previously, she was a Credit Analyst at ABSA and Nedbank, where she completed credit applications, analyzed statements, and monitored client accounts and risk exposures. She holds a BComm in Marketing and an Honours in Financial Management.