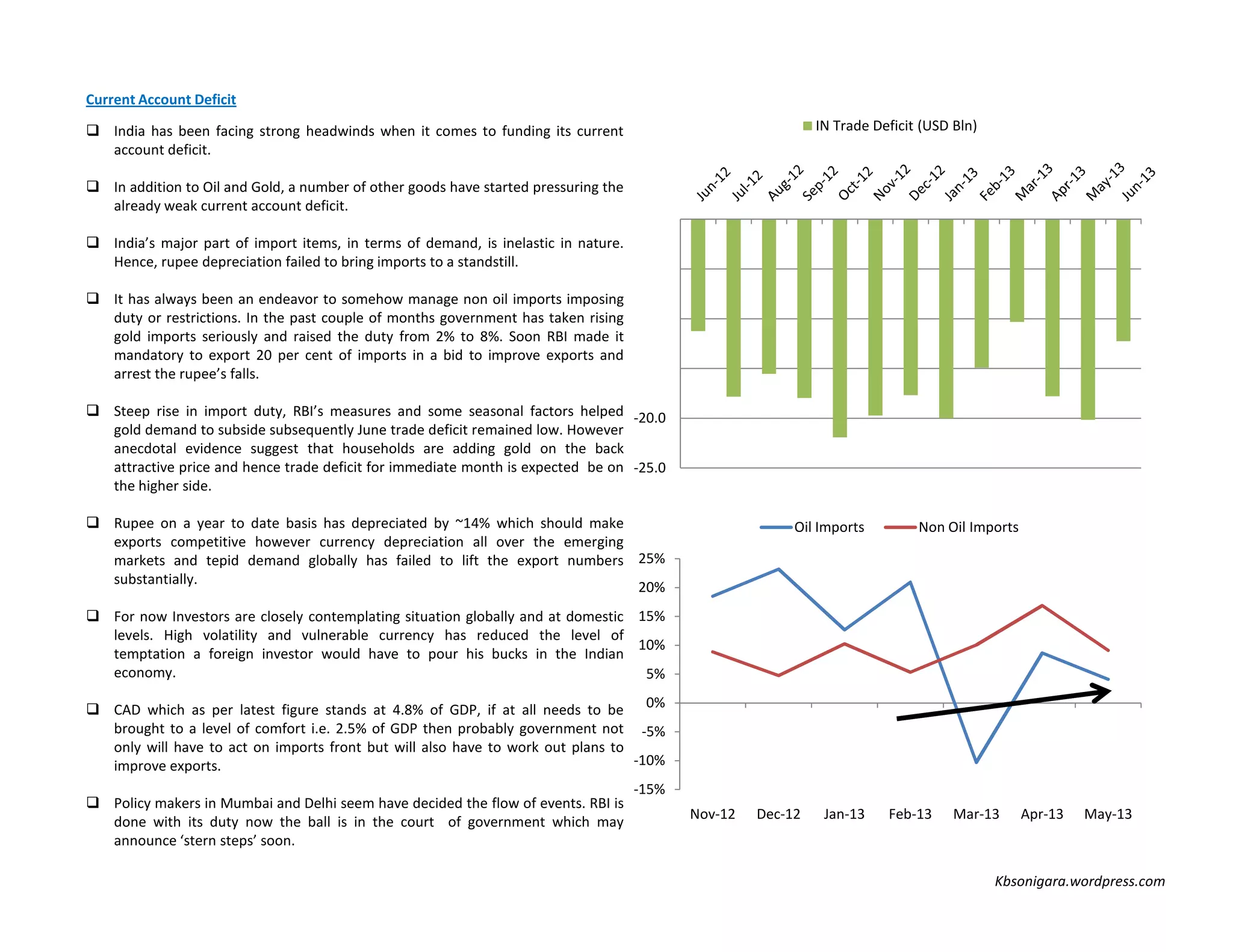

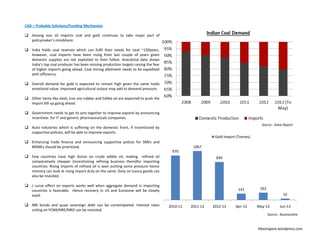

India has been facing a large current account deficit due to high oil and gold imports. While the rupee has depreciated by about 14% against other currencies, this has not significantly boosted exports due to weak global demand. To reduce the current account deficit to a more comfortable level of around 2.5% of GDP, the government will need to take steps both to reduce imports and improve exports. Policymakers seem prepared to take stern steps on the imports side, while incentives may be needed to boost exports in sectors like IT, pharmaceuticals, and automobiles.