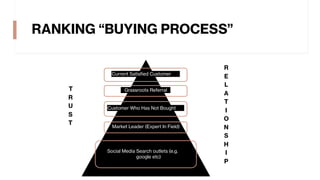

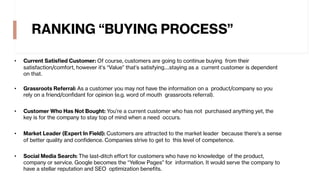

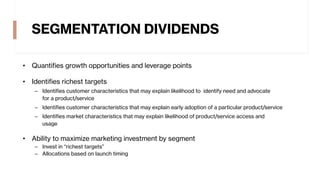

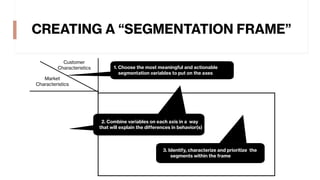

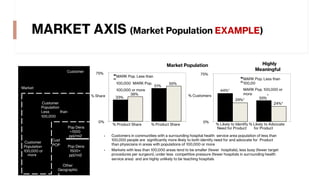

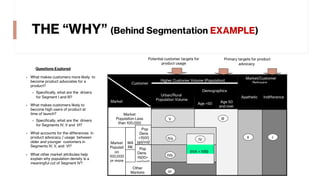

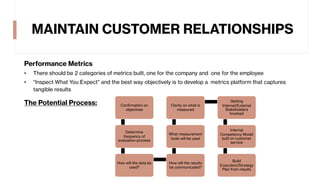

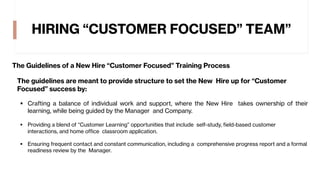

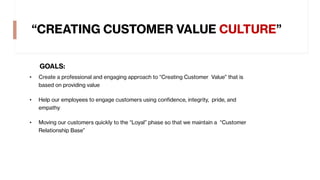

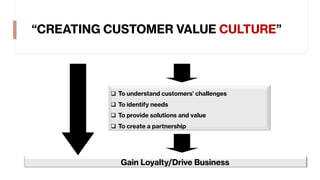

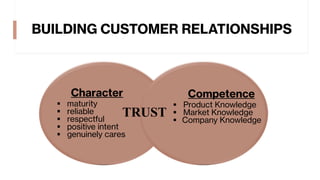

This presentation discusses how to gather customer insight and use it to grow a customer database. It examines customer segmentation to identify opportunities. Customer insight is gained by understanding emotional and rational drivers that influence customer perceptions. The goal is to uncover hidden forces that shape customer attitudes, beliefs, motivations and behaviors. A survey found the top reasons customers buy are need, customer service, value and cost. Current satisfied customers, referrals and market leaders are top trusted sources in the buying process. Segmentation helps identify appropriate channels, focus branding, and target audiences. Creating a customer-focused culture and team is key to establishing customer loyalty through commitment, positive experiences, and addressing issues. Metrics should measure both company and employee performance on customer focus.