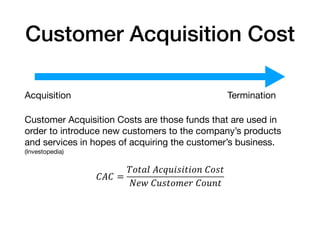

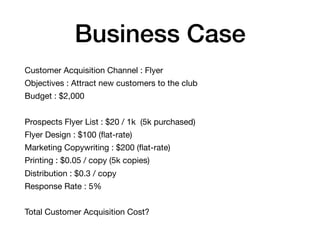

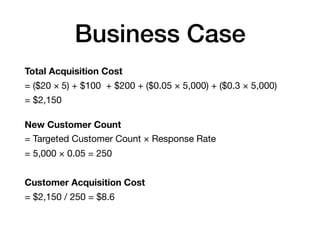

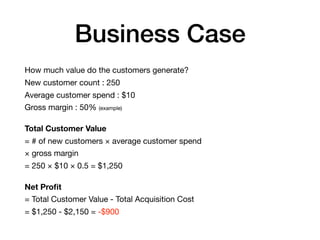

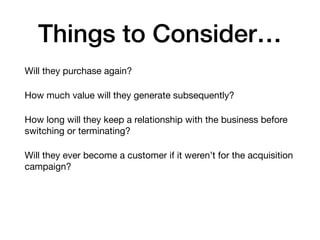

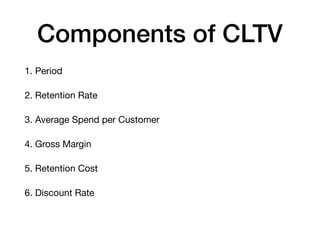

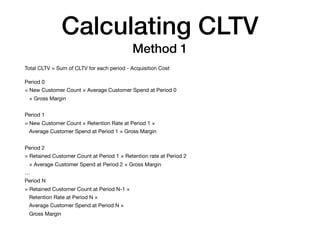

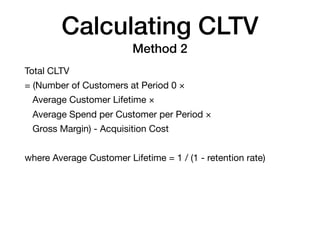

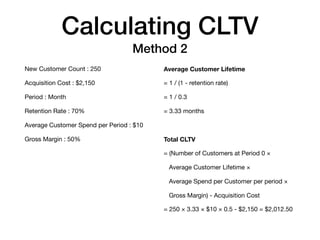

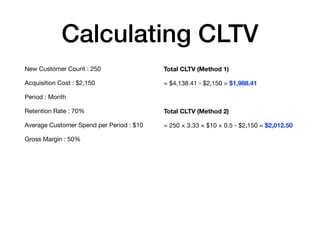

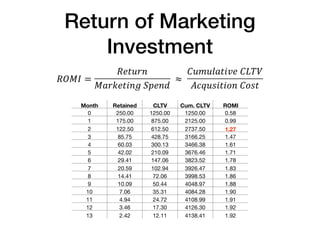

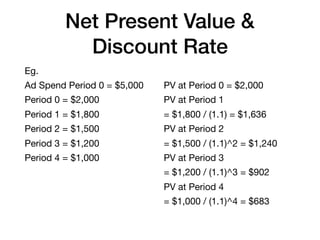

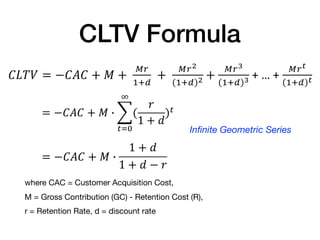

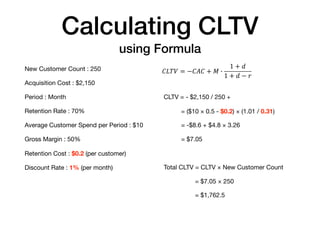

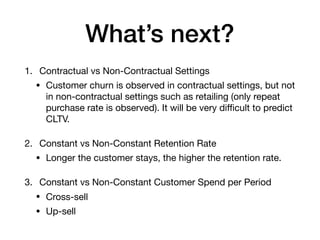

This document discusses Customer Lifetime Value (CLTV), detailing its definition, calculation methods, and importance in assessing customer acquisitions and profitability. It provides an example of calculating customer acquisition costs and CLTV over time, including factors such as retention rates and gross margins. The document concludes with considerations for future predictions of CLTV in different market scenarios.